Question: On October 3 1 , 2 0 2 4 , the bank statement for the cash account of Goldfeather Video shows a balance of $

On October the bank statement for the cash account of Goldfeather Video shows a balance of $ while the companys records show a cash balance of $ Information that might be useful in preparing a bank reconciliation is as follows:

Outstanding checks are $

The October cash receipts of $ are not deposited in the bank until November

The EFT payment for utilities of $ is correctly recorded by the bank but is recorded by Goldfeather as a disbursement of $

In accordance with prior authorization, the bank withdraws $ directly from the account as payment on a note payable. The interest portion of that payment is $ and the principal portion is $ Goldfeather has not recorded the direct withdrawal.

Bank service fees of $ are listed on the bank statement.

A deposit of $ is recorded by the bank on October but it did not belong to Goldfeather. The deposit should have been made to the account of Hollybuster Video, a separate company.

The bank statement includes a charge of $ for an NSF check from a customer. The check is returned with the bank statement, and the company will seek payment from the customer. Complete this question by entering your answers in the tabs below.

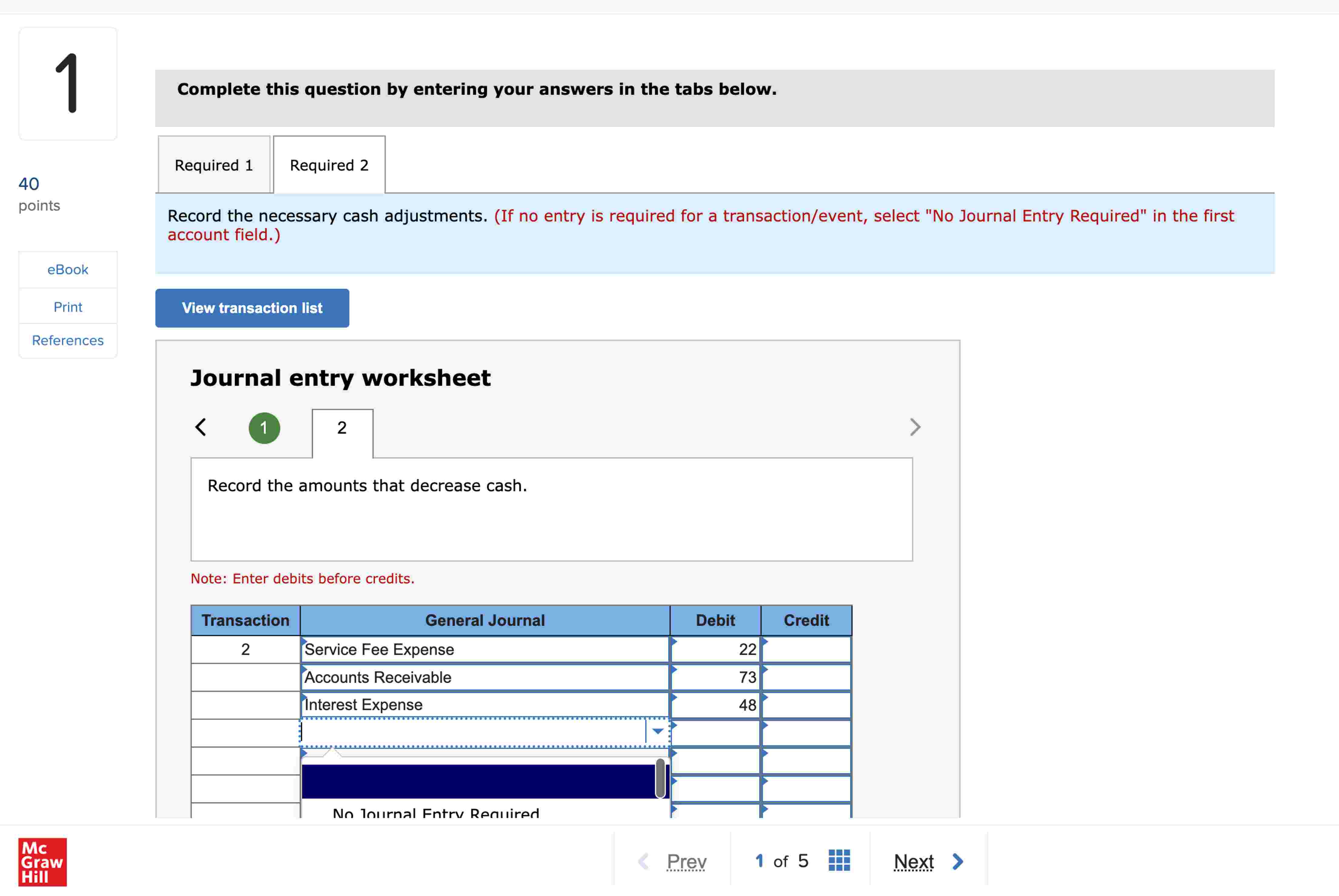

Record the necessary cash adjustments. If no entry is required for a transactionevent select No Journal Entry Required" in the first

account field.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock