Question: On October 31, 2021, the bank statement for the checking account of Blockwood Video shows a balance of $12,900, while the company's records show

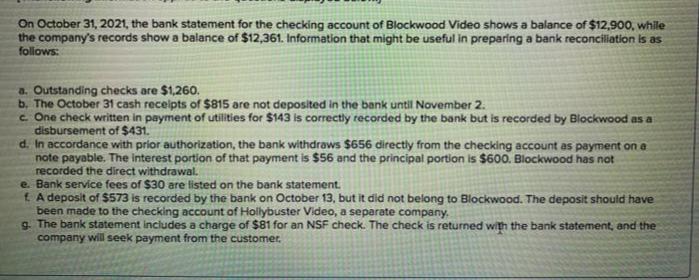

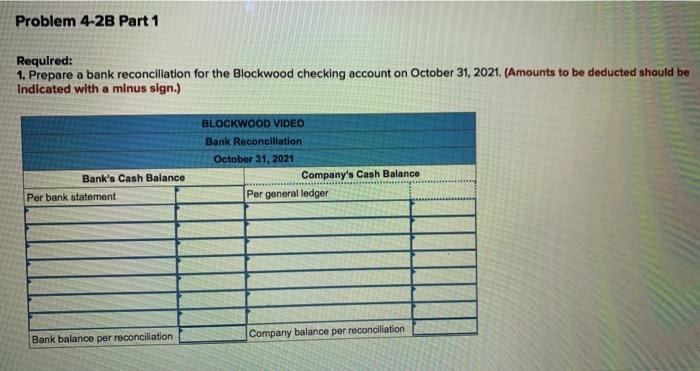

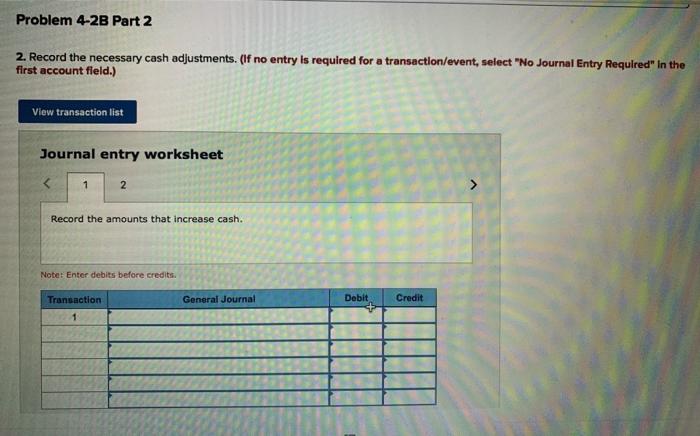

On October 31, 2021, the bank statement for the checking account of Blockwood Video shows a balance of $12,900, while the company's records show a balance of $12,361. Information that might be useful in preparing a bank reconciliation is as follows: a. Outstanding checks are $1,260. b. The October 31 cash receipts of $815 are not deposited in the bank until November 2. c. One check written in payment of utilities for $143 is correctly recorded by the bank but is recorded by Blockwood as a disbursement of $431. d. In accordance with prior authorization, the bank withdraws $656 directly from the checking account as payment on a note payable. The interest portion of that payment is $56 and the principal portion is $600. Blockwood has not recorded the direct withdrawal. e. Bank service fees of $30 are listed on the bank statement. f A deposit of $573 is recorded by the bank on October 13, but it did not belong to Blockwood. The deposit should have been made to the checking account of Hollybuster Video, a separate company, g. The bank statement includes a charge of $81 for an NSF check. The check is returned with the bank statement, and the company will seek payment from the customer. Problem 4-2B Part 1 Required: 1. Prepare a bank reconciliation for the Blockwood checking account on October 31, 2021. (Amounts to be deducted should be Indicated with a minus sign.) BLOCKWOOD VIDEO Bank Reconciliation October 31, 2021 Bank's Cash Balance Company's Cash Balance Per bank statement Bank balance per reconciliation Per general ledger Company balance per reconciliation Problem 4-2B Part 2 2. Record the necessary cash adjustments. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 2 Record the amounts that increase cash. Note: Enter debits before credits. Transaction General Journal Debit Credit

Step by Step Solution

There are 3 Steps involved in it

1 Bank Reconciliation Oct31 Cash balance according to Bank Statement 12900 ... View full answer

Get step-by-step solutions from verified subject matter experts