Question: On page 5, Lazard presented the precedent transaction multiples compared to both the consolidated and ongoing implied multiples at the $43.50 offer price. Which is

On page 5, Lazard presented the precedent transaction multiples compared to both the consolidated and ongoing implied multiples at the $43.50 offer price. Which is the more relevant comparison and why?

8) On page 5, do you think the Board should weigh the EV/EBITDA or the P/E (price to earnings) ratio more in evaluating whether to approve the $43.50 transaction price? Why?

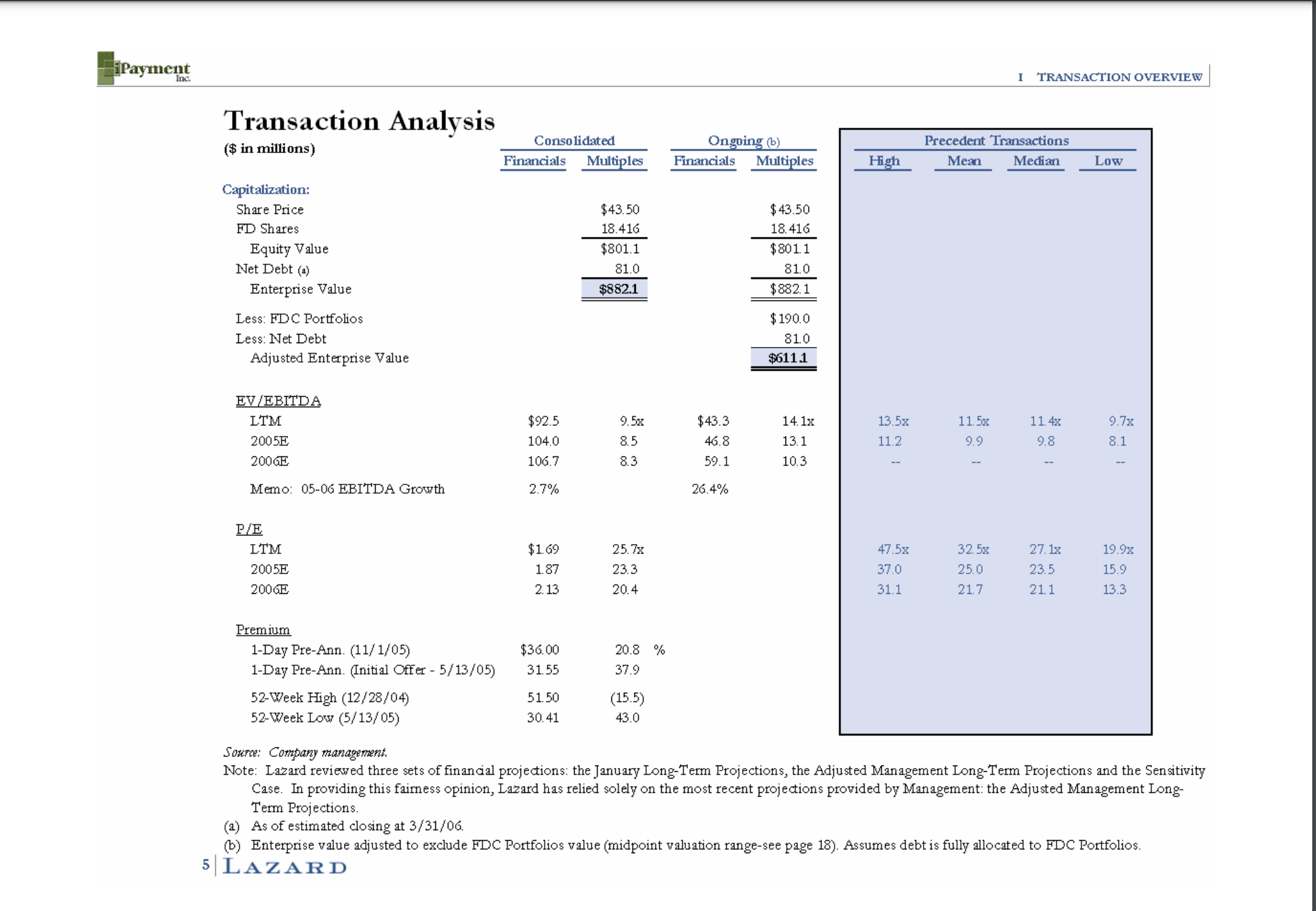

Note: Lazard reviewed three sets of financial projections: the January Long-Term Projections, the Adjusted Management Long-Term Projections and the Sensitivity Case. In providing this faimess opinion, Lazard has relied solely on the most recent projections provided by Management: the Adjusted Management LongTerm Projections. (a) As of estimated closing at 3/31/06. (b) Enterprise value adjusted to exclude FDC Portfolios value (midpoint valuation range-see page 18). Assumes debt is fully allocated to FDC Portfolios. 5 LAZAR D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts