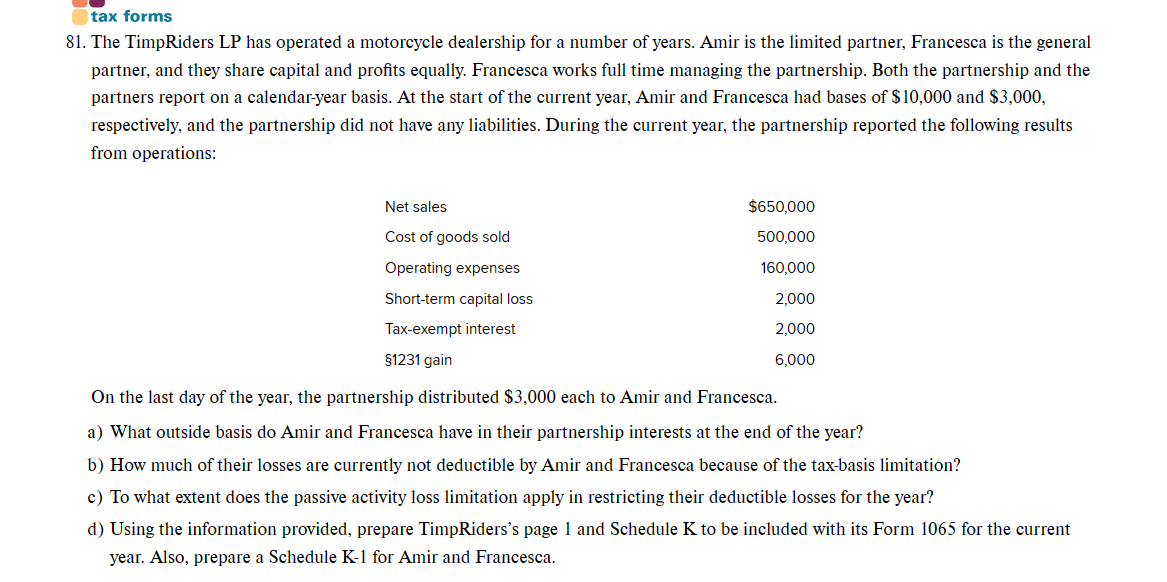

Question: On part a: o There are 2 items that increase the basis. That leads to basis before distribution o Then report the cash distribution, and

On part a:

o There are items that increase the basis. That leads to basis before distribution

o Then report the cash distribution, and gets to the Basis before Loss Allocations

o Determine the ordinary loss, and allocate it to the two partners

o This gets you the partners ending tax basis

On part b apply the first two limitation rules

On part c he is a limited partner, which leads to a passive activity loss. This should guide you

on how to allocate the ordinary business loss for each partner; the answer is not the same for

two partners

On part d you have to report do all of this in excel

o Page of form

o Page of form

o K for Francesa and a separate K for Amir. You need numbers in the following lines

Part II L two items

Part III, line QBI

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock