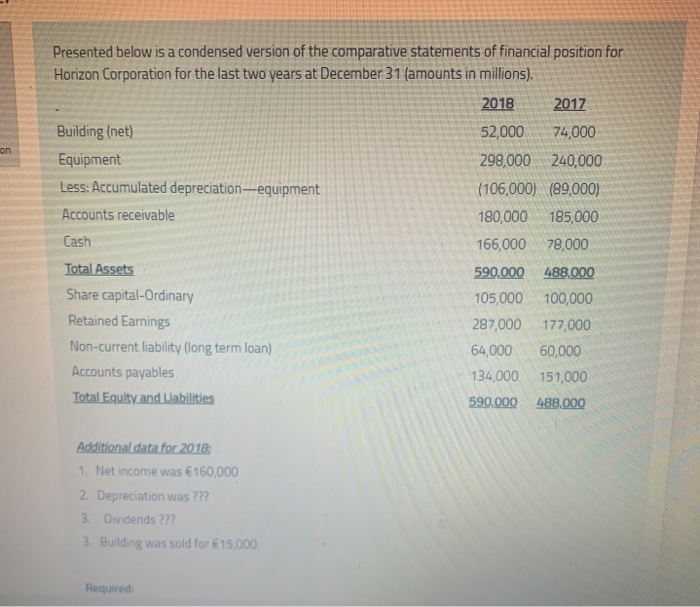

Question: on Presented below is a condensed version of the comparative statements of financial position for Horizon Corporation for the last two years at December 31

on Presented below is a condensed version of the comparative statements of financial position for Horizon Corporation for the last two years at December 31 (amounts in millions). 2018 2017 Building (net) 52,000 74,000 Equipment 298,000 240,000 Less: Accumulated depreciation-equipment (106,000) (89,000) Accounts receivable 180,000 185,000 Cash 166,000 78,000 Total Assets 590,000 488.000 Share capital-Ordinary 105,000 100,000 Retained Earnings 287,000 177,000 Non-current liability (long term loan) 64,000 60,000 Accounts payables 134,000 151,000 Total Equity and Liabilities 590,000 488,000 Additional data for 2018: 1. Net income was 160,000 2. Depreciation was ??? 3. Dividends??? 3. Building was sold for 15,000. Required Required: 1-Prepare a statement of cash flows for the year ending December 31, 2018 2- Determine Horizon corporation's free cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts