Question: On question B, the options in the drop down are either A or B Jeanne Lewis is attempting to evaluate two possible portfolios consisting of

On question B, the options in the drop down are either "A" or "B"

On question B, the options in the drop down are either "A" or "B"

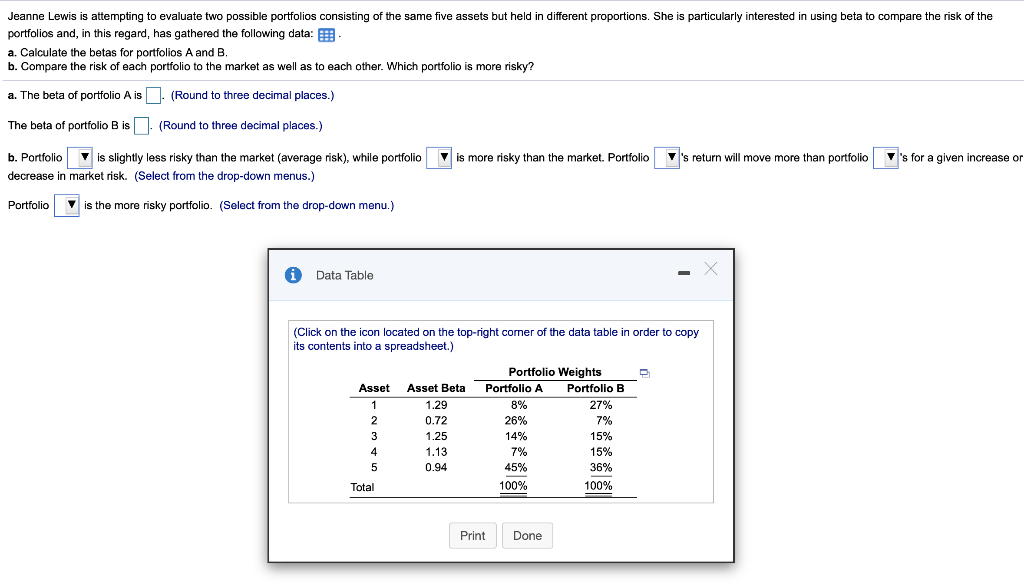

Jeanne Lewis is attempting to evaluate two possible portfolios consisting of the same five assets but held in different proportions. She is particularly interested in using beta to compare the risk of the portfolios and, in this regard, has gathered the following data: 3 a. Calculate the betas for portfolios A and B. b. Compare the risk of each portfolio to the market as well as to each other. Which portfolio is more risky? a. The beta of portfolio Ais (Round to three decimal places.) The beta of portfolio B is 7 (Round to three decimal places.) is more risky than the market. Portfolio v's return will move more than portfolio v's for a given increase or b. Portfolio is slightly less risky than the market (average risk), while portfolio decrease in market risk. (Select from the drop-down menus.) Portfolio is the more risky portfolio. (Select from the drop-down menu.) i Data Table (Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet.) Asset 8% 7% Asset Beta 1.29 0.72 1.25 1.13 0.94 Portfolio Weights Portfolio Portfolio B 27% 26% 14% 15% 7% 15% 45% 36% 100% 100% Total Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts