Question: On September 1 , 2 0 2 1 , Kellogg's Corporation purchased a machine at a list price of $ 9 4 , 0 0

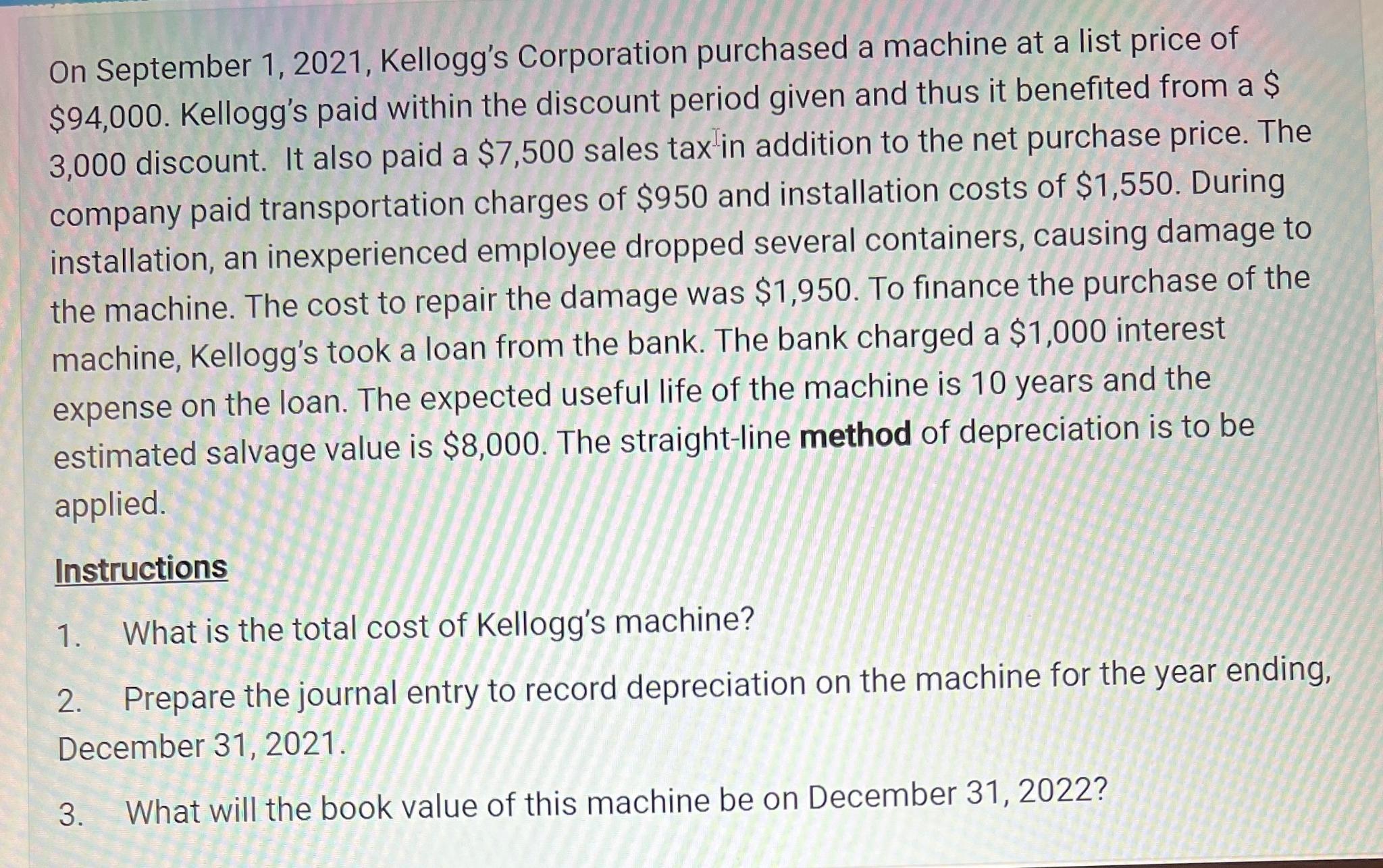

On September Kellogg's Corporation purchased a machine at a list price of $ Kellogg's paid within the discount period given and thus it benefited from a $ discount. It also paid a $ sales tax in addition to the net purchase price. The company paid transportation charges of $ and installation costs of $ During installation, an inexperienced employee dropped several containers, causing damage to the machine. The cost to repair the damage was $ To finance the purchase of the machine, Kellogg's took a loan from the bank. The bank charged a $ interest expense on the loan. The expected useful life of the machine is years and the estimated salvage value is $ The straightline method of depreciation is to be applied.

Instructions

What is the total cost of Kellogg's machine?

Prepare the journal entry to record depreciation on the machine for the year ending, December

What will the book value of this machine be on December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock