Question: On September 1 , 2 0 2 3 , Sandra purchases for $ 1 0 0 , 0 0 0 ( at the original Interest

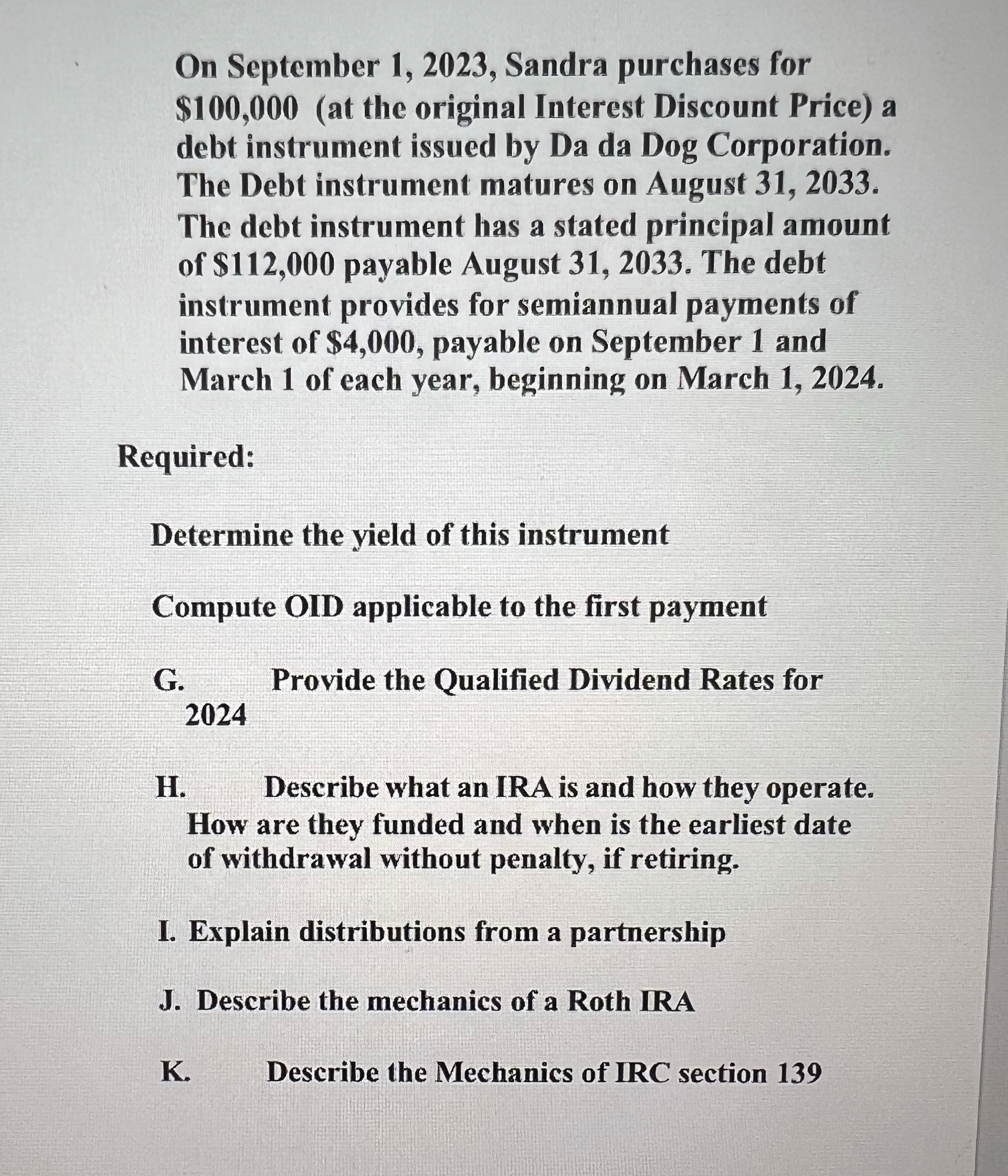

On September Sandra purchases for $at the original Interest Discount Price a debt instrument issued by Da da Dog Corporation. The Debt instrument matures on August The debt instrument has a stated principal amount of $ payable August The debt instrument provides for semiannual payments of interest of $ payable on September and March of each year, beginning on March

Required:

Determine the yield of this instrument

Compute OID applicable to the first payment

G Provide the Qualified Dividend Rates for

H Describe what an IRA is and how they operate. How are they funded and when is the earliest date of withdrawal without penalty, if retiring.

I. Explain distributions from a partnership

J Describe the mechanics of a Roth IRA

K Describe the Mechanics of IRC section

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock