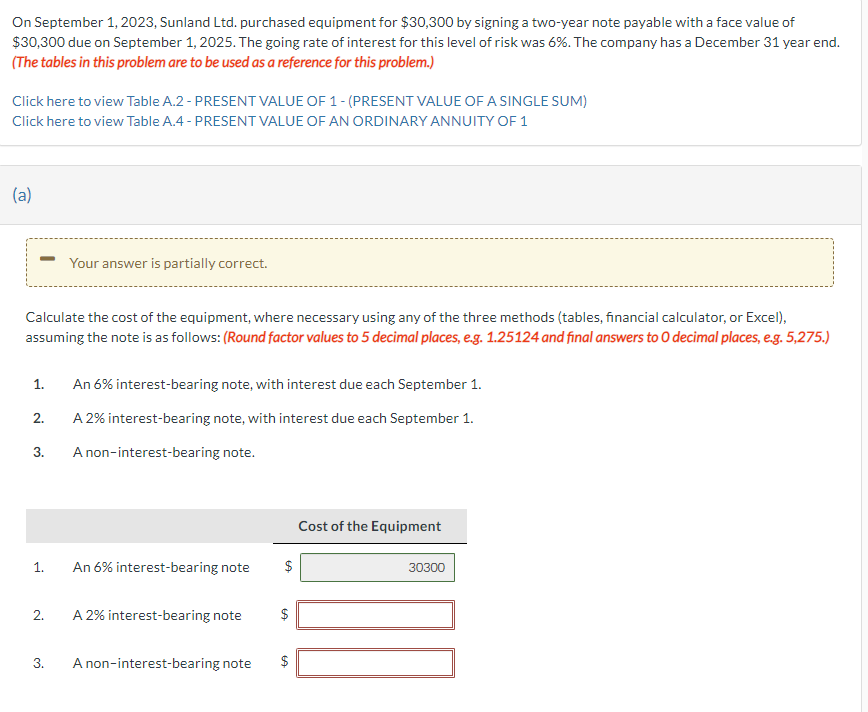

Question: On September 1 , 2 0 2 3 , Sunland Ltd . purchased equipment for $ 3 0 , 3 0 0 by signing a

On September Sunland Ltd purchased equipment for $ by signing a twoyear note payable with a face value of

$ due on September The going rate of interest for this level of risk was The company has a December year end.

The tables in this problem are to be used as a reference for this problem.

Click here to view Table A PRESENT VALUE OF PRESENT VALUE OF A SINGLE SUM

Click here to view Table A PRESENT VALUE OF AN ORDINARY ANNUITY OF

Calculate the cost of the equipment, where necessary using any of the three methods tables financial calculator, or Excel

assuming the note is as follows: Round factor values to decimal places, eg and final answers to decimal places, eg

An interestbearing note, with interest due each September

A interestbearing note, with interest due each September

A noninterestbearing note.

Cost of the Equipment

An interestbearing note

$

A interestbearing note

$

A noninterestbearing note

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock