Question: On September 1 , 2 0 2 4 , Lindsey Engineering botrows $ 4 0 0 , 0 0 0 c m h . The

On September Lindsey Engineering botrows $ The loan is made by Firstlending, under the agreement that Lindsey will repay the grinclosil wh four pryments of $ Payments are due by October each year, whopel the firt poyment being due October next year interest on the borrowing is K and Lindsey's yearend is December

Required:

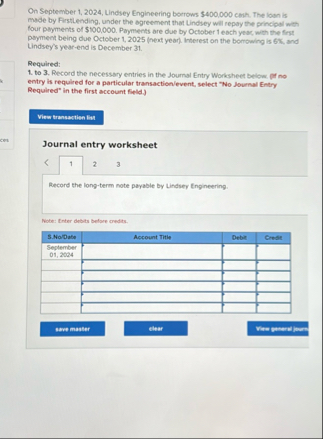

to Record the necessary entries in the Joumal Entry Worksheet belom. pf no entry is required for a particular transactionlevent, select No Journal Entry Required" in the first accoumt field.

Journal entry worksheet

Pecord the longterm note payable by Lindsey Ingineering.

Note: Inter debits before credits.

tableSNoDateAccount Titie,Debit,CrestSeptember

On September Lindsey Engineering borrows $ cash. The loan is made by FirstLending. under the agreement that Lindsey will repay the principal with four payments of $ Payments are due by October esch yoor, with the first payment being due October next year Interest on the borrowing is and Lindsey's yearend is December

Required:

to Record the necessary entries in the Journal Entry Worksheet below. If no entry is required for a particular transactionevent select No Journal Entry Required" in the first account field.

Journal entry worksheet

Record the adjusting entry for interest on December

Nole: Eneer debits belore creshs.

tableDaleOeneral Journa!,Debit,CreditDecember

On September Lindsey Engineering borrows $ cash. The loan is made by Firstlending, under the agreement that Lindsey will repay the princlpa weh four payments of $ Payments are due by October each year, whth the frut payment being due October next yerr Interesf on the borrowing is K and thidsey's yearend is December

Required:

to Record the necessary entries in the Journal Entry Worksheet below. pf no entry is required for a particular transactionevent select No Journal Entry Required" in the first account field.

Journal entry worksheet

Record the entry to reclassify the current portion of the note on December

Note: Inter debits before eredits.

tableDutGeneral Journal,Detalt,Crest December

Cran

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock