Question: On September 1, 2022, Hare Today pet-supply store Co. borrowed $9,000 from Gone Tomorrow Bank, signing a 6-month, 4-percent note. Interest is to be paid

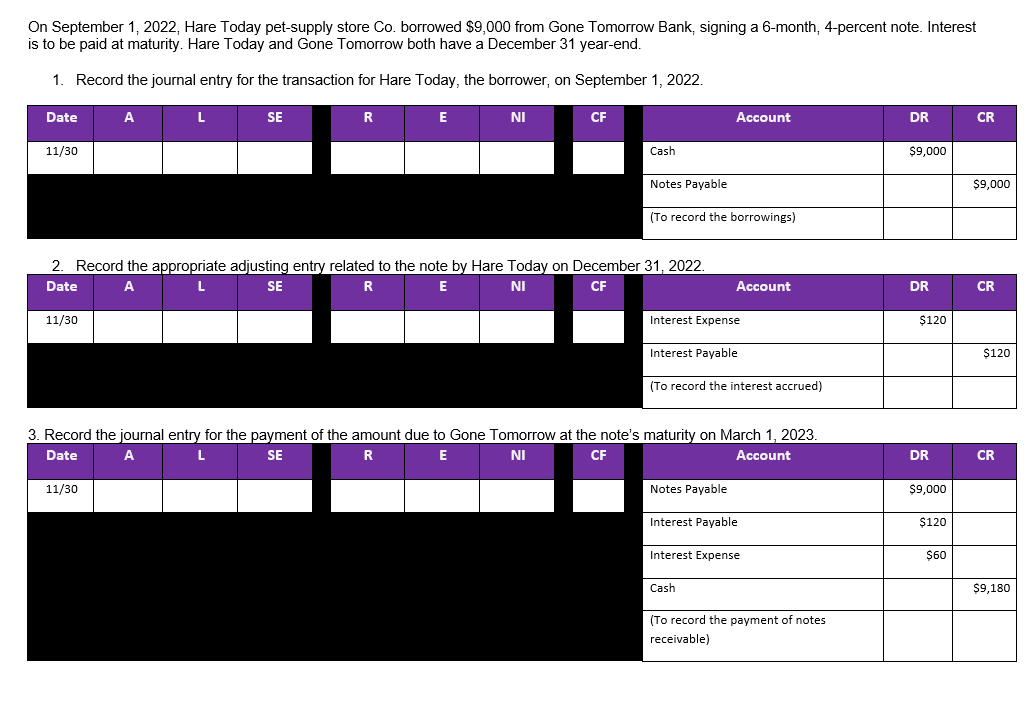

On September 1, 2022, Hare Today pet-supply store Co. borrowed $9,000 from Gone Tomorrow Bank, signing a 6-month, 4-percent note. Interest is to be paid at maturity. Hare Today and Gone Tomorrow both have a December 31 year-end.

- Record the journal entry for the transaction for Hare Today, the borrower, on September 1, 2022.

- Record the appropriate adjusting entry related to the note by Hare Today on December 31, 2022.

- Record the journal entry for the payment of the amount due to Gone Tomorrow at the notes maturity on March 1, 2023.

On September 1, 2022, Hare Today pet-supply store Co. borrowed $9,000 from Gone Tomorrow Bank, signing a 6-month, 4-percent note. Interest is to be paid at maturity. Hare Today and Gone Tomorrow both have a December 31 year-end. 1. Record the journal entry for the transaction for Hare Today, the borrower, on September 1, 2022. Date L SE R E NI CF Account DR CR 11/30 Cash $9,000 Notes Payable $9,000 (To record the borrowings) 2. Record the appropriate adjusting entry related to the note by Hare Today on December 31, 2022. Date L SE R E E NI CF Account DR CR 11/30 Interest Expense $120 Interest Payable $120 (To record the interest accrued) 3. Record the journal entry for the payment of the amount due to Gone Tomorrow at the note's maturity on March 1, 2023. Date A L SE R R E NI CF Account DR CR 11/30 Notes Payable $9,000 Interest Payable $120 Interest Expense $60 Cash $9,180 (To record the payment of notes receivable)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts