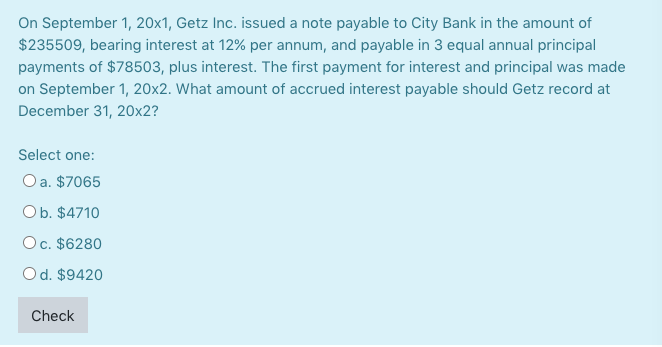

Question: On September 1, 20x1, Getz Inc. issued a note payable to City Bank in the amount of $235509, bearing interest at 12% per annum, and

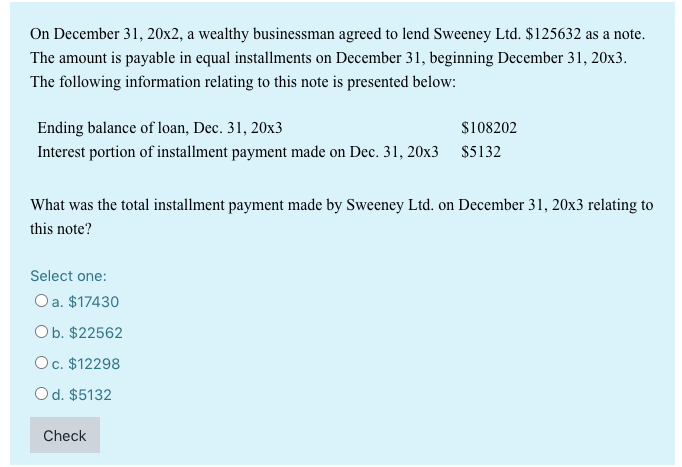

On September 1, 20x1, Getz Inc. issued a note payable to City Bank in the amount of $235509, bearing interest at 12% per annum, and payable in 3 equal annual principal payments of $78503, plus interest. The first payment for interest and principal was made on September 1, 20x2. What amount of accrued interest payable should Getz record at December 31, 20x2? Select one: O a. $7065 Ob. $4710 O c. $6280 O d. $9420 Check On December 31, 20x2, a wealthy businessman agreed to lend Sweeney Ltd. $125632 as a note. The amount is payable in equal installments on December 31, beginning December 31, 20x3. The following information relating to this note is presented below: Ending balance of loan, Dec. 31, 20x3 $108202 Interest portion of installment payment made on Dec. 31, 20x3 $5132 What was the total installment payment made by Sweeney Ltd. on December 31, 20x3 relating to this note? Select one: O a. $17430 Ob. $22562 O c. $12298 Od. $5132 Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts