Question: On September 1 5 , Year 4 , the county in which Spirit Company operates enacted changes in the countys tax law. These changes are

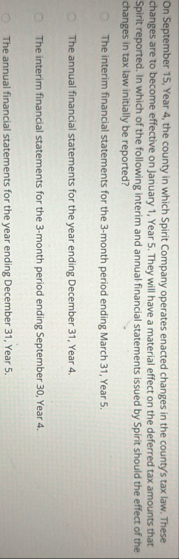

On September Year the county in which Spirit Company operates enacted changes in the countys tax law. These changes are to become effective on January Year They will have a material effect on the deferred tax amounts that Spirit reported. In which of the following interim and annual financial statements issued by Spirit should the effect of the changes in tax law initially be reported?

The interim financial statements for the month period ending March Year

The annual financial statements for the year ending December Year

The interim financial statements for the month period ending September Year

The annual financial statements for the year ending December Year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock