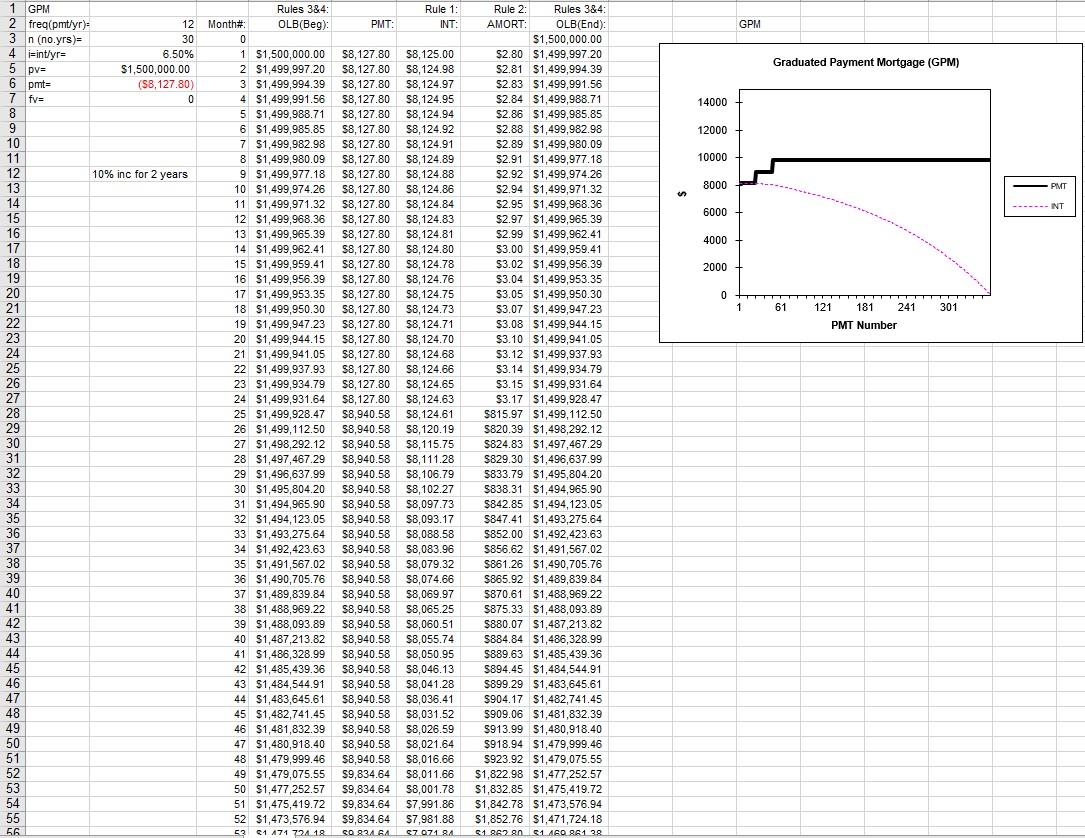

Question: On the fourth tab build the full amortization table for a 30 year Graduated Payment Mortgage (GPM) Loan with a 6.5% interest rate compounded monthly.

On the fourth tab build the full amortization table for a 30 year Graduated Payment Mortgage (GPM) Loan with a 6.5% interest rate compounded monthly. The initial loan amount should be $1,500,000. There should be 2 step ups, each a 10% increase. One every 2 years with the 1stthrough 24th, 25th through 48th, and 49th through 360th payments being the same amount respectively.

please review this work

GPM Graduated Payment Mortgage (GPM) 5 pv= 14000 12000 10000 8000 PMT 6000 ---- INT 4000 2000 0 1 61 121 181 241 301 PMT Number 1 GPM Rules 3&4: Rule 1: Rule 2: Rules 3&4: 2 freq(pm/yr)- 12 Month# OLB(Beg): PMT: INT: AMORT: OLB(End): 3 n (no.yrs)- 30 0 $1,500,000.00 4 i=intyra 6.50% 1 $1,500,000.00 $8,127.80 $8,125.00 $2.80 $1,499,997.20 $1,500,000.00 2 $1,499,997.20 58,127.80 58,124.98 S2.81 $1,499,994.39 6 pmtu (58,127.80) 3 $1,499,994.39 $8,127.80 $8,124.97 $2.83 $1,499.991.56 7 fv= 0 4 $1,499,991.56 $8,127.80 $8,124.95 $2.84 $1,499,988.71 8 5 $1,499,988.71 $8,127.80 $8,124.94 $2.86 $1,499,985.85 9 6 $1,499,985.85 $8,127.80 $8,124.92 $2.88 $1,499,982.98 10 7 $1,499,982.98 $8,127.80 $8,124.91 $2.89 $1,499,980.09 11 8 $1,499,980.09 $8,127.80 $8,124.89 $2.91 $1,499,977.18 12 10% inc for 2 years 9 $1,499,977.18 $8,127.80 $8,124.88 $2.92 $1,499,974.26 13 10 $1,499,974.26 $8,127.80 $8,124.86 $2.94 $1,499,971.32 14 11 $1,499,971.32 $8,127.80 $8,124.84 $2.95 $1,499,968.36 15 12 $1,499,968.36 $8,127.80 $8,124.83 $2.97 $1,499,965.39 16 13 $1,499,965.39 $8,127.80 $8,124.81 $2.99 $1,499,962.41 17 14 $1,499,962.41 $8,127.80 $8,124.80 $3.00 $1,499,959.41 18 15 $1,499,959.41 $8,127.80 $8,124.78 $3.02 $1,499,956.39 19 16 $1,499,956.39 $8,127.80 $8,124.76 $3.04 $1,499,953.35 20 17 $1,499,953.35 $8,127.80 $8,124.75 $3.05 $1,499,950.30 21 18 $1,499,950.30 S8,127.80 S8,124.73 $3.07 $1,499,947.23 22 19 $1,499,947.23 $8,127.80 $8,124.71 $3.08 $1,499,944.15 23 20 $1,499,944.15 $8,127.80 $8,124.70 $3.10 $1,499,941.05 24 21 $1,499,941.05 $8,127.80 $8,124.68 $3.12 $1,499,937.93 25 22 $1,499,937.93 $8,127.80 $8,124.66 $3.14 $1,499,934.79 26 23 $1,499,934.79 $8,127.80 $8,124.65 $3.15 $1,499,931.64 27 24 $1,499,931.64 $8,127.80 $8,124.63 $3.17 $1,499,928.47 28 25 $1,499,928.47 $8,940.58 S8,124.61 $815.97 $1,499,112.50 29 26 $1,499,112.50 $8,940.58 $8,120.19 $820.39 $1,498,292.12 30 27 $1,498,292.12 $8,940.58 $8,115.75 $824.83 $1,497,467.29 31 28 $1,497,467.29 $8,940.58 $8,111.28 $829.30 $1,496,637.99 32 29 $1,496,637.99 $8,940.58 $8,106.79 $833.79 $1,495,804.20 33 30 $1,495,804.20 $8,940.58 $8,102.27 $838.31 $1,494,965.90 34 31 $1,494,965.90 $8,940.58 $8,097.73 $842.85 $1,494, 123.05 35 32 $1,494,123.05 $8,940.58 $8,093.17 5847.41 $1,493,275.64 36 33 $1,493,275.64 $8,940.58 $8,088.58 $852.00 $1,492,423.63 37 34 $1,492,423.63 58,940.58 58,083.96 $856.62 $1,491,567.02 38 35 $1,491,567.02 $8,940.58 $8,079.32 $861.26 $1,490,705.76 39 36 $1,490,705.76 $8,940.58 $8,074.66 $865.92 $1,489,839.84 40 37 $1,489,839.84 $8,940.58 $8,069.97 $870.61 $1,488,969.22 41 38 $1,488,969.22 $8,940.58 $8,065.25 $875.33 $1,488,093.89 42 39 $1,488,093.89 $8,940.58 $8,060.51 $880.07 $1,487,213.82 43 40 $1,487,213.82 $8,940.58 $8,055.74 $884.84 $1,486,328.99 44 41 $1,486,328.99 $8,940.58 $8,050.95 S889.63 $1,485,439.36 45 42 $1,485,439.36 $8,940.58 $8,046.13 $894.45 $1,484,544.91 46 43 $1,484,544.91 $8,940.58 $8,041.28 $899.29 $1,483,645.61 47 44 $1,483,645,61 $8,940.58 $8,036.41 $904.17 $1,482,741.45 48 45 $1,482,741.45 $8,940.58 $8,031.52 $909.06 $1,481,832.39 49 46 $1,481,832.39 $8,940.58 $8,026.59 $913.99 $1,480,918.40 50 47 $1,480,918.40 $8,940.58 $8,021.64 $918.94 $1,479,999.46 51 48 $1,479,999.46 $8,940.58 $8,016.66 S923.92 $1,479,075.55 52 49 $1,479,075.55 $9,834.64 $8,011.66 $1,822.98 $1,477,252.57 53 50 51,477,252.57 $9,834.64 $8,001.78 $1,832.85 $1,475,419.72 54 51 51,475,419.72 9,834.64 $7,991.86 $1,842.78 $1,473,576.94 55 52 $1,473,576.94 $9,834.64 $7,981.88 $1,852.76 $1,471,724.18 56 53 1 471 724 18 CO 824 64 67 071 BA 61 862 A 1.460 861 38 GPM Graduated Payment Mortgage (GPM) 5 pv= 14000 12000 10000 8000 PMT 6000 ---- INT 4000 2000 0 1 61 121 181 241 301 PMT Number 1 GPM Rules 3&4: Rule 1: Rule 2: Rules 3&4: 2 freq(pm/yr)- 12 Month# OLB(Beg): PMT: INT: AMORT: OLB(End): 3 n (no.yrs)- 30 0 $1,500,000.00 4 i=intyra 6.50% 1 $1,500,000.00 $8,127.80 $8,125.00 $2.80 $1,499,997.20 $1,500,000.00 2 $1,499,997.20 58,127.80 58,124.98 S2.81 $1,499,994.39 6 pmtu (58,127.80) 3 $1,499,994.39 $8,127.80 $8,124.97 $2.83 $1,499.991.56 7 fv= 0 4 $1,499,991.56 $8,127.80 $8,124.95 $2.84 $1,499,988.71 8 5 $1,499,988.71 $8,127.80 $8,124.94 $2.86 $1,499,985.85 9 6 $1,499,985.85 $8,127.80 $8,124.92 $2.88 $1,499,982.98 10 7 $1,499,982.98 $8,127.80 $8,124.91 $2.89 $1,499,980.09 11 8 $1,499,980.09 $8,127.80 $8,124.89 $2.91 $1,499,977.18 12 10% inc for 2 years 9 $1,499,977.18 $8,127.80 $8,124.88 $2.92 $1,499,974.26 13 10 $1,499,974.26 $8,127.80 $8,124.86 $2.94 $1,499,971.32 14 11 $1,499,971.32 $8,127.80 $8,124.84 $2.95 $1,499,968.36 15 12 $1,499,968.36 $8,127.80 $8,124.83 $2.97 $1,499,965.39 16 13 $1,499,965.39 $8,127.80 $8,124.81 $2.99 $1,499,962.41 17 14 $1,499,962.41 $8,127.80 $8,124.80 $3.00 $1,499,959.41 18 15 $1,499,959.41 $8,127.80 $8,124.78 $3.02 $1,499,956.39 19 16 $1,499,956.39 $8,127.80 $8,124.76 $3.04 $1,499,953.35 20 17 $1,499,953.35 $8,127.80 $8,124.75 $3.05 $1,499,950.30 21 18 $1,499,950.30 S8,127.80 S8,124.73 $3.07 $1,499,947.23 22 19 $1,499,947.23 $8,127.80 $8,124.71 $3.08 $1,499,944.15 23 20 $1,499,944.15 $8,127.80 $8,124.70 $3.10 $1,499,941.05 24 21 $1,499,941.05 $8,127.80 $8,124.68 $3.12 $1,499,937.93 25 22 $1,499,937.93 $8,127.80 $8,124.66 $3.14 $1,499,934.79 26 23 $1,499,934.79 $8,127.80 $8,124.65 $3.15 $1,499,931.64 27 24 $1,499,931.64 $8,127.80 $8,124.63 $3.17 $1,499,928.47 28 25 $1,499,928.47 $8,940.58 S8,124.61 $815.97 $1,499,112.50 29 26 $1,499,112.50 $8,940.58 $8,120.19 $820.39 $1,498,292.12 30 27 $1,498,292.12 $8,940.58 $8,115.75 $824.83 $1,497,467.29 31 28 $1,497,467.29 $8,940.58 $8,111.28 $829.30 $1,496,637.99 32 29 $1,496,637.99 $8,940.58 $8,106.79 $833.79 $1,495,804.20 33 30 $1,495,804.20 $8,940.58 $8,102.27 $838.31 $1,494,965.90 34 31 $1,494,965.90 $8,940.58 $8,097.73 $842.85 $1,494, 123.05 35 32 $1,494,123.05 $8,940.58 $8,093.17 5847.41 $1,493,275.64 36 33 $1,493,275.64 $8,940.58 $8,088.58 $852.00 $1,492,423.63 37 34 $1,492,423.63 58,940.58 58,083.96 $856.62 $1,491,567.02 38 35 $1,491,567.02 $8,940.58 $8,079.32 $861.26 $1,490,705.76 39 36 $1,490,705.76 $8,940.58 $8,074.66 $865.92 $1,489,839.84 40 37 $1,489,839.84 $8,940.58 $8,069.97 $870.61 $1,488,969.22 41 38 $1,488,969.22 $8,940.58 $8,065.25 $875.33 $1,488,093.89 42 39 $1,488,093.89 $8,940.58 $8,060.51 $880.07 $1,487,213.82 43 40 $1,487,213.82 $8,940.58 $8,055.74 $884.84 $1,486,328.99 44 41 $1,486,328.99 $8,940.58 $8,050.95 S889.63 $1,485,439.36 45 42 $1,485,439.36 $8,940.58 $8,046.13 $894.45 $1,484,544.91 46 43 $1,484,544.91 $8,940.58 $8,041.28 $899.29 $1,483,645.61 47 44 $1,483,645,61 $8,940.58 $8,036.41 $904.17 $1,482,741.45 48 45 $1,482,741.45 $8,940.58 $8,031.52 $909.06 $1,481,832.39 49 46 $1,481,832.39 $8,940.58 $8,026.59 $913.99 $1,480,918.40 50 47 $1,480,918.40 $8,940.58 $8,021.64 $918.94 $1,479,999.46 51 48 $1,479,999.46 $8,940.58 $8,016.66 S923.92 $1,479,075.55 52 49 $1,479,075.55 $9,834.64 $8,011.66 $1,822.98 $1,477,252.57 53 50 51,477,252.57 $9,834.64 $8,001.78 $1,832.85 $1,475,419.72 54 51 51,475,419.72 9,834.64 $7,991.86 $1,842.78 $1,473,576.94 55 52 $1,473,576.94 $9,834.64 $7,981.88 $1,852.76 $1,471,724.18 56 53 1 471 724 18 CO 824 64 67 071 BA 61 862 A 1.460 861 38

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts