Question: On the next page is a binomial tree which gives the yen price of 1 British pound, that is, the units are yen/. The length

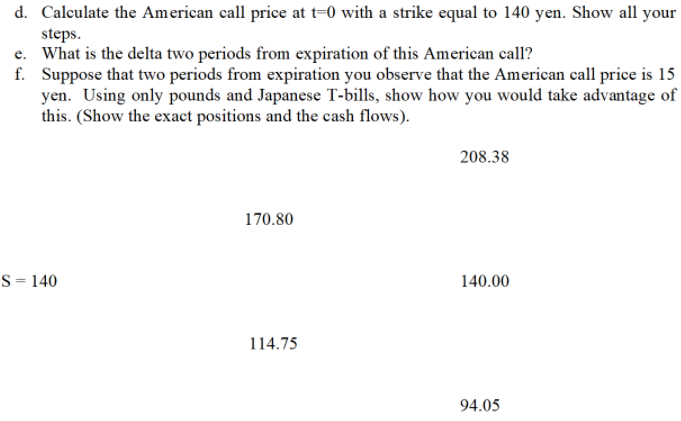

On the next page is a binomial tree which gives the yen price of 1 British pound, that is, the units are yen/. The length of each binomial period is 0.25 year. The annual continuously compounded Japanese risk free rate is 2% and the annual continuously compounded British risk free rate is 5%. a. What are u and d? b. What is o, the annual volatility of the exchange rate? c. What is p, the risk neutral probability for the exchange rate to move up each period? d. Calculate the American call price at t=0 with a strike equal to 140 yen. Show all your steps. e. What is the delta two periods from expiration of this American call? f. Suppose that two periods from expiration you observe that the American call price is 15 yen. Using only pounds and Japanese T-bills, show how you would take advantage of this. (Show the exact positions and the cash flows). 208.38 170.80 S= 140 140.00 114.75 94.05 On the next page is a binomial tree which gives the yen price of 1 British pound, that is, the units are yen/. The length of each binomial period is 0.25 year. The annual continuously compounded Japanese risk free rate is 2% and the annual continuously compounded British risk free rate is 5%. a. What are u and d? b. What is o, the annual volatility of the exchange rate? c. What is p, the risk neutral probability for the exchange rate to move up each period? d. Calculate the American call price at t=0 with a strike equal to 140 yen. Show all your steps. e. What is the delta two periods from expiration of this American call? f. Suppose that two periods from expiration you observe that the American call price is 15 yen. Using only pounds and Japanese T-bills, show how you would take advantage of this. (Show the exact positions and the cash flows). 208.38 170.80 S= 140 140.00 114.75 94.05

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts