Question: On the Trial Balance sheet, label two columns, Debit and Credit, and move the amounts into the proper columns to show the correct debit and

- Current Ratio

- Gross Profit Ratio

- Debt to Equity Ratio

- Acid Test (Quick Ratio)

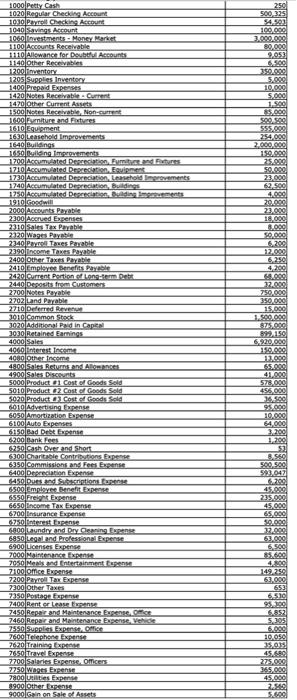

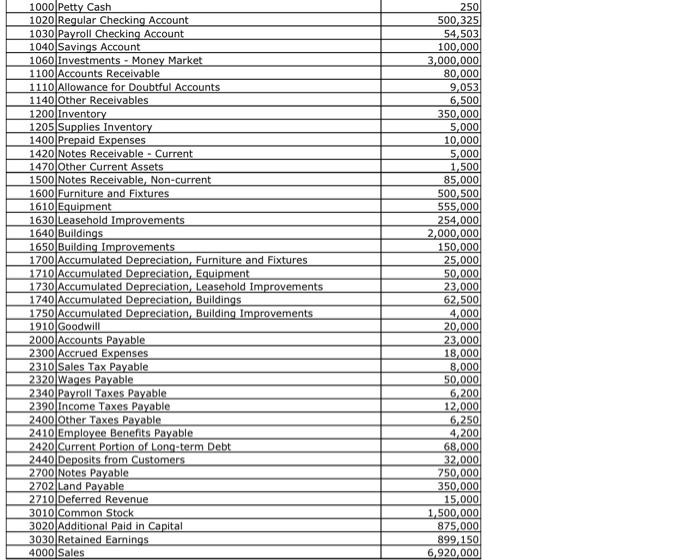

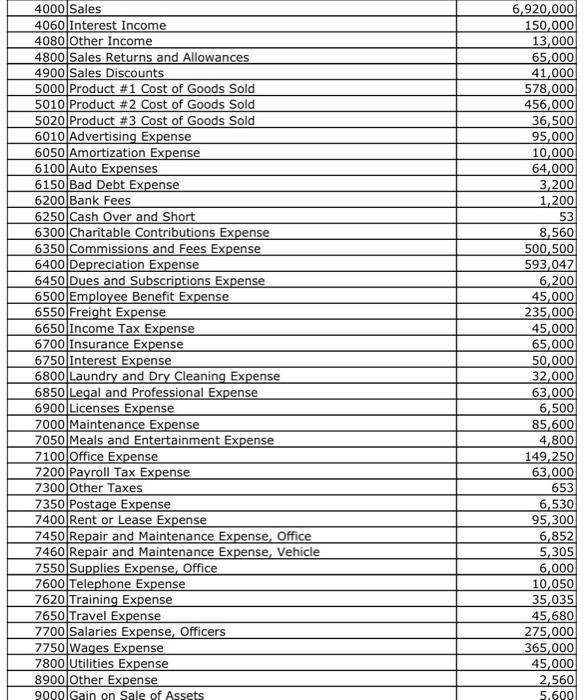

\begin{tabular}{|c|c|c|} \hline 1000/P12 & Petty Cash & 250 \\ \hline 1020 & Regular Cheding Accoung & 500,325 \\ \hline 1030 & Perroll Coecking Ascoum & 54,503 \\ \hline 1040 & Sovings Aecount & 100,000 \\ \hline 1060 & Inestments - Moner Merket & 3.000000 \\ \hline 1100 & Accounts Receivable. & 82,000 \\ \hline 11100 & Alswance for Deubtifu Acebunts. & 3,053 \\ \hline 1140 & Other Recrovablet & 5.500 \\ \hline 1200 & imventory & 35000 \\ \hline 1205 & Supplies inventoo & 5.000 \\ \hline 1400 & Prepaid Expensts & 10.00C \\ \hline 14201 & Nutes Recelvable - Current & 5,000 \\ \hline 1470 & Other Current Asseds & 1.500 \\ \hline 1500 & Nates Rectehrable, Non-cuires & 85,000 \\ \hline 1600 & Fumiture and Fatyeres & sogsec \\ \hline 1610 & Equigment & cos5000 \\ \hline 1630L & Leasehold Improverments & 254,000 \\ \hline 1640 & Bullings & 2,000,000 \\ \hline 1650 & Pyllesing improvements. & 150,000 \\ \hline 1700 & & 25,000 \\ \hline 17210 & Accumulated Depreclytion, Feyipmens. & 50000 \\ \hline 1730 & Accumulated Dearnciation, Leanehold Inesovements & 23,000 \\ \hline 17400 & Aceumulated Derareciation, Buldiness & 62,500 \\ \hline & & 4.000 \\ \hline 1910 & Croofwill & 20,000 \\ \hline 2000 & Accounts Parable & 23,000 \\ \hline 2300 & Accrued Expenses & 18,000 \\ \hline 23105 & Salm Tex Pryabie & 8.000 \\ \hline & Wages Payabie & 50,000 \\ \hline 2340 & Prynel Touses Porable. & 6.200 \\ \hline 2390 & Income Taxes Payable. & 12,000 \\ \hline 24000 & Other Taxes Parabie & 6.250 \\ \hline 24101 & Empleyree Benefits Fayole & 4,200 \\ \hline 2420 & Current Portion of ions-term pets. & sin000 \\ \hline 244010 & Desoeits frem Customer: & 52000 \\ \hline 2700 & Noses Parable & 750,000 \\ \hline 2702 & Land Parabir & 350,000 \\ \hline 27100 & Deferred Revenue & 15,000 \\ \hline 3010 & Common Stack & 1.500,000 \\ \hline 3020 & Additiongl Paid in Caperd. & 8500 \\ \hline 3030 & Retained Eamings & 83.150 \\ \hline 4000 & Soles & 6.920,000 \\ \hline 4000 & Interest inctime & 180.000 \\ \hline 4000 & Diner income & 12000 \\ \hline 4800 & Sales Returns and Aliomencet: & 65.000 \\ \hline 49005 & Soles Dereverts. & 41.000 \\ \hline 5000 & Preduct of Cost of Coods Seld & 578,000 \\ \hline 5010 & Product 12 Cost of Cosds Sold & 456,000 \\ \hline 5020 & Product a) Cost ef Coods Sold & \\ \hline 6010 & Afvertising Expense & sog \\ \hline 6050 & Amortization Expense. & 10,006 \\ \hline 6100 & Aute Expenses & 64,000 \\ \hline 6450 & Ead Drbt Expense. & 3,200 \\ \hline 62001 & Bank fees & 1.200 \\ \hline 6250 & Cash oxe and Short & 53 \\ \hline 6300 & Charitable Contripations Experese & 8.580 \\ \hline 6350 & Commissions bnd Fees Exasnse & 500.500 \\ \hline 6400 & Despreciasion Expense. & 53,047 \\ \hline 8450 & Dues end Sabstriptions tapente & 6.200 \\ \hline 65001 & Emploxe lenchit Fxperse. & 45,000 \\ \hline 6550. & Frelohs Exgense. & 235.000 \\ \hline 66501 & Income Tax Expense & 45,000 \\ \hline 6700 & Insurance Expense & 65,000 \\ \hline 6750 & finterest Fupense & 58000 \\ \hline 6900 & Layndry and Pry Ciepning Eupesne: & \\ \hline 69501 & Legal and Prolestiond I Expense. & 53,000 \\ \hline 6900 & Licenses Expense & 6.590 \\ \hline 7000 & Maintenence fxpente. & 85.600 \\ \hline 7050 & Meals end Intertainment fepense & \\ \hline 7100 & office Expenge & 149.240 \\ \hline 2200 & Parnoll Tax Expense & 63,000 \\ \hline 23000 & Other Taxes & 653 \\ \hline 73sop & Poultage fupense & 6.510 \\ \hline 7400 & Rent er lease trpense & os 200 \\ \hline 74501 & Repair and Maintensnce Fupense, Cefice. & 5.852 \\ \hline 7460 & Repar and Maintensnce Expense, Yehide & 5,305 \\ \hline 7550 & Supples Expenst, CHise & 6000 \\ \hline 7600 & Telephose Expense & 10,050 \\ \hline 7620 & Training fxpetsen & 35,053 \\ \hline 7650 & Travel Pxperder & 45. Ses. \\ \hline & Salaries Expense, Officers. & 275,000 \\ \hline 7350 & Wages Erpense & 365.000 \\ \hline 7800 & ugillies Expenst & 45,000 \\ \hline 8900 & Other Erense & 2.50 \\ \hline 9000 & Gain on Sale of Asuets & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline 4000 & Sales & 6,920,000 \\ \hline 4060 & Interest Income & 150,000 \\ \hline 4080 & Other Income & 13,000 \\ \hline 4800 & Sales Returns and Allowances & 65,000 \\ \hline 4900 & Sales Discounts & 41,000 \\ \hline 5000 & Product \#1 Cost of Goods Sold & 578,000 \\ \hline 5010 & Product #2 Cost of Goods Sold & 456,000 \\ \hline 5020 & Product #3 Cost of Goods Sold & 36,500 \\ \hline 6010 & Advertising Expense & 95,000 \\ \hline 6050 & Amortization Expense & 10,000 \\ \hline 6100 & Auto Expenses & 64,000 \\ \hline 6150 & Bad Debt Expense & 3,200 \\ \hline 6200 & Bank Fees & 1,200 \\ \hline 6250 & Cash Over and Short & 53 \\ \hline 6300 & Charitable Contributions Expense & 8,560 \\ \hline 6350 & Commissions and Fees Expense & 500,500 \\ \hline 6400 & Depreciation Expense & 593,047 \\ \hline 6450 & Dues and Subscriptions Expense & 6,200 \\ \hline 6500 & Employee Benefit Expense & 45,000 \\ \hline 6550 & Freight Expense & 235,000 \\ \hline 6650 & Income Tax Expense & 45,000 \\ \hline 6700 & Insurance Expense & 65,000 \\ \hline 6750 & Interest Expense & 50,000 \\ \hline 6800 & Laundry and Dry Cleaning Expense & 32,000 \\ \hline 6850 & Legal and Professional Expense & 63,000 \\ \hline 6900 & Licenses Expense & 6,500 \\ \hline 7000 & Maintenance Expense & 85,600 \\ \hline 7050 & Meals and Entertainment Expense & 4,800 \\ \hline 7100 & Office Expense & 149,250 \\ \hline 7200 & Payroll Tax Expense & 63,000 \\ \hline 7300 & Other Taxes & 653 \\ \hline 7350 & Postage Expense & 6,530 \\ \hline 7400 & Rent or Lease Expense & 95,300 \\ \hline 7450 & Repair and Maintenance Expense, Office & 6,852 \\ \hline 7460 & Repair and Maintenance Expense, Vehicle & 5,305 \\ \hline 7550 & Supplies Expense, Office & 6,000 \\ \hline 7600 & Telephone Expense & 10,050 \\ \hline 7620 & Training Expense & 35,035 \\ \hline 7650 & Travel Expense & 45,680 \\ \hline 7700 & Salaries Expense, Officers & 275,000 \\ \hline 7750 & Wages Expense & 365,000 \\ \hline 7800 & Utilities Expense & 45,000 \\ \hline 8900 & Other Expense & 2,560 \\ \hline 9000 & Gain on Sale of As & 5.600 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|} \hline 1000 & Petty Cash & 250 \\ \hline 1020 & Regular Checking Account & 500,325 \\ \hline 1030 & Payroll Checking Account & 54,503 \\ \hline 1040 & Savings Account & 100,000 \\ \hline 1060 & Investments - Money Market & 3,000,000 \\ \hline 1100 & Accounts Receivable & 80,000 \\ \hline 1110 & Allowance for Doubtful Accounts & 9,053 \\ \hline 1140 & Other Receivables & 6,500 \\ \hline 1200 & Inventory & 350,000 \\ \hline 1205 & Supplies Inventory & 5,000 \\ \hline 1400 & Prepaid Expenses & 10,000 \\ \hline 1420 & Notes Receivable - Current & 5,000 \\ \hline 1470 & Other Current Assets & 1,500 \\ \hline 1500 & Notes Receivable, Non-Current & 85,000 \\ \hline 1600 & Furniture and Fixtures & 500,500 \\ \hline 1610 & Equipment & 555,000 \\ \hline 1630 & Leasehold Improvements & 254,000 \\ \hline 1640 & Buildings & 2,000,000 \\ \hline 1650 & Building Improvements & 150,000 \\ \hline 1700 & Accumulated Depreciation, Furniture and Fixtures & 25,000 \\ \hline 1710 & Accumulated Depreciation, Equipment & 50,000 \\ \hline 1730 & Accumulated Depreciation, Leasehold Improvements & 23,000 \\ \hline 1740 & Accumulated Depreciation, Buildings & 62,500 \\ \hline 1750 & Accumulated Depreciation, Building Improvements & 4,000 \\ \hline 1910 & Goodwill & 20,000 \\ \hline 2000 & Accounts Payable & 23,000 \\ \hline 2300 & Accrued Expenses & 18,000 \\ \hline 2310 & Sales Tax Payable & 8,000 \\ \hline 2320 & Wages Payable & 50,000 \\ \hline 2340 & Payroll Taxes Payable & 6,200 \\ \hline 2390 & Income Taxes Payable & 12,000 \\ \hline 2400 & Other Taxes Payable & 6,250 \\ \hline 2410 & Employee Benefits Payable & 4,200 \\ \hline 2420 & Current Portion of Long-term Debt & 68,000 \\ \hline 2440 & Deposits from Customers & 32,000 \\ \hline 2700 & Notes Payable & 750,000 \\ \hline 2702 & Land Payable & 350,000 \\ \hline 2710 & Deferred Revenue & 15,000 \\ \hline 3010 & Common Stock & 1,500,000 \\ \hline 3020 & Additional Paid in Capital & 875,000 \\ \hline 3030 & Retained Eamings & 899,150 \\ \hline 4000 & Sales & 6,920,000 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts