Question: On this particular question. This is one in which I have gotten stuck on. Exercise 5.3. Assume a 2-by-2 economy With the state space 0

On this particular question. This is one in which I have gotten stuck on.

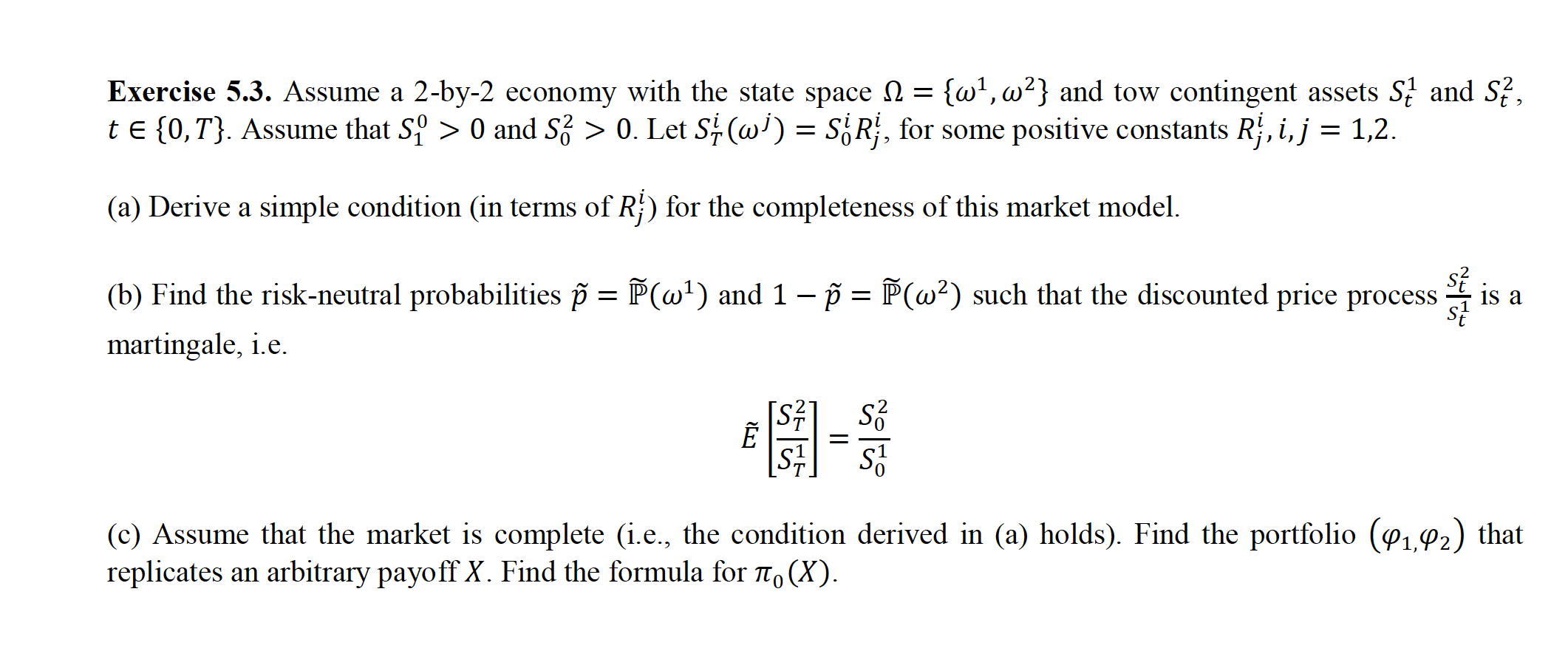

Exercise 5.3. Assume a 2-by-2 economy With the state space 0 = {(01, (102} and tow contingent assets St1 and 53, t E {0,T}. Assume that Sf > 0 and 53 > 0. Let 5% (mi) 2 56R}, for some positive constants R}, i,j = 1,2. (a) Derive a simple condition (in terms of R1?) for the completeness of this market model. ~ ~ 2 (b) Find the risk-neutral probabilities 13 = ]P'(a)1) and 1 33 = lP'(w2) such that the discounted price process :41 is a t martingale, ie H 5% 55 EE= r o (c) Assume that the market is complete (i.e., the condition derived in (a) holds). Find the portfolio ((plfpz) that replicates an arbitrary payoff X. Find the formula for no (X)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts