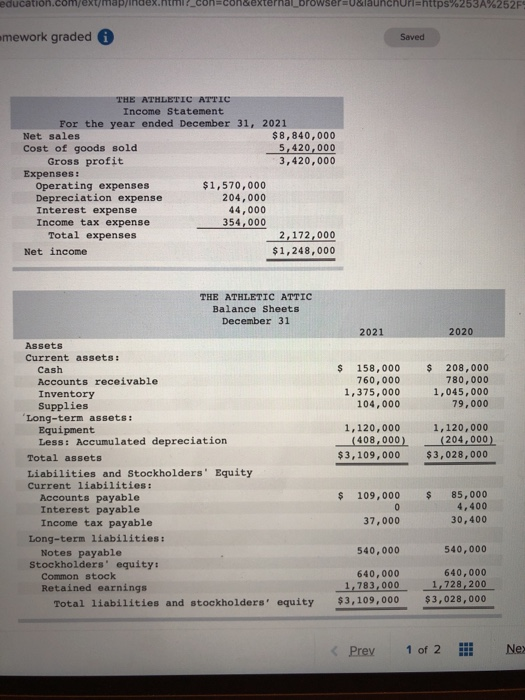

Question: on.com ser Udla https%253A%252F mework graded 0 Saved THE ATHLETIC ATTIC Income Statement For the year ended December 31, 2021 Net sales $8,840,000 Cost of

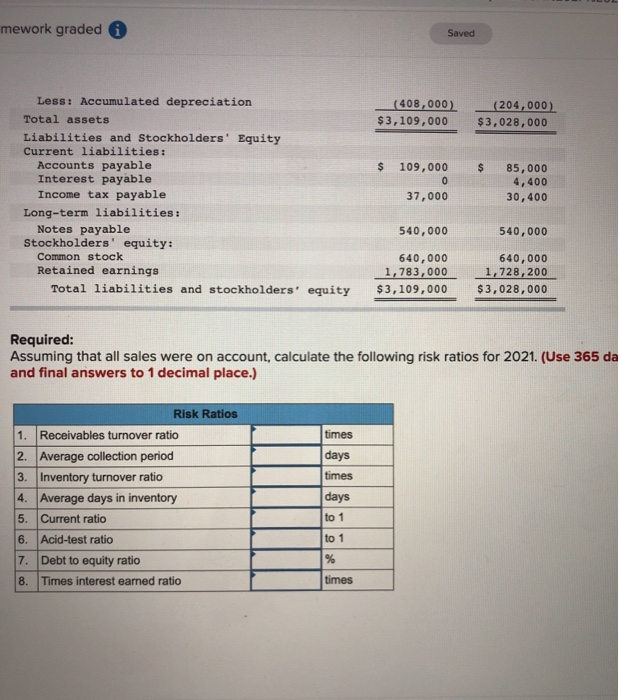

on.com ser Udla https%253A%252F mework graded 0 Saved THE ATHLETIC ATTIC Income Statement For the year ended December 31, 2021 Net sales $8,840,000 Cost of goods sold 5,420,000 Gross profit 3,420,000 Expenses : Operating expenses $1,570,000 Depreciation expense 204,000 Interest expense 44,000 Income tax expense 354,000 Total expenses 2,172,000 Net income $1,248,000 THE ATHLETIC ATTIC Balance Sheets December 31 2021 2020 $ $ 158,000 760,000 1,375,000 104,000 208,000 780,000 1,045,000 79,000 1,120,000 (408,000) $3,109,000 1,120,000 (204,000) $3,028,000 Assets Current assets: Cash Accounts receivable Inventory Supplies 'Long-term assets: Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity $ $ 109,000 0 37,000 85,000 4,400 30,400 540,000 540,000 640,000 1,783,000 $3,109,000 640,000 1,728, 200 $3,028,000 Prey 1 of 2 Nex mework graded 0 Saved (408,000) $3,109,000 (204,000) $3,028,000 $ $ Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity 109,000 o 37,000 85,000 4,400 30,400 540,000 540,000 640,000 1,783,000 $3,109,000 640,000 1,728,200 $3,028,000 Required: Assuming that all sales were on account, calculate the following risk ratios for 2021. (Use 365 da and final answers to 1 decimal place.) Risk Ratios 1. Receivables turnover ratio 2. Average collection period 3. Inventory turnover ratio 4. Average days in inventory 5. Current ratio 6. Acid-test ratio 7. Debt to equity ratio 8. Times interest earned ratio times days times days to 1 to 1 % times

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts