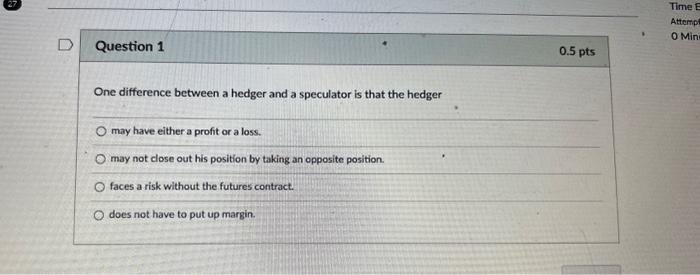

Question: One difference between a hedger and a speculator is that the hedger may have either a profit or a loss. may not close out his

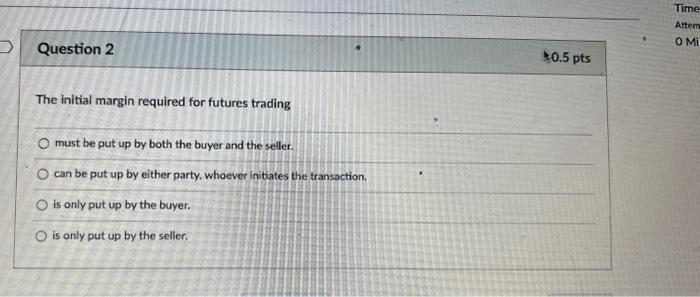

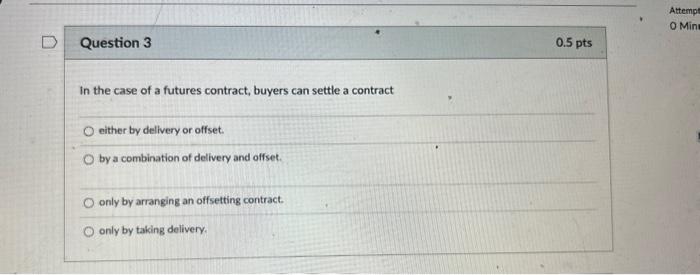

One difference between a hedger and a speculator is that the hedger may have either a profit or a loss. may not close out his position by taking an opposite position. faces a risk without the futures contract. does not have to put up margin. Question 3 0.5pts In the case of a futures contract, buyers can settle a contract either by delivery or offset. by a combination of delivery and offset. only by arranging an offsetting contract. only by taking delivery. The initial margin required for futures trading must be put up by both the buyer and the seller. can be put up by either party, whoever initiates the transaction. is only put up by the buyer. is only put up by the seller

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts