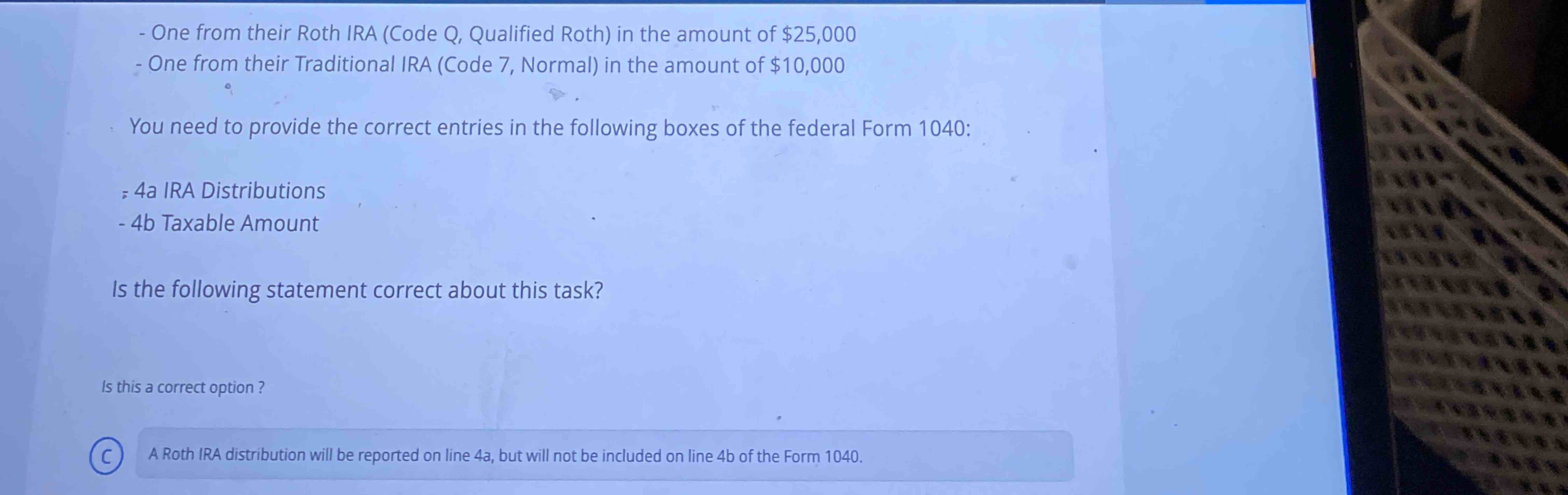

Question: - One from their Roth IRA ( Code Q , Qualified Roth ) in the amount of ( $ 2 5 , 0

One from their Roth IRA Code Q Qualified Roth in the amount of $

One from their Traditional IRA Code Normal in the amount of $

You need to provide the correct entries in the following boxes of the federal Form :

a IRA Distributions

b Taxable Amount

Is the following statement correct about this task?

Is this a correct option

c A Roth IRA distribution will be reported on line a but will not be included on line b of the Form

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock