Question: One hedge fund strategy that involves simultaneously holding short and long positions in common stock is most likely O a. volatility O b. distressed/restructuring O

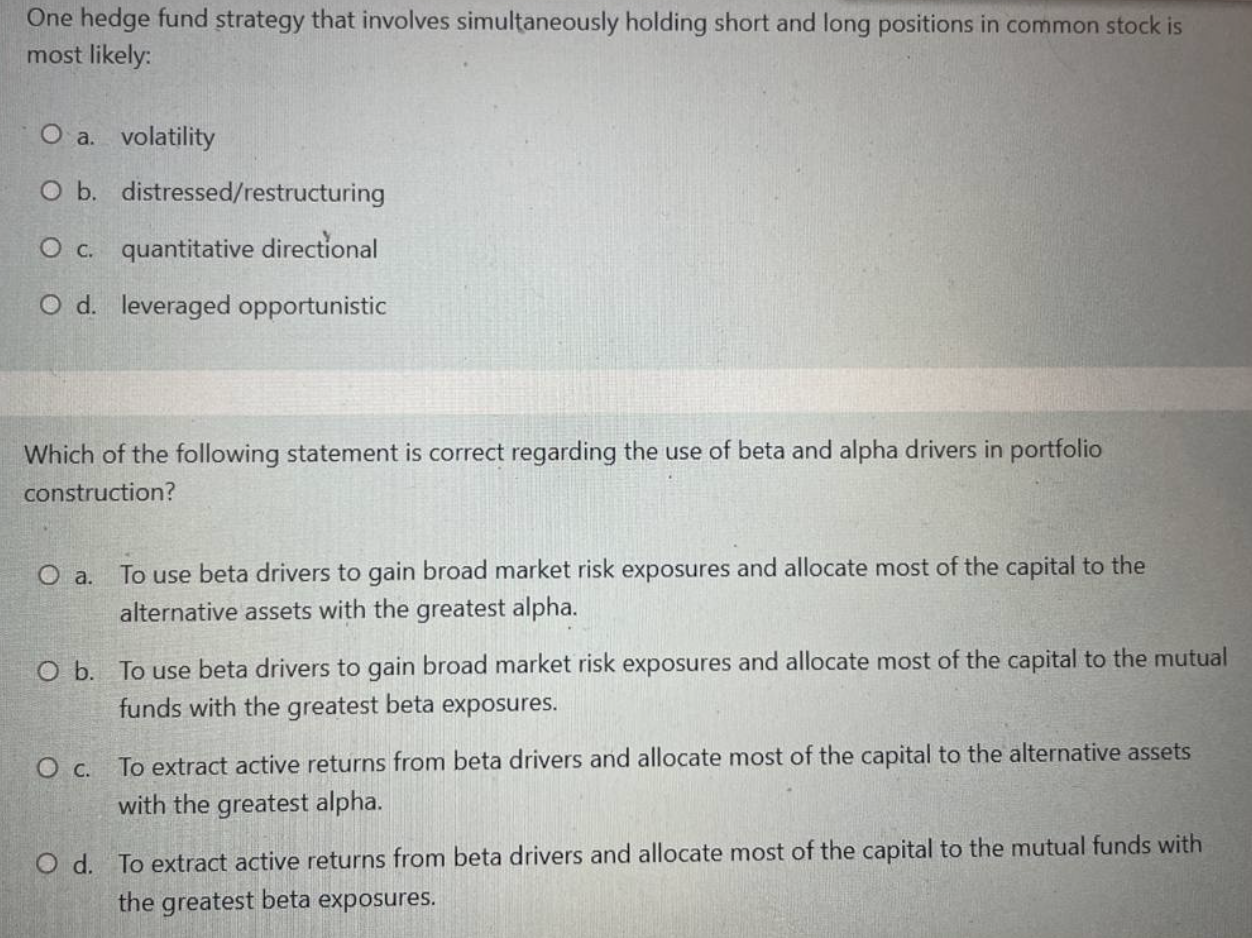

One hedge fund strategy that involves simultaneously holding short and long positions in common stock is most likely O a. volatility O b. distressed/restructuring O c. quantitative directional O d. leveraged opportunistic Which of the following statement is correct regarding the use of beta and alpha drivers in portfolio construction? O a. To use beta drivers to gain broad market risk exposures and allocate most of the capital to the alternative assets with the greatest alpha. O b. To use beta drivers to gain broad market risk exposures and allocate most of the capital to the mutual funds with the greatest beta exposures. O c. To extract active returns from beta drivers and allocate most of the capital to the alternative assets with the greatest alpha. O d. To extract active returns from beta drivers and allocate most of the capital to the mutual funds with the greatest beta exposures

Step by Step Solution

There are 3 Steps involved in it

For the first question Holding simultaneous short and long position... View full answer

Get step-by-step solutions from verified subject matter experts