Question: One of the key differences between a total return mandate and a structured mandate is: Select one A . In . total return mandate the

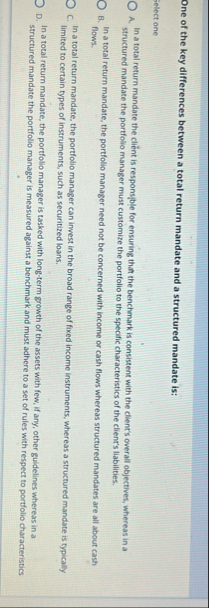

One of the key differences between a total return mandate and a structured mandate is:

Select one

A In total return mandate the client is responsjble for ensuring that the benchmark is consistent with the client's overall objectives, whereas in a structured mandate the portfolio manager must customize the portfolio to the specific characteristics of the client's liabilities.

B In total return mandate, the portfolio manager need not be concerned with income or cash flows whereas structured mandates are all about cash flows.

C In a total return mandate, the portfolio manager can invest in the broad range of foxed income instruments, whereas a structured mandate is typically limited to certain types of instruments, such as securitized loans.

D In i total return mandate, the portfolio manager is tasked with longterm growth of the assets with few, if any, other guidelines whereas in a structured mandate the portfolio manager is measured against a benchmark and must adhere to a set of rules with respect to portfolio characteristics

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock