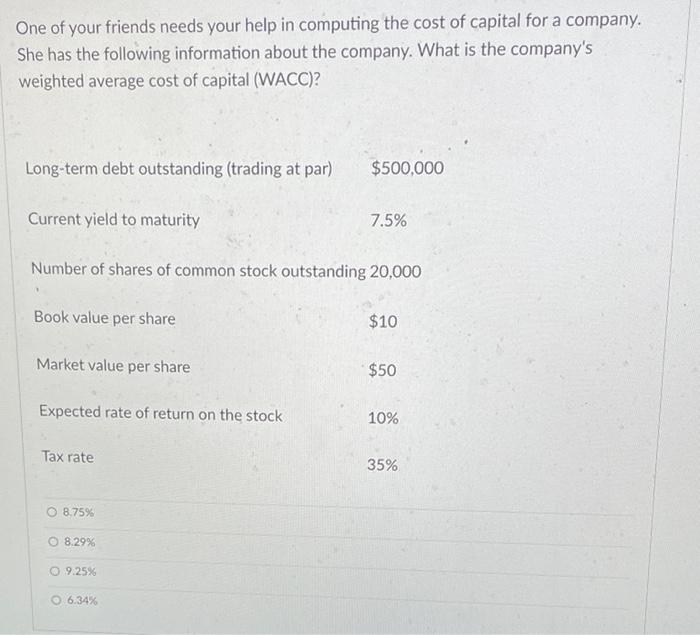

Question: One of your friends needs your help in computing the cost of capital for a company. She has the following information about the company. What

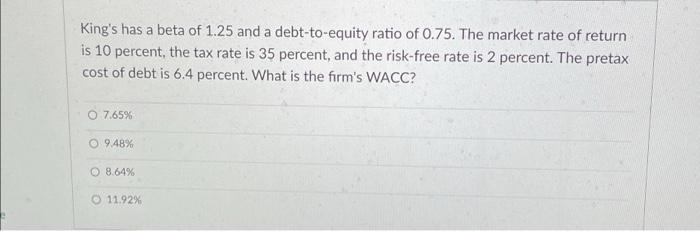

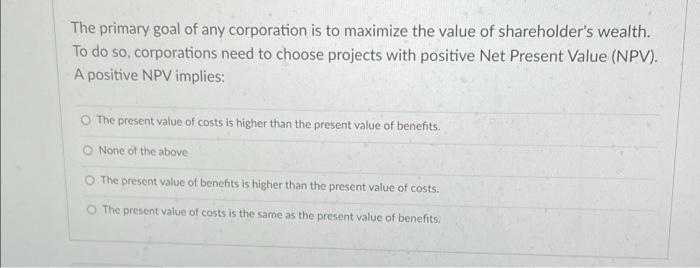

One of your friends needs your help in computing the cost of capital for a company. She has the following information about the company. What is the company's weighted average cost of capital (WACC)? Long-term debt outstanding (trading at par) $500,000 Current yield to maturity 7.5% Number of shares of common stock outstanding 20,000 Book value per share $10 Market value per share $50 Expected rate of return on the stock 10% Tax rate 35% O 8.75% 8.29% 0 9.25% 6.34% King's has a beta of 1.25 and a debt-to-equity ratio of 0.75. The market rate of return is 10 percent, the tax rate is 35 percent, and the risk-free rate is 2 percent. The pretax cost of debt is 6.4 percent. What is the firm's WACC? 7.65% 9.48% O 8.64% 11.92% The primary goal of any corporation is to maximize the value of shareholder's wealth. To do so, corporations need to choose projects with positive Net Present Value (NPV). A positive NPV implies: The present value of costs is higher than the present value of benefits. None of the above The present value of benefits is higher than the present value of costs. The present value of costs is the same as the present value of benefits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts