Question: One or multiple answers are possible 4. About the CAPM and relevant investment implications, correct statements are:( ) A Passive strategy should be all investor's

One or multiple answers are possible

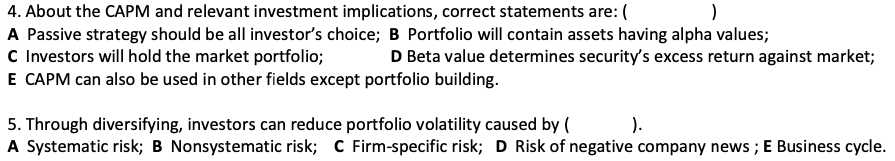

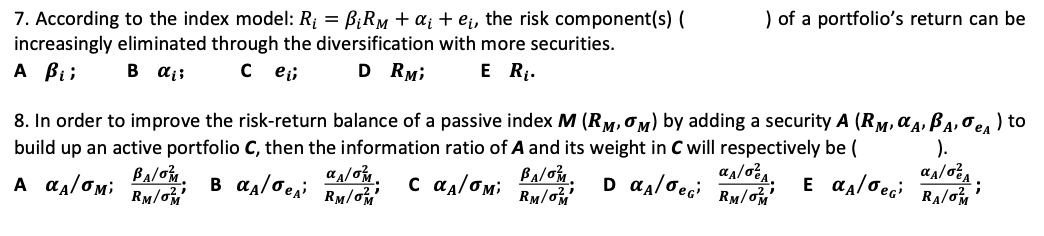

4. About the CAPM and relevant investment implications, correct statements are:( ) A Passive strategy should be all investor's choice; B Portfolio will contain assets having alpha values; C Investors will hold the market portfolio; D Beta value determines security's excess return against market; E CAPM can also be used in other fields except portfolio building. 5. Through diversifying, investors can reduce portfolio volatility caused by ( ). A Systematic risk; B Nonsystematic risk; C Firm-specific risk; D Risk of negative company news ; E Business cycle. ) of a portfolio's return can be 7. According to the index model: Ri = BiRM + di + e, the risk component(s) ( increasingly eliminated through the diversification with more securities. A Bii B dii Ce ii E Ri. DRM 8. In order to improve the risk-return balance of a passive index M (RM, OM) by adding a security A (Ry, QA, BA, OEA) to build up an active portfolio C, then the information ratio of A and its weight in C will respectively be ). A aglomi B agloen sec aglomi BAOM RM/OM RM/OM BA/0%. agloa, E agloed Room Daglegi RM/O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts