Question: One problem about the capital budgeting decision is that what should you use as the discount rate? The weighted average cost of capital (WACC) can

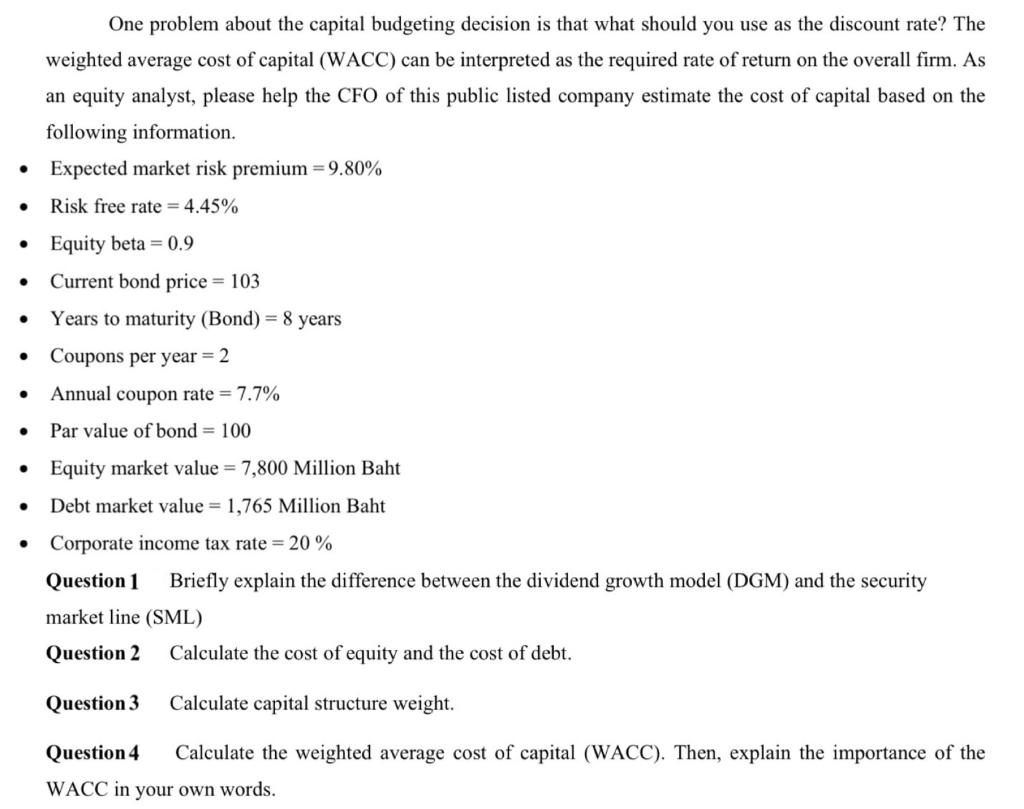

One problem about the capital budgeting decision is that what should you use as the discount rate? The weighted average cost of capital (WACC) can be interpreted as the required rate of return on the overall firm. As an equity analyst, please help the CFO of this public listed company estimate the cost of capital based on the following information. - Expected market risk premium =9.80% - Risk free rate =4.45% - Equity beta =0.9 - Current bond price =103 - Years to maturity ( Bond )=8 years - Coupons per year =2 - Annual coupon rate =7.7% - Par value of bond =100 - Equity market value =7,800 Million Baht - Debt market value =1,765 Million Baht - Corporate income tax rate =20% Question 1 Briefly explain the difference between the dividend growth model (DGM) and the security market line (SML) Question 2 Calculate the cost of equity and the cost of debt. Question 3 Calculate capital structure weight. Question 4 Calculate the weighted average cost of capital (WACC). Then, explain the importance of the WACC in your own words

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts