Question: One Question. Please solve a and b. Thank You. 3. Expected return and standard deviation: a. Johnson & Johnson (JNJ) is trading at 123.64 (5/12/2017

One Question. Please solve a and b. Thank You.

3. Expected return and standard deviation:

a. Johnson & Johnson (JNJ) is trading at 123.64 (5/12/2017 close). JNJ is a large health care conglomerate. It has done well over the last couple of years and you think it will continue to do well. After careful analysis you conclude that in one year the price will be (90, 105, 125, 155, 175) with associated probabilities of (0.1, 0.2, 0.4, 0.2, 0.1). Looking at the companys past record you project that JNJ will pay a dividend of 3.40 (four quarterly dividends of 0.85). (i) What is the expected return of JNJ stock? (ii) Calculate the standard deviation of the return of JNJ stock (remember that you are using probabilities to do this, not historical data).

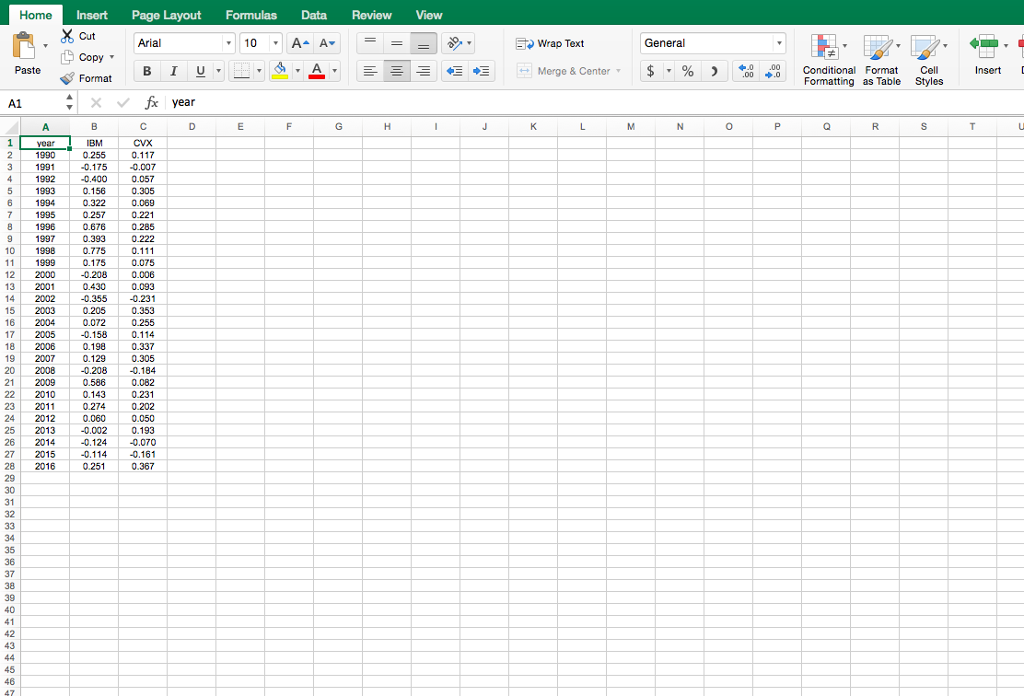

b. In the second sheet of the Excel file PS4 you will find historical data for IBM and CVX returns. (i) Calculate the sample expected return and sample standard deviation for both. (ii) What is the standard error of the sample average in each case? What is the +/- 2 standard error confidence interval of the sample average?

Home Insert Page Layout Formulas Data Review View Copy Paste Format A1 year 1990 0.255 0.117 5 1993 0.156 0.305 1995 0.257 0.221 10 1998 0.775 0.111 11 -0.355 -0.23 17 -0.158 0.114 18 2006 0.198 0.337 2007 0.129 0.305 20 -0.208 -0.184. 21 0.082 22 2010 0.143 0.23 23 2011 0.274 0.202 24 0.060 2012 0.050 25 2013 -0.002 0.193 26 2014 -0,124 -0.070 27 2015 -0,114 28 2016 0.25 0.367 29 30 31 32 33 35 36 37 38 39 40 41 42 43 45 46 Wrap Text Merge & Center General Conditional Forma Cell Formatting as Table Styles nsert

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts