Question: one question with 1 sub part. i will give likes On March 31, 2020, Capital investment Advisers paid $4,580,000 for and with two buildings on

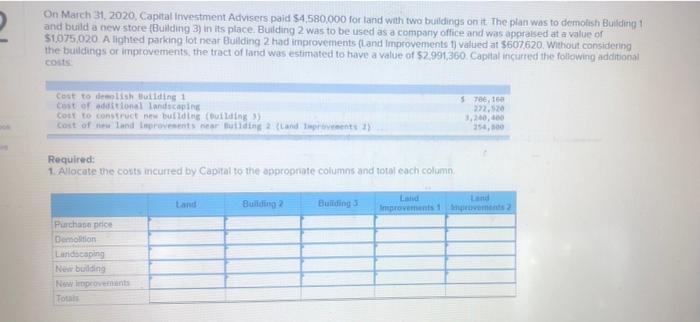

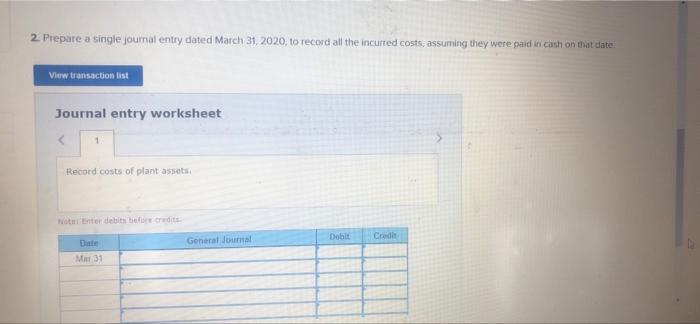

On March 31, 2020, Capital investment Advisers paid $4,580,000 for and with two buildings on it. The plan was to demolish Building 1 and build a new store (Building 3) in its place Building 2 was to be used as a company office and was appraised at a value of $1,075,020 A lighted parking lot near Building 2 had improvements (Land improvements t) valued at $607620. Without considering the buildings or improvements, the tract of land was estimated to have a value of $2,991,360 Capital incurred the following additional COSTS Cost to demolish Building 1 cost of additional landscaping Cot to construct new blog (building >> cost of land prevents near Butiding 2 (land trots) $76,10 272,120 Required: 1. Allocate the costs incurred by Capital to the appropriate columns and total each column Land Building Building Land Land Improvements 1 m2 Purchase price Demolition Landscaping New building Now improvement Total 2. Prepare a single journal entry dated March 31, 2020, to record all the incurred costs, assuming they were paid in canh on that date: View transaction list Journal entry worksheet Record costs of plant assets Not Enon debit bereits General Journal Doble Credit Date Mar 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts