Question: One way to compute the total contribution margin is to deduct total fixed expenses from net operating income. 1. On a cost-volume-profit graph, the revenue

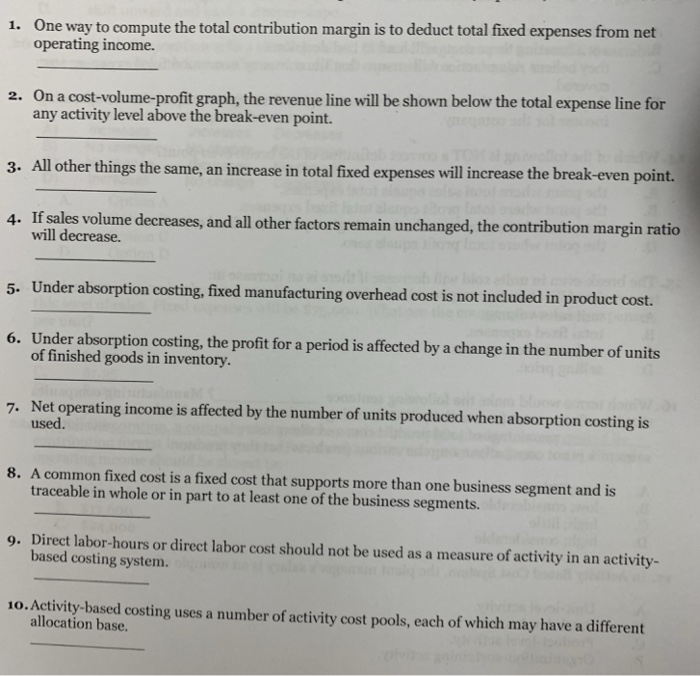

One way to compute the total contribution margin is to deduct total fixed expenses from net operating income. 1. On a cost-volume-profit graph, the revenue line will be shown below the total expense line for any activity level above the break-even point. 2. 3. All other things the same, an increase in total fixed expenses will increase the break-even point. 4. If sales volume decreases, and all other factors remain unchanged, the contribution margin ratio will decrease. 5. Under absorption costing, fixed manufacturing overhead cost is not included in product cost. Under absorption costing, the profit for a period is affected by a change in the number of units of finished goods in inventory 6. Net operating income is affected by the number of units produced when absorption costing is used. 7. A common fixed cost is a fixed cost that supports more than one business segment and is traceable in whole or in part to at least one of the business segments 8. Direct labor-hours or direct labor cost should not be used as a measure of activity in an activity- based costing system. 9. o. Activity-based costing uses a number of activity cost pools, each of which may have a different allocation base

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts