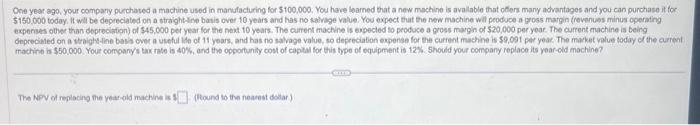

Question: One year ago, your compary purchated a machine used in mansfacturing for $100,000. You have learned that a new mochine is avallable that ofers many

One year ago, your compary purchated a machine used in mansfacturing for $100,000. You have learned that a new mochine is avallable that ofers many advantagos and you can purchase it for 5150 , 000 today. it will be depreciated on a straight Ane basis over 10 years and has no salvage value. You expect that the new machine will peoduce a gross margin (reventies minus operating experises oblec than deprecistion) of 545,000 pet year for the neat 10 years. The current machine is expecled to produce a gross margin of 520,000 per year The current machine is being oeprecialed on a wraightine bess ovec a useful life of 11 years, and has no salvage value, so depreciation expense for the current machine is $9,091 per yeac. The maket yalve today of the current machint is $50,000. Your company's tax nise is 40%, and the opportunily cost of capial for this type of equipment is 12%. 5 should your compary replace its year-old mochine? The NPF of replacing the yeared machire is (hlound to the neasest dolar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts