Question: One-time special order decision Bob makes widgets. Variable costs per unit are $4. Fixed cost per unit (at an output level of 100) are $2

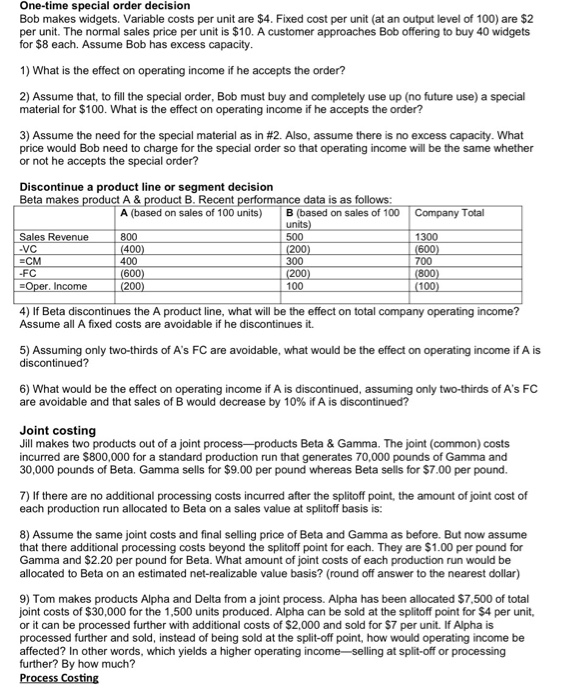

One-time special order decision Bob makes widgets. Variable costs per unit are $4. Fixed cost per unit (at an output level of 100) are $2 per unit. The normal sales price per unit is $10. A customer approaches Bob offering to buy 40 widgets for $8 each. Assume Bob has excess capacity. 1) What is the effect on operating income if he accepts the order? 2) Assume that, to fill the special order, Bob must buy and completely use up (no future use) a special material for $100. What is the effect on operating income if he accepts the order? 3) Assume the need for the special material as in #2. Also, assume there is no excess capacity. What price would Bob need to charge for the special order so that operating income will be the same whether or not he accepts the special order? Discontinue a product line or segment decision Beta makes product A & product B. Recent performance data is as follows: B (based on sales of 100 units) 500 Company Total A (based on sales of 100 units) Sales Revenue 800 (400) 400 1300 (600) 700 (800) (100) -VC (200) 300 (200) 100 CM -FC (600) (200) Oper. Income 4) If Beta discontinues the A product line, what will be the effect on total company operating income? Assume all A fixed costs are avoidable if he discontinues it. 5) Assuming only two-thirds of A's FC are avoidable, what would be the effect on operating income if A is discontinued? 6) What would be the effect on operating income if A is discontinued, assuming only two-thirds of A's FC are avoidable and that sales of B would decrease by 10% if A is discontinued? Joint costing Jill makes two products out of a joint process-products Beta & Gamma. The joint (common) costs incurred are $800,000 for a standard production run that generates 70,000 pounds of Gamma and 30,000 pounds of Beta. Gamma sells for $9.00 per pound whereas Beta sells for $7.00 per pound. 7) If there are no additional processing costs incurred after the splitoff point, the amount of joint cost of each production run allocated to Beta ona sales value at splitoff basis is: 8) Assume the same joint costs and final selling price of Beta and Gamma as before. But now assume that there additional processing costs beyond the splitoff point for each. They are $1.00 per pound for Gamma and $2.20 per pound for Beta. What amount of joint costs of each production run would be allocated to Beta on an estimated net-realizable value basis? (round off answer to the nearest dollar) 9) Tom makes products Alpha and Delta from a joint process. Alpha has been allocated $7,500 of total joint costs of $30,000 for the 1,500 units produced. Alpha can be sold at the splitoff point for $4 per unit, or it can be processed further with additional costs of $2,000 and sold for $7 per unit. If Alpha is processed further and sold, instead of being sold at the split-off point, how would operating income be affected? In other words, which yields a higher operating income-selling at split-off or processing further? By how much? Process Costing 9) Tom makes products Alpha and Delta from a joint process. Alpha has been allocated $7,500 of total joint costs of $30,000 for the 1,500 units produced. Alpha can be sold at the splitoff point for $4 per unit, or it can be processed further with additional costs of $2,000 and sold for $7 per unit. If Alpha is processed further and sold, instead of being sold at the split-off point, how would operating income be affected? In other words, which yields a higher operating income-selling at split-off or processing further? By how much? Process Costing The following information applies to the next 4 questions Beta uses process costing. It started the period with zero beginning inventory in WIP and Finished Goods inventory. It began work on 400 units during the period and incurred the following costs during the period. Direct materials are added at the beginning of the process followed by the conversion process. Direct Material Costs: $128,000 Conversion Costs: $74,400 At the end of the period, the degree of completion of the 400 units for each cost category was as follows: Direct Materials: 400 units were 100% completed Conversion Costs: 175 units were 100% completed and transferred to Finished Goods inventory 225 units were 60% completed 10) Calculate the number of equivalent units for the Conversion Cost category. 11) Calculate the total (DM+ Conversion Costs) manufacturing cost per finished unit. 12) Calculate the ending balance (in dollars ) of Work-in-Process (WIP) inventory 13) Calculate the ending balance (in dollars ) of Finished Goods inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts