Question: Only 1(b) The table above lists the par coupon yields on 1, 2, 3, and 5 year bonds with a Face Value of $100 and

Only 1(b)

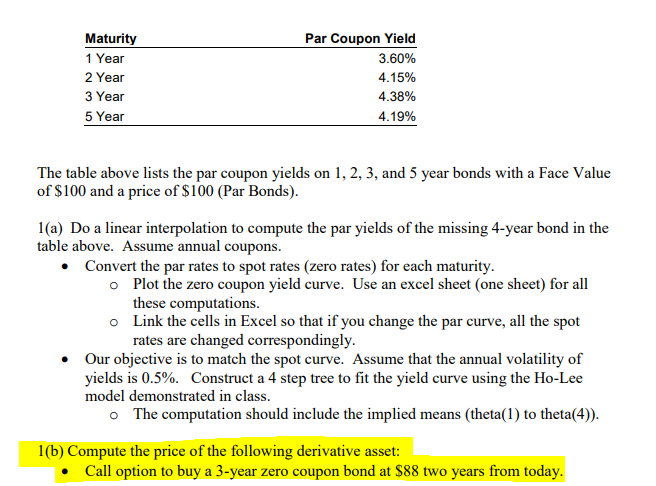

The table above lists the par coupon yields on 1, 2, 3, and 5 year bonds with a Face Value of $100 and a price of $100 (Par Bonds). 1(a) Do a linear interpolation to compute the par yields of the missing 4-year bond in the table above. Assume annual coupons. - Convert the par rates to spot rates (zero rates) for each maturity. - Plot the zero coupon yield curve. Use an excel sheet (one sheet) for all these computations. - Link the cells in Excel so that if you change the par curve, all the spot rates are changed correspondingly. - Our objective is to match the spot curve. Assume that the annual volatility of yields is 0.5%. Construct a 4 step tree to fit the yield curve using the Ho-Lee model demonstrated in class. - The computation should include the implied means (theta(1) to theta(4)). 1(b) Compute the price of the following derivative asset: - Call option to buy a 3-year zero coupon bond at $88 two years from today. The table above lists the par coupon yields on 1, 2, 3, and 5 year bonds with a Face Value of $100 and a price of $100 (Par Bonds). 1(a) Do a linear interpolation to compute the par yields of the missing 4-year bond in the table above. Assume annual coupons. - Convert the par rates to spot rates (zero rates) for each maturity. - Plot the zero coupon yield curve. Use an excel sheet (one sheet) for all these computations. - Link the cells in Excel so that if you change the par curve, all the spot rates are changed correspondingly. - Our objective is to match the spot curve. Assume that the annual volatility of yields is 0.5%. Construct a 4 step tree to fit the yield curve using the Ho-Lee model demonstrated in class. - The computation should include the implied means (theta(1) to theta(4)). 1(b) Compute the price of the following derivative asset: - Call option to buy a 3-year zero coupon bond at $88 two years from today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts