Question: Only #2 is required Question 1 (30 points): Consider an escalation rate of 11% for all costs (including environmental remediation cost) and 8% for all

Only #2 is required

Only #2 is required

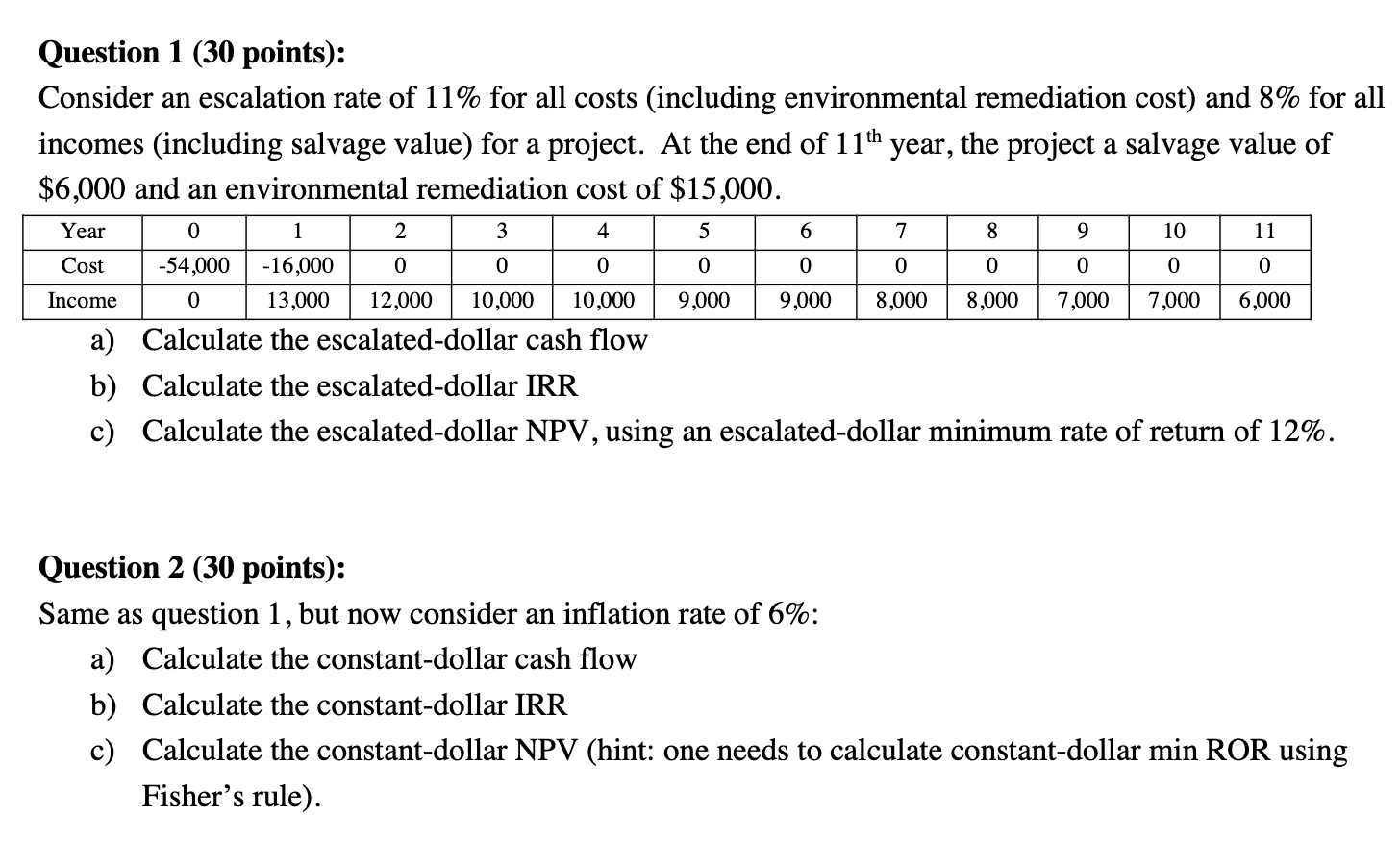

Question 1 (30 points): Consider an escalation rate of 11% for all costs (including environmental remediation cost) and 8% for all incomes (including salvage value) for a project. At the end of 11th year, the project a salvage value of $6,000 and an environmental remediation cost of $15,000. Year 0 1 2 3 4 5 6 7 8 9 10 11 Cost -54,000 -16,000 0 0 0 0 0 Income 0 13,000 12,000 10,000 10,000 9,000 9 ,000 8,000 8,000 7,000 7,000 6,000 a) Calculate the escalated-dollar cash flow b) Calculate the escalated-dollar IRR c) Calculate the escalated-dollar NPV, using an escalated-dollar minimum rate of return of 12%. 0 0 0 0 0 Question 2 (30 points): Same as question 1, but now consider an inflation rate of 6%: a) Calculate the constant-dollar cash flow b) Calculate the constant-dollar IRR c) Calculate the constant-dollar NPV (hint: one needs to calculate constant-dollar min ROR using Fisher's rule)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts