Question: **** ONLY 2.1 i), ii), iii) and a).****** (If needed, you can make up the numbers. Thank you!) PART 2: SIMULATION REPORT (Application of Simple

**** ONLY 2.1 i), ii), iii) and a).****** (If needed, you can make up the numbers. Thank you!)

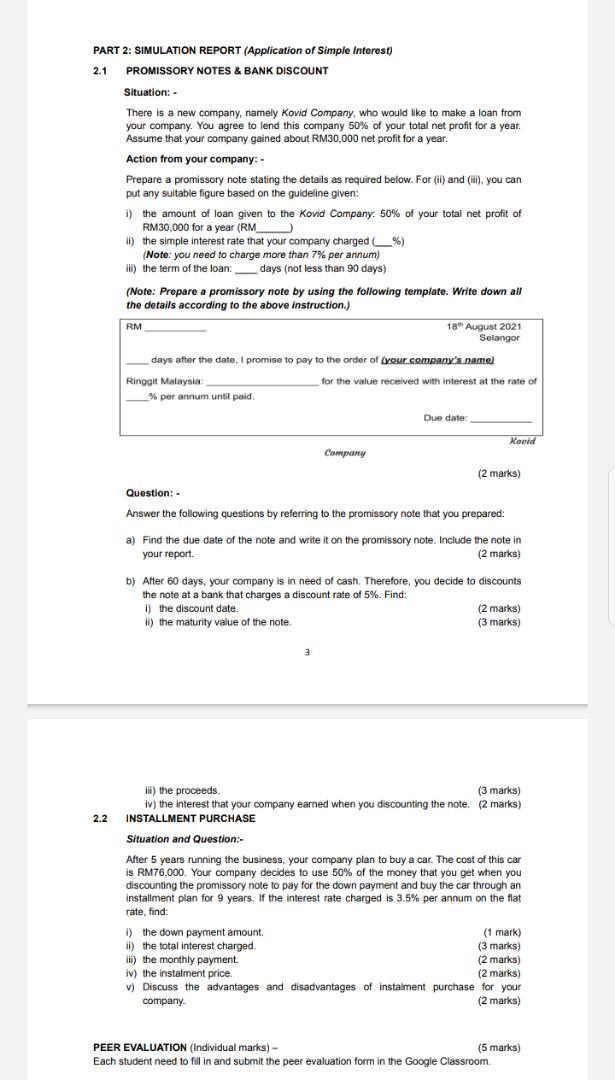

PART 2: SIMULATION REPORT (Application of Simple Interest) 2.1 PROMISSORY NOTES & BANK DISCOUNT Situation: - There is a new company, namely Kovid Company, who would like to make a loan from your company. You agree to lend this company 50% of your total net profit for a year. Assume that your company gained about RM30,000 net profit for a year. Action from your company: - - Prepare a promissory note stating the details as required below. For (i) and (iii), you can put any suitable figure based on the guideline given: i) the amount of loan given to the Kovid Company. 50% of your total net profit of RM30,000 for a year (RM ii) the simple interest rate that your company charged (%) (Note: you need to charge more than 7% per annum) ii) the term of the loan_days (not less than 90 days) (Note: Prepare a promissory note by using the following template. Write down all the details according to the above instruction.) RM 18 August 2021 Selangor days after the date. I promise to pay to the order of your company's name) ) Ringgit Malaysia for the value received with interest at the rate of _ % per annum until paid Due date: Kould Company (2 marks) Question: - Answer the following questions by referring to the promissory note that you prepared: a) Find the due date of the note and write it on the promissory note. Include the note in your report. (2 marks) (2 ) b) After 60 days, your company is in need of cash. Therefore, you decide to discounts the note at a bank that charges a discount rate of 5%. Find: I) the discount date. (2 marks) ii) the maturity value of the note (3 marks) 3 lii) the proceeds. (3 marks) ( iv) the interest that your company earned when you discounting the note. (2 marks) 2.2 INSTALLMENT PURCHASE Situation and Question:- After 5 years running the business, your company plan to buy a car. The cost of this car is RM76.000. Your company decides to use 50% of the money that you get when you discounting the promissory note to pay for the down payment and buy the car through an installment plan for 9 years. If the interest rate charged is 3.5% per annum on the flat rate, find D 1) the down payment amount. 1 (1 mark) ii) the total interest charged. 3 ) (3 marks) iii) the monthly payment (2 marks) ) iv) the instalment price, (2 marks) 2 W V) Discuss the advantages and disadvantages of instalment purchase for your company. (2 marks) PEER EVALUATION (Individual marks) - (5 marks) Each student need to fill in and submit the peer evaluation form in the Google Classroom

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts