Question: only 54. the problem goes over 2 pages. second page has the rest of the problem and main question. i only need question 54. 54.

only 54. the problem goes over 2 pages. second page has the rest of the problem and main question. i only need question 54.

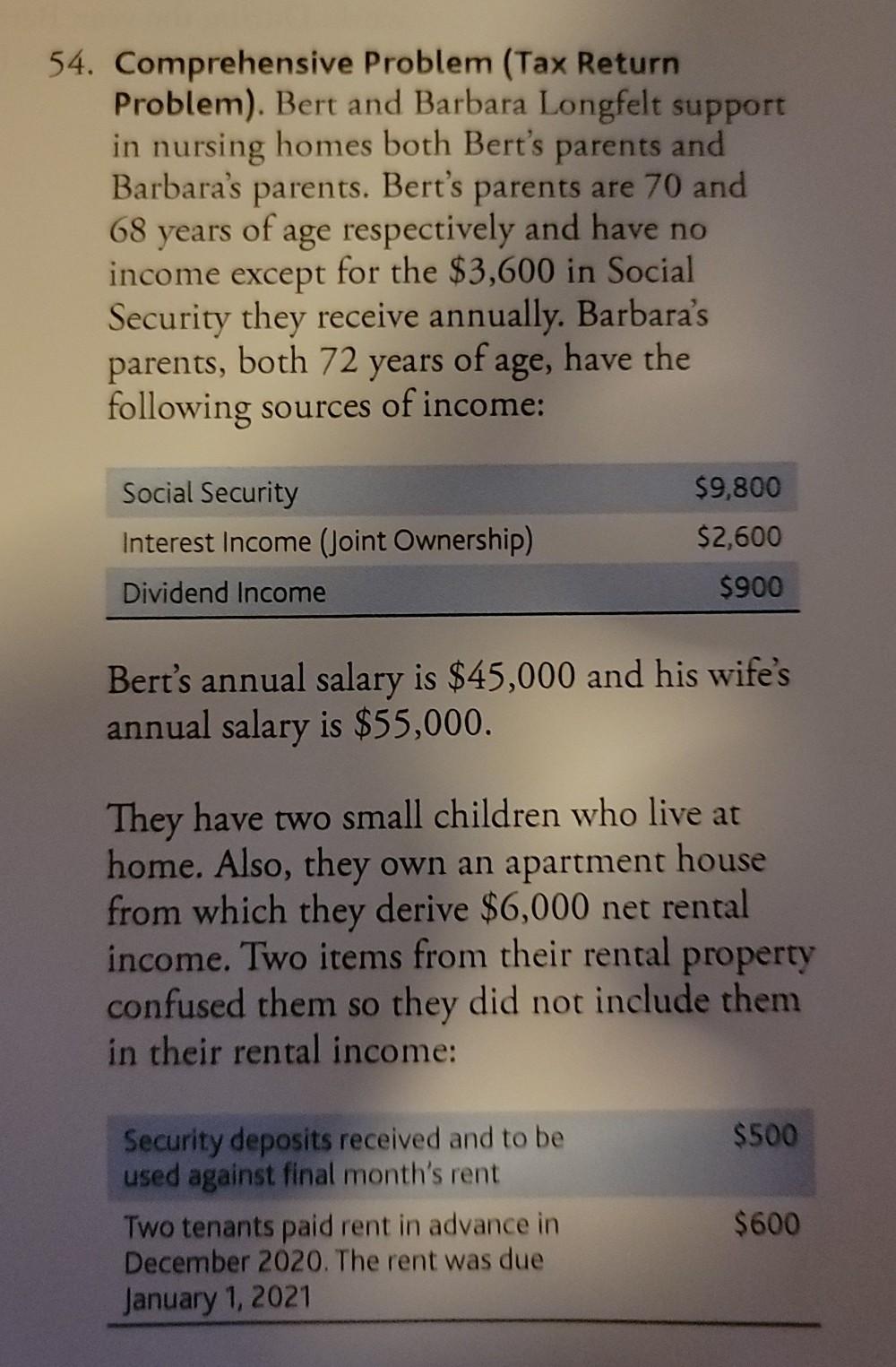

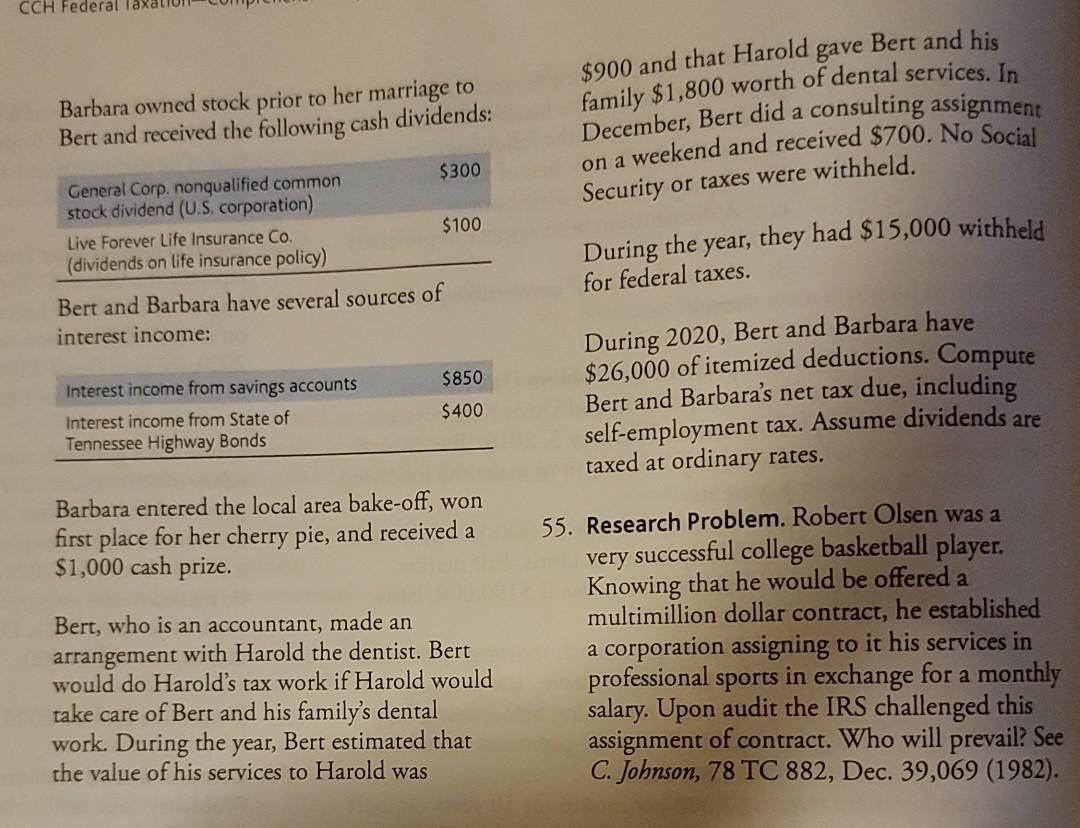

54. Comprehensive Problem (Tax Return Problem). Bert and Barbara Longfelt support in nursing homes both Bert's parents and Barbara's parents. Bert's parents are 70 and 68 years of age respectively and have no income except for the $3,600 in Social Security they receive annually. Barbara's parents, both 72 years of age, have the following sources of income: Social Security Interest Income (Joint Ownership) Dividend Income $9,800 $2,600 $900 Bert's annual salary is $45,000 and his wife's annual salary is $55,000. They have two small children who live at home. Also, they own an apartment house from which they derive $6,000 net rental income. Two items from their rental property confused them so they did not include them in their rental income: $500 Security deposits received and to be used against final month's rent Two tenants paid rent in advance in December 2020. The rent was due January 1, 2021 $600 CCH Federal Taxa Barbara owned stock prior to her marriage to Bert and received the following cash dividends: $900 and that Harold gave Bert and his family $1,800 worth of dental services. In December, Bert did a consulting assignment on a weekend and received $700. No Social Security or taxes were withheld. $300 General Corp. nonqualified common stock dividend (U.S. corporation) Live Forever Life Insurance Co. $100 (dividends on life insurance policy) Bert and Barbara have several sources of interest income: During the year, they had $15,000 withheld for federal taxes. $850 Interest income from savings accounts Interest income from State of Tennessee Highway Bonds $400 During 2020, Bert and Barbara have $26,000 of itemized deductions. Compute Bert and Barbara's net tax due, including self-employment tax. Assume dividends are taxed at ordinary rates. Barbara entered the local area bake-off, won first place for her cherry pie, and received a $1,000 cash prize. Bert, who is an accountant, made an arrangement with Harold the dentist. Bert would do Harold's tax work if Harold would take care of Bert and his family's dental work. During the year, Bert estimated that the value of his services to Harold was 55. Research Problem. Robert Olsen was a very successful college basketball player. Knowing that he would be offered a multimillion dollar contract, he established a corporation assigning to it his services in professional sports in exchange for a monthly salary. Upon audit the IRS challenged this assignment of contract. Who will prevail? See C. Johnson, 78 TC 882, Dec. 39,069 (1982). 54. Comprehensive Problem (Tax Return Problem). Bert and Barbara Longfelt support in nursing homes both Bert's parents and Barbara's parents. Bert's parents are 70 and 68 years of age respectively and have no income except for the $3,600 in Social Security they receive annually. Barbara's parents, both 72 years of age, have the following sources of income: Social Security Interest Income (Joint Ownership) Dividend Income $9,800 $2,600 $900 Bert's annual salary is $45,000 and his wife's annual salary is $55,000. They have two small children who live at home. Also, they own an apartment house from which they derive $6,000 net rental income. Two items from their rental property confused them so they did not include them in their rental income: $500 Security deposits received and to be used against final month's rent Two tenants paid rent in advance in December 2020. The rent was due January 1, 2021 $600 CCH Federal Taxa Barbara owned stock prior to her marriage to Bert and received the following cash dividends: $900 and that Harold gave Bert and his family $1,800 worth of dental services. In December, Bert did a consulting assignment on a weekend and received $700. No Social Security or taxes were withheld. $300 General Corp. nonqualified common stock dividend (U.S. corporation) Live Forever Life Insurance Co. $100 (dividends on life insurance policy) Bert and Barbara have several sources of interest income: During the year, they had $15,000 withheld for federal taxes. $850 Interest income from savings accounts Interest income from State of Tennessee Highway Bonds $400 During 2020, Bert and Barbara have $26,000 of itemized deductions. Compute Bert and Barbara's net tax due, including self-employment tax. Assume dividends are taxed at ordinary rates. Barbara entered the local area bake-off, won first place for her cherry pie, and received a $1,000 cash prize. Bert, who is an accountant, made an arrangement with Harold the dentist. Bert would do Harold's tax work if Harold would take care of Bert and his family's dental work. During the year, Bert estimated that the value of his services to Harold was 55. Research Problem. Robert Olsen was a very successful college basketball player. Knowing that he would be offered a multimillion dollar contract, he established a corporation assigning to it his services in professional sports in exchange for a monthly salary. Upon audit the IRS challenged this assignment of contract. Who will prevail? See C. Johnson, 78 TC 882, Dec. 39,069 (1982)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts