Question: Only a expert should answer this. Question 2: Young Company purchased a computer that cost $60,000 on March 31, Year 1. This computer had an

Only a expert should answer this.

Only a expert should answer this.

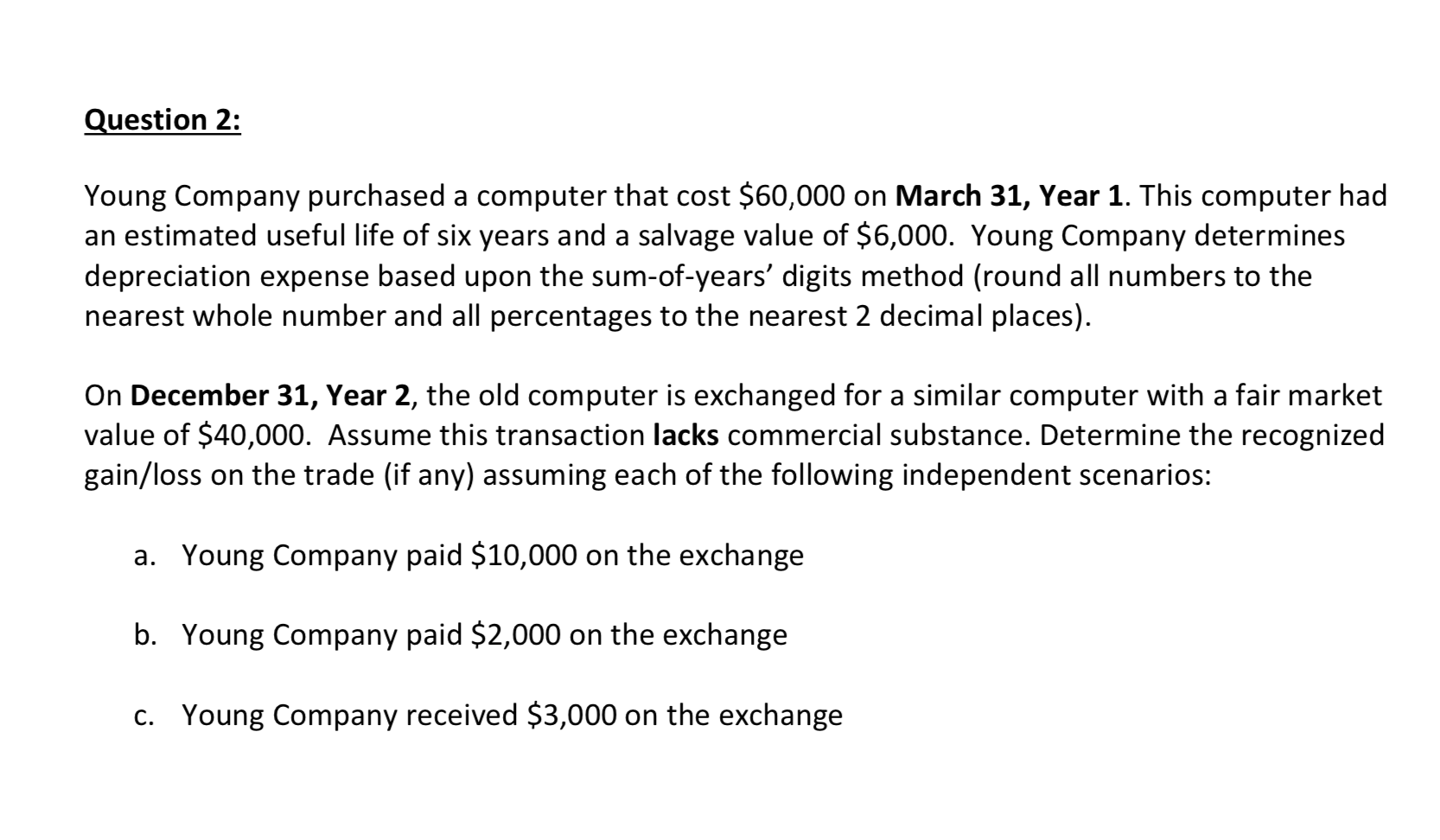

Question 2: Young Company purchased a computer that cost $60,000 on March 31, Year 1. This computer had an estimated useful life of six years and a salvage value of $6,000. Young Company determines depreciation expense based upon the sum-of-years' digits method (round all numbers to the nearest whole number and all percentages to the nearest 2 decimal places). On December 31, Year 2, the old computer is exchanged for a similar computer with a fair market value of $40,000. Assume this transaction lacks commercial substance. Determine the recognized gain/loss on the trade (if any) assuming each of the following independent scenarios: a. Young Company paid $10,000 on the exchange b. Young Company paid $2,000 on the exchange C. Young Company received $3,000 on the exchange

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts