Question: Only accept hand - written assignment. Use pen and paper, ipad or tablet, save as pdf file and upload. After uploading your assignment, download and

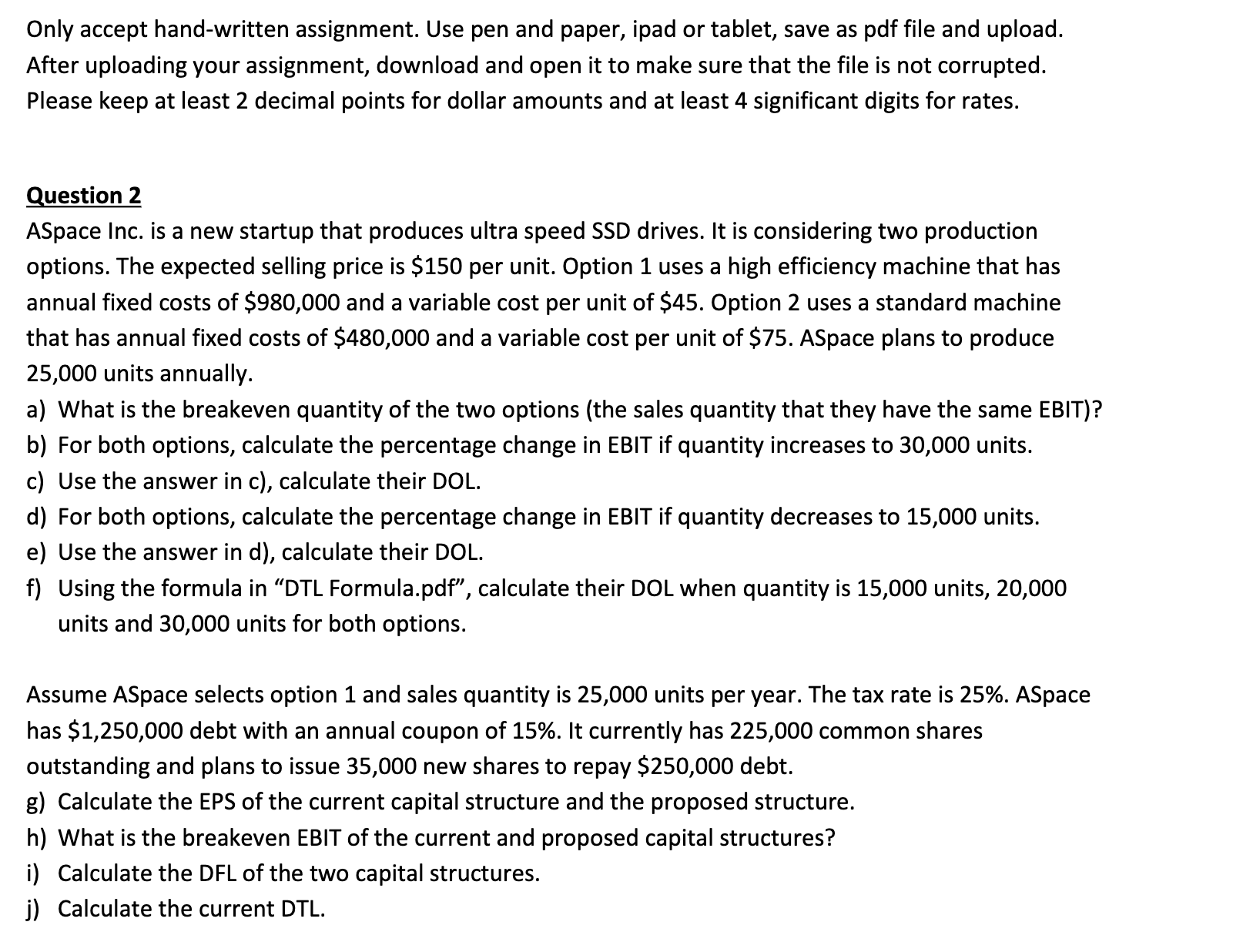

Only accept handwritten assignment. Use pen and paper, ipad or tablet, save as pdf file and upload.

After uploading your assignment, download and open it to make sure that the file is not corrupted.

Please keep at least decimal points for dollar amounts and at least significant digits for rates.

Question

ASpace Inc. is a new startup that produces ultra speed SSD drives. It is considering two production

options. The expected selling price is $ per unit. Option uses a high efficiency machine that has

annual fixed costs of $ and a variable cost per unit of $ Option uses a standard machine

that has annual fixed costs of $ and a variable cost per unit of $ ASpace plans to produce

units annually.

a What is the breakeven quantity of the two options the sales quantity that they have the same EBIT

b For both options, calculate the percentage change in EBIT if quantity increases to units.

c Use the answer in c calculate their DOL.

d For both options, calculate the percentage change in EBIT if quantity decreases to units.

e Use the answer in d calculate their DOL.

f Using the formula in DTL Formula.pdf calculate their DOL when quantity is units,

units and units for both options.

Assume ASpace selects option and sales quantity is units per year. The tax rate is ASpace

has $ debt with an annual coupon of It currently has common shares

outstanding and plans to issue new shares to repay $ debt.

g Calculate the EPS of the current capital structure and the proposed structure.

h What is the breakeven EBIT of the current and proposed capital structures?

i Calculate the DFL of the two capital structures.

j Calculate the current DTL

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock