Question: only answer a QUESTION 4 (25 MARKS) (a) The cost of capital is the rate of return that a company must make on its investment

only answer a

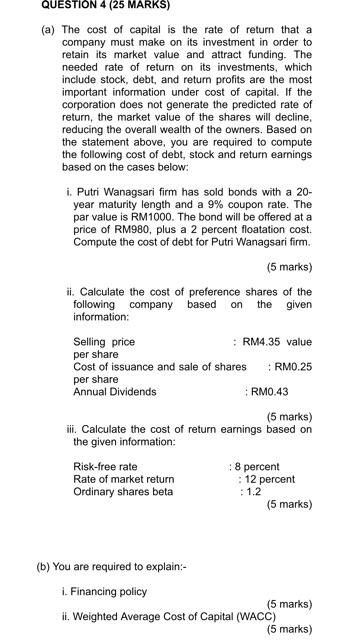

QUESTION 4 (25 MARKS) (a) The cost of capital is the rate of return that a company must make on its investment in order to retain its market value and attract funding. The needed rate of return on its investments, which include stock, debt, and return profits are the most important information under cost of capital. If the corporation does not generate the predicted rate of return, the market value of the shares will decline, reducing the overall wealth of the owners. Based on the statement above, you are required to compute the following cost of debt, stock and return earnings based on the cases below: i. Putri Wanagsari firm has sold bonds with a 20- year maturity length and a 9% coupon rate. The par value is RM1000. The bond will be offered at a price of RM980, plus a 2 percent floatation cost. Compute the cost of debt for Putri Wanagsari firm. (5 marks) ii. Calculate the cost of preference shares of the following company based on the given information: Selling price : RM4.35 value per share Cost of issuance and sale of shares + RM0 25 per share Annual Dividends ; RM0.43 (5 marks) ii. Calculate the cost of return earnings based on the given information: Risk-free rate : 8 percent Rate of market return : 12 percent Ordinary shares beta : 1.2 (5 marks) (b) You are required to explain:- 1. Financing policy (5 marks) it. Weighted Average Cost of Capital (WACC)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts