Question: Only answer b) please 1. The following table provided CALL and PUT options for Apple Inc. (AAPL) stock, which ended trading at US$121.03 (-$0.93; -

Only answer b) please

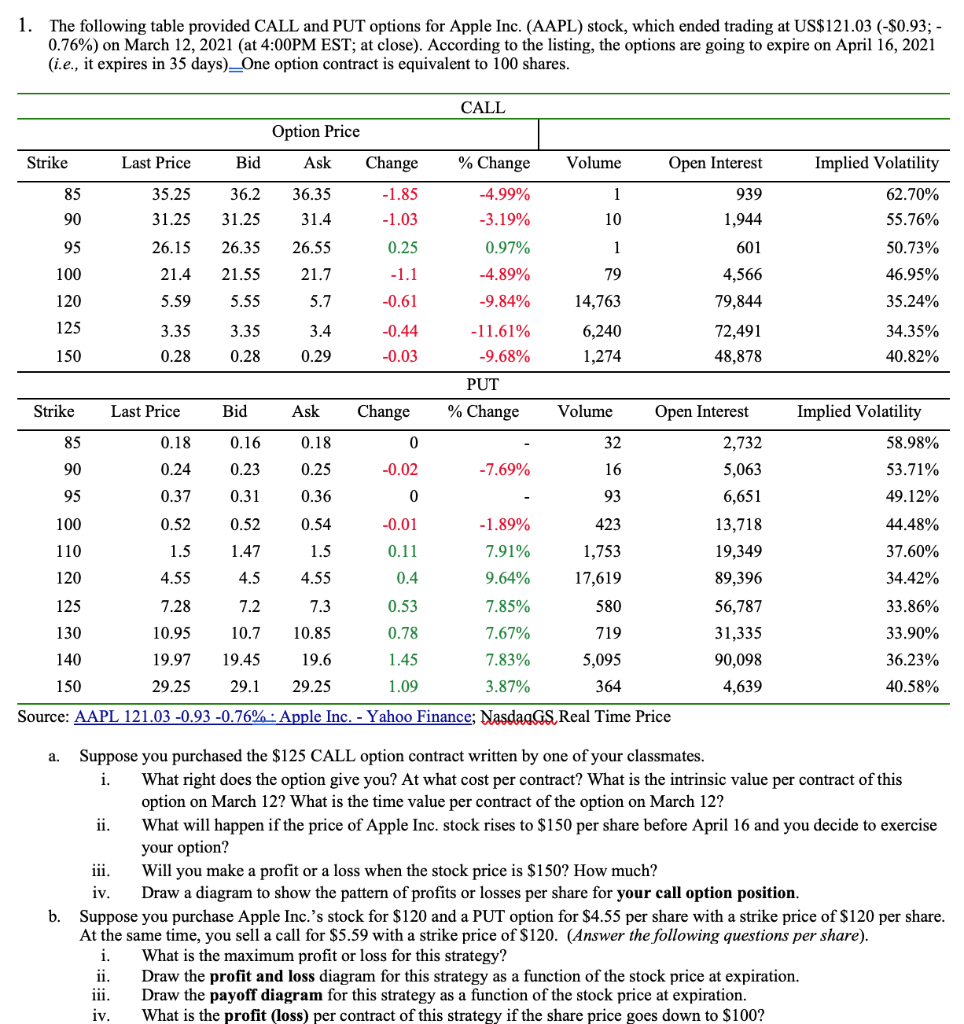

1. The following table provided CALL and PUT options for Apple Inc. (AAPL) stock, which ended trading at US$121.03 (-$0.93; - 0.76%) on March 12, 2021 (at 4:00PM EST; at close). According to the listing, the options are going to expire on April 16, 2021 (i.e., it expires in 35 days)_One option contract is equivalent to 100 shares. CALL Option Price Strike Last Price Bid Ask Change % Change Volume Open Interest Implied Volatility 85 35.25 1 939 36.2 31.25 36.35 31.4 -1.85 -1.03 62.70% 55.76% 90 31.25 10 1,944 601 95 26.35 0.25 26.15 21.4 -4.99% -3.19% 0.97% -4.89% -9.84% 26.55 21.7 1 79 50.73% 46.95% 21.55 4,566 -1.1 -0.61 5.59 5.55 5.7 14,763 79,844 35.24% 100 120 125 150 3.35 0.28 3.35 0.28 3.4 0.29 -0.44 -0.03 -11.61% -9.68% 6,240 1,274 72,491 48,878 34.35% 40.82% PUT % Change Strike Last Price Bid Ask Change Volume Open Interest Implied Volatility 85 0 32 0.18 0.24 0.16 0.23 0.31 0.18 0.25 -0.02 90 95 -7.69% 16 93 2,732 5,063 6,651 0.37 0 0.36 0.54 58.98% 53.71% 49.12% 44.48% 37.60% 100 0.52 -0.01 0.52 1.47 1.5 1.5 0.11 110 120 -1.89% 7.91% 9.64% 423 1,753 17,619 580 4.55 4.5 4.55 0.4 125 7.28 7.3 0.53 7.2 10.7 13,718 19,349 89,396 56,787 31,335 90,098 4,639 130 10.95 10.85 7.85% 7.67% 7.83% 3.87% 0.78 34.42% 33.86% 33.90% 36.23% 40.58% 140 19.97 19.6 1.45 719 5,095 364 19.45 29.1 150 29.25 29.25 1.09 Source: AAPL 121.03 -0.93 -0.76%. Apple Inc. - Yahoo Finance; Nasdag GS Real Time Price a. Suppose you purchased the $125 CALL option contract written by one of your classmates. i. What right does the option give you? At what cost per contract? What is the intrinsic value per contract of this option on March 12? What is the time value per contract of the option on March 12? ii. What will happen if the price of Apple Inc. stock rises to $150 per share before April 16 and you decide to exercise your option? iii. Will you make a profit or a loss when the stock price is $150? How much? iv. Draw a diagram to show the pattern of profits or losses per share for your call option position. b. Suppose you purchase Apple Inc.'s stock for $120 and a PUT option for $4.55 per share with a strike price of $120 per share. At the same time, you sell a call for $5.59 with a strike price of $120. (Answer the following questions per share). i. What is the maximum profit or loss for this strategy? ii. Draw the profit and loss diagram for this strategy as a function of the stock price at expiration. iii. Draw the payoff diagram for this strategy as a function of the stock price at expiration. iv. What is the profit (loss) per contract of this strategy if the share price goes down to $100? 1. The following table provided CALL and PUT options for Apple Inc. (AAPL) stock, which ended trading at US$121.03 (-$0.93; - 0.76%) on March 12, 2021 (at 4:00PM EST; at close). According to the listing, the options are going to expire on April 16, 2021 (i.e., it expires in 35 days)_One option contract is equivalent to 100 shares. CALL Option Price Strike Last Price Bid Ask Change % Change Volume Open Interest Implied Volatility 85 35.25 1 939 36.2 31.25 36.35 31.4 -1.85 -1.03 62.70% 55.76% 90 31.25 10 1,944 601 95 26.35 0.25 26.15 21.4 -4.99% -3.19% 0.97% -4.89% -9.84% 26.55 21.7 1 79 50.73% 46.95% 21.55 4,566 -1.1 -0.61 5.59 5.55 5.7 14,763 79,844 35.24% 100 120 125 150 3.35 0.28 3.35 0.28 3.4 0.29 -0.44 -0.03 -11.61% -9.68% 6,240 1,274 72,491 48,878 34.35% 40.82% PUT % Change Strike Last Price Bid Ask Change Volume Open Interest Implied Volatility 85 0 32 0.18 0.24 0.16 0.23 0.31 0.18 0.25 -0.02 90 95 -7.69% 16 93 2,732 5,063 6,651 0.37 0 0.36 0.54 58.98% 53.71% 49.12% 44.48% 37.60% 100 0.52 -0.01 0.52 1.47 1.5 1.5 0.11 110 120 -1.89% 7.91% 9.64% 423 1,753 17,619 580 4.55 4.5 4.55 0.4 125 7.28 7.3 0.53 7.2 10.7 13,718 19,349 89,396 56,787 31,335 90,098 4,639 130 10.95 10.85 7.85% 7.67% 7.83% 3.87% 0.78 34.42% 33.86% 33.90% 36.23% 40.58% 140 19.97 19.6 1.45 719 5,095 364 19.45 29.1 150 29.25 29.25 1.09 Source: AAPL 121.03 -0.93 -0.76%. Apple Inc. - Yahoo Finance; Nasdag GS Real Time Price a. Suppose you purchased the $125 CALL option contract written by one of your classmates. i. What right does the option give you? At what cost per contract? What is the intrinsic value per contract of this option on March 12? What is the time value per contract of the option on March 12? ii. What will happen if the price of Apple Inc. stock rises to $150 per share before April 16 and you decide to exercise your option? iii. Will you make a profit or a loss when the stock price is $150? How much? iv. Draw a diagram to show the pattern of profits or losses per share for your call option position. b. Suppose you purchase Apple Inc.'s stock for $120 and a PUT option for $4.55 per share with a strike price of $120 per share. At the same time, you sell a call for $5.59 with a strike price of $120. (Answer the following questions per share). i. What is the maximum profit or loss for this strategy? ii. Draw the profit and loss diagram for this strategy as a function of the stock price at expiration. iii. Draw the payoff diagram for this strategy as a function of the stock price at expiration. iv. What is the profit (loss) per contract of this strategy if the share price goes down to $100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts