Question: Only answer b&c please It is March 12. Apple Inc.'s (AAPL) stock is currently trading at US$121.03 per share and has a volatility of 40%.

Only answer b&c please

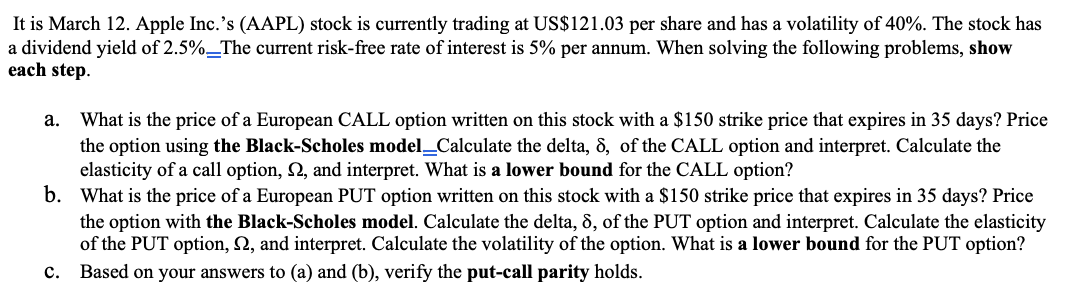

It is March 12. Apple Inc.'s (AAPL) stock is currently trading at US$121.03 per share and has a volatility of 40%. The stock has a dividend yield of 2.5%_The current risk-free rate of interest is 5% per annum. When solving the following problems, show each step. a. What is the price of a European CALL option written on this stock with a $150 strike price that expires in 35 days? Price the option using the Black-Scholes model_Calculate the delta, 8, of the CALL option and interpret. Calculate the elasticity of a call option, 2, and interpret. What is a lower bound for the CALL option? b. What is the price of a European PUT option written on this stock with a $150 strike price that expires in 35 days? Price the option with the Black-Scholes model. Calculate the delta, d, of the PUT option and interpret. Calculate the elasticity of the PUT option, 2, and interpret. Calculate the volatility of the option. What is a lower bound for the PUT option? c. Based on your answers to (a) and (b), verify the put-call parity holds. It is March 12. Apple Inc.'s (AAPL) stock is currently trading at US$121.03 per share and has a volatility of 40%. The stock has a dividend yield of 2.5%_The current risk-free rate of interest is 5% per annum. When solving the following problems, show each step. a. What is the price of a European CALL option written on this stock with a $150 strike price that expires in 35 days? Price the option using the Black-Scholes model_Calculate the delta, 8, of the CALL option and interpret. Calculate the elasticity of a call option, 2, and interpret. What is a lower bound for the CALL option? b. What is the price of a European PUT option written on this stock with a $150 strike price that expires in 35 days? Price the option with the Black-Scholes model. Calculate the delta, d, of the PUT option and interpret. Calculate the elasticity of the PUT option, 2, and interpret. Calculate the volatility of the option. What is a lower bound for the PUT option? c. Based on your answers to (a) and (b), verify the put-call parity holds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts