Question: Only answer cash flow question in part C and D .com/t/6/0/doc/572869/sp/179251400/mi/571347679?cfi=%2F%2F4 Disney+ M Gmail Facebook Twitter GroupMe NAU Acc44 0 Canvas Outlook Mall Publix Passport

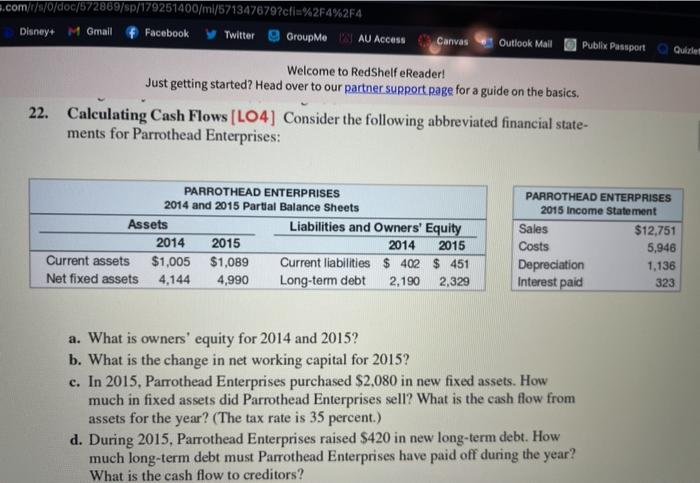

.com/t/6/0/doc/572869/sp/179251400/mi/571347679?cfi=%2F%2F4 Disney+ M Gmail Facebook Twitter GroupMe NAU Acc44 0 Canvas Outlook Mall Publix Passport Welcome to Red Shelf eReader Just getting started? Head over to our partner support page for a guide on the basics. 22. Calculating Cash Flows (L04] Consider the following abbreviated financial state- ments for Parrothead Enterprises: PARROTHEAD ENTERPRISES 2014 and 2015 Partial Balance Sheets Assets Liabilities and Owners' Equity 2014 2015 2014 2015 Current assets $1,005 $1,089 Current liabilities $ 402 $ 451 Net fixed assets 4,144 4,990 Long-term debt 2,190 2,329 PARROTHEAD ENTERPRISES 2015 Income Statement Sales $12,751 Costs 5,946 Depreciation 1.136 Interest paid 323 a. What is owners' equity for 2014 and 2015? b. What is the change in net working capital for 2015? c. In 2015, Parrothead Enterprises purchased $2,080 in new fixed assets. How much in fixed assets did Parrothead Enterprises sell? What is the cash flow from assets for the year? (The tax rate is 35 percent.) d. During 2015, Parrothead Enterprises raised $420 in new long-term debt. How much long-term debt must Parrothead Enterprises have paid off during the year? What is the cash flow to creditors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts