Question: Only Answer D,E, and F please. ( Templates for problems below) Your division is considering two investment projects, each of which requires an up-front expenditure

Only Answer D,E, and F please. ( Templates for problems below)

Only Answer D,E, and F please. ( Templates for problems below)

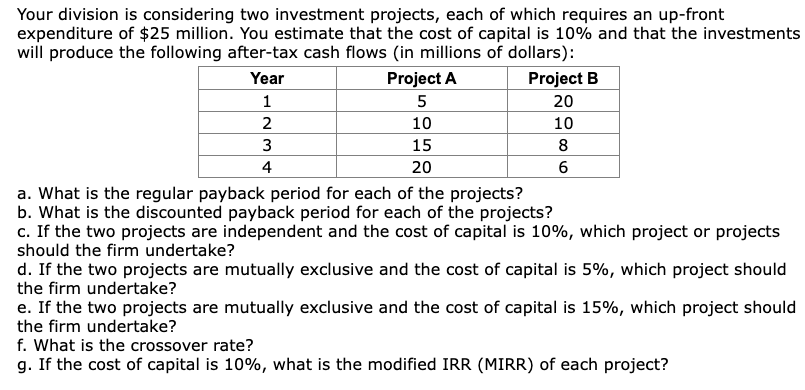

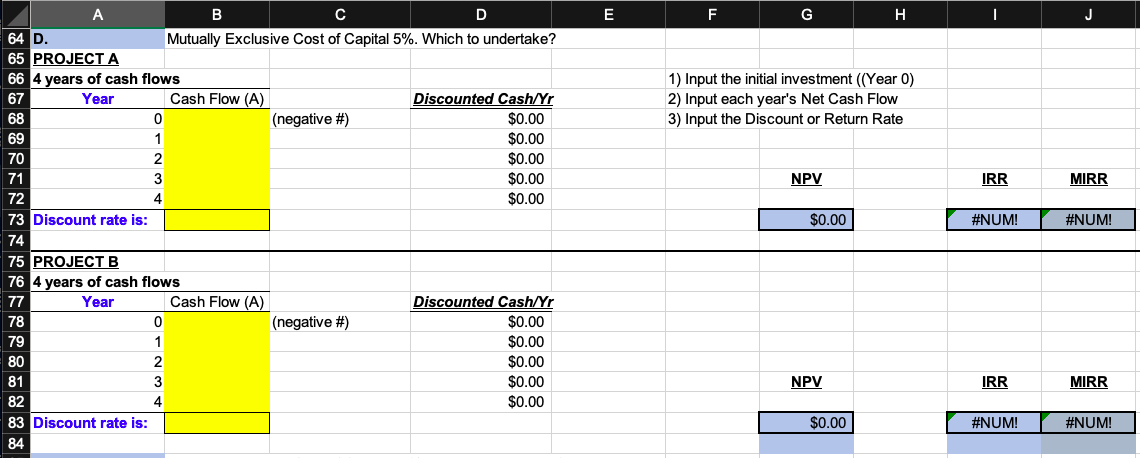

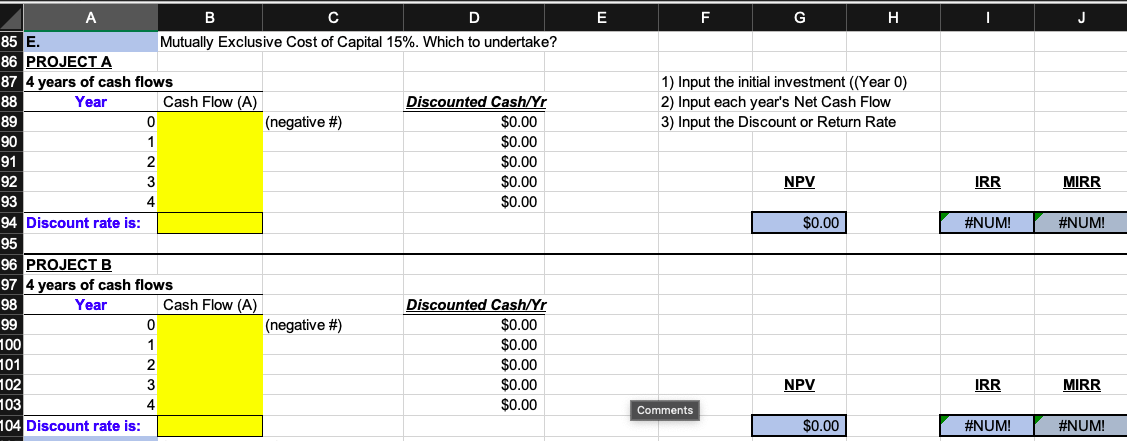

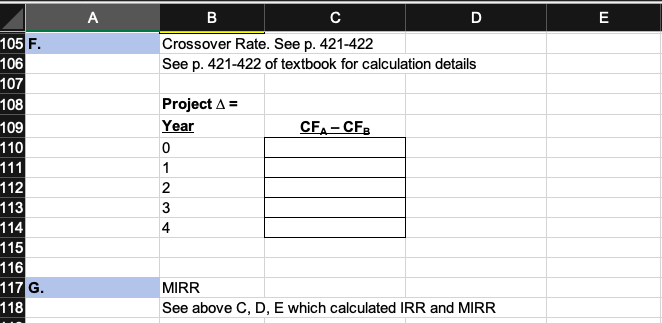

Your division is considering two investment projects, each of which requires an up-front expenditure of $25 million. You estimate that the cost of capital is 10% and that the investments will produce the following after-tax cash flows (in millions of dollars): a. What is the regular payback period for each of the projects? b. What is the discounted payback period for each of the projects? c. If the two projects are independent and the cost of capital is 10%, which project or projects should the firm undertake? d. If the two projects are mutually exclusive and the cost of capital is 5%, which project should the firm undertake? e. If the two projects are mutually exclusive and the cost of capital is 15%, which project should the firm undertake? f. What is the crossover rate? g. If the cost of capital is 10%, what is the modified IRR (MIRR) of each project? Your division is considering two investment projects, each of which requires an up-front expenditure of $25 million. You estimate that the cost of capital is 10% and that the investments will produce the following after-tax cash flows (in millions of dollars): a. What is the regular payback period for each of the projects? b. What is the discounted payback period for each of the projects? c. If the two projects are independent and the cost of capital is 10%, which project or projects should the firm undertake? d. If the two projects are mutually exclusive and the cost of capital is 5%, which project should the firm undertake? e. If the two projects are mutually exclusive and the cost of capital is 15%, which project should the firm undertake? f. What is the crossover rate? g. If the cost of capital is 10%, what is the modified IRR (MIRR) of each project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts