Question: ONLY ANSWER IF YOU WILL DO 1-7 PLEASE. WILL GIVE A THUMBS UP FOR NUMBERS 1-7 THANKS D. MULTIPLE CHOICE. Select the one, best answer

ONLY ANSWER IF YOU WILL DO 1-7 PLEASE. WILL GIVE A THUMBS UP FOR NUMBERS 1-7 THANKS

ONLY ANSWER IF YOU WILL DO 1-7 PLEASE. WILL GIVE A THUMBS UP FOR NUMBERS 1-7 THANKS

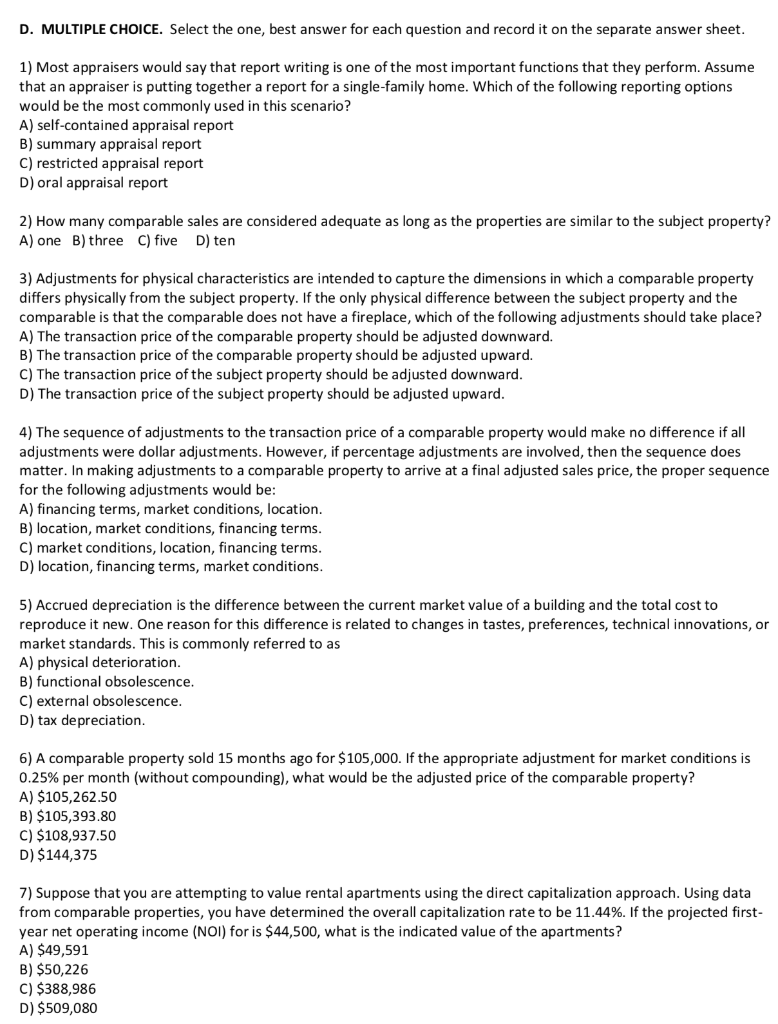

D. MULTIPLE CHOICE. Select the one, best answer for each question and record it on the separate answer sheet. 1) Most appraisers would say that report writing is one of the most important functions that they perform. Assume that an appraiser is putting together a report for a single-family home. Which of the following reporting options would be the most commonly used in this scenario? A) self-contained appraisal report B) summary appraisal report C) restricted appraisal report D) oral appraisal report 2) How many comparable sales are considered adequate as long as the properties are similar to the subject property? A) one B) three C) five D) ten 3) Adjustments for physical characteristics are intended to capture the dimensions in which a comparable property differs physically from the subject property. If the only physical difference between the subject property and the comparable is that the comparable does not have a fireplace, which of the following adjustments should take place? A) The transaction price of the comparable property should be adjusted downward. B) The transaction price of the comparable property should be adjusted upward. C) The transaction price of the subject property should be adjusted downward. D) The transaction price of the subject property should be adjusted upward. 4) The sequence of adjustments to the transaction price of a comparable property would make no difference if all adjustments were dollar adjustments. However, if percentage adjustments are involved, then the sequence does matter. In making adjustments to a comparable property to arrive at a final adjusted sales price, the proper sequence for the following adjustments would be: A) financing terms, market conditions, location. B) location, market conditions, financing terms. C) market conditions, location, financing terms. D) location, financing terms, market conditions. 5) Accrued depreciation is the difference between the current market value of a building and the total cost to reproduce it new. One reason for this difference is related to changes in tastes, preferences, technical innovations, or market standards. This is commonly referred to as A) physical deterioration. B) functional obsolescence. C) external obsolescence. D) tax depreciation. 6) A comparable property sold 15 months ago for $105,000. If the appropriate adjustment for market conditions is 0.25% per month (without compounding), what would be the adjusted price of the comparable property? A) $105,262.50 B) $105,393.80 C) $108,937.50 D) $144,375 7) Suppose that you are attempting to value rental apartments using the direct capitalization approach. Using data from comparable properties, you have determined the overall capitalization rate to be 11.44%. If the projected first- year net operating income (NOI) for is $44,500, what is the indicated value of the apartments? A) $49,591 B) $50,226 C) $388,986 D) $509,080

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts