Question: ONLY ANSWER PLEASE ASAP We R Toys (WRT) is considering expanding into new geographic markets. The expansion will have the same business risk as WRT's

ONLY ANSWER PLEASE ASAP

ONLY ANSWER PLEASE ASAP

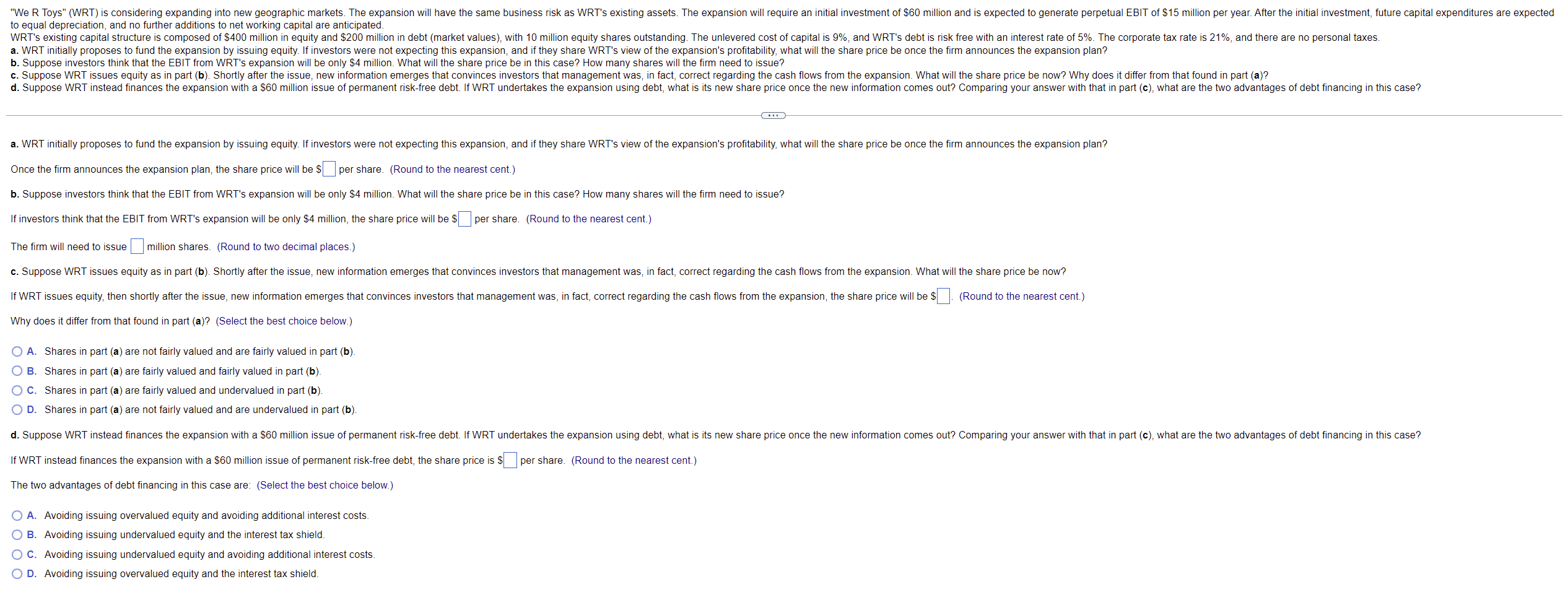

"We R Toys" (WRT) is considering expanding into new geographic markets. The expansion will have the same business risk as WRT's existing assets. The expansion will require an initial investment of $60 million and is expected to generate perpetual EBIT of $15 million per year. After the initial investment, future capital expenditures are expected to equal depreciation, and no further additions to net working capital are anticipated. WRT's existing capital structure is composed of $400 million in equity and $200 million in debt (market values), with 10 million equity shares outstanding. The unlevered cost of capital is 9%, and WRT's debt is risk free with an interest rate of 5%. The corporate tax rate is 21%, and there are no personal taxes. a. WRT initially proposes to fund the expansion by issuing equity. If investors were not expecting this expansion, and if they share WRT's view of the expansion's profitability, what will the share price be once the firm announces the expansion plan? b. Suppose investors think that the EBIT from WRT's expansion will be only $4 million. What will the share price be in this case? How many shares will the firm need to issue? c. Suppose WRT issues equity as in part (b). Shortly after the issue, new information emerges that convinces investors that management was, in fact, correct regarding the cash flows from the expansion. What will the share price be now? Why does it differ from that found in part (a)? d. Suppose WRT instead finances the expansion with a $60 million issue of permanent risk-free debt. If WRT undertakes the expansion using debt, what is its new share price once the new information comes out? Comparing your answer with that in part (c), what are the two advantages of debt financing in this case? I a. WRT initially proposes to fund the expansion by issuing equity. If investors were not expecting this expansion, and if they share WRT's view of the expansion's profitability, what will the share price be once the firm announces the expansion plan? Once the firm announces the expansion plan, the share price will be $ per share. (Round to the nearest cent.) b. Suppose investors think that the EBIT from WRT's expansion will be only $4 million. What will the share price be in this case? How many shares will the firm need to issue? If investors think that the EBIT from WRT's expansion will be only $4 million, the share price will be s per share. (Round to the nearest cent.) The firm will need to issue million shares. (Round to two decimal places.) c. Suppose WRT issues equity as in part (b). Shortly after the issue, new information emerges that convinces investors that management was, in fact, correct regarding the cash flows from the expansion. What will the share price be now? If WRT issues equity, then shortly after the issue, new information emerges that convinces investors that management was, in fact, correct regarding the cash flows from the expansion, the share price will be $ (Round to the nearest cent.) Why does it differ from that found in part (a)? (Select the best choice below.) O A. Shares in part (a) are not fairly valued and are fairly valued in part (b). O B. Shares in part (a) are fairly valued and fairly valued in part (b) O C. Shares in part (a) are fairly valued and undervalued in part (b). OD. Shares in part (a) are not fairly valued and are undervalued in part (b). d. Suppose WRT instead finances the expansion with a $60 million issue of permanent risk-free debt. If WRT undertakes the expansion using debt, what is its new share price once the new information comes out? Comparing your answer with that in part (c), what are the two advantages of debt financing in this case? If WRT instead finances the expansion with a $60 million issue of permanent risk-free debt, the share price is $ per share. (Round to the nearest cent.) The two advantages of debt financing in this case are: (Select the best choice below.) O A. Avoiding issuing overvalued equity and avoiding additional interest costs. OB. Avoiding issuing undervalued equity and the interest tax shield. O C. Avoiding issuing undervalued equity and avoiding additional interest costs. OD. Avoiding issuing overvalued equity and the interest tax shield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts