Question: Only answer q2. q1 is just for reference zero so that you would have a positive profit at time zero and zero net cash flow

Only answer q2. q1 is just for reference

Only answer q2. q1 is just for reference

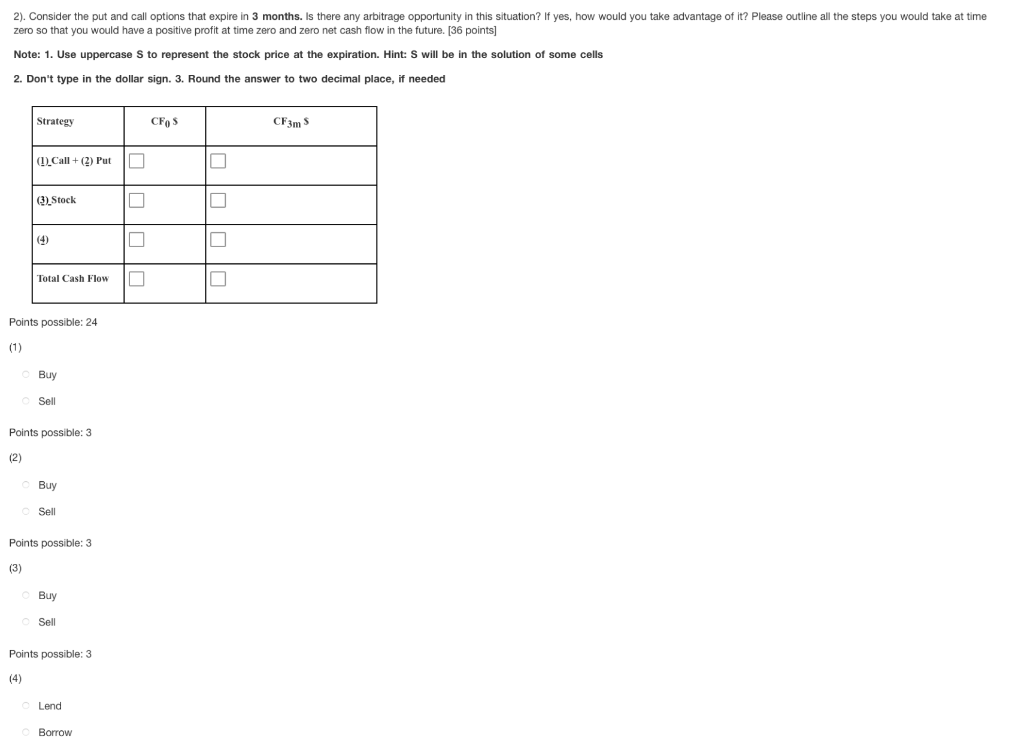

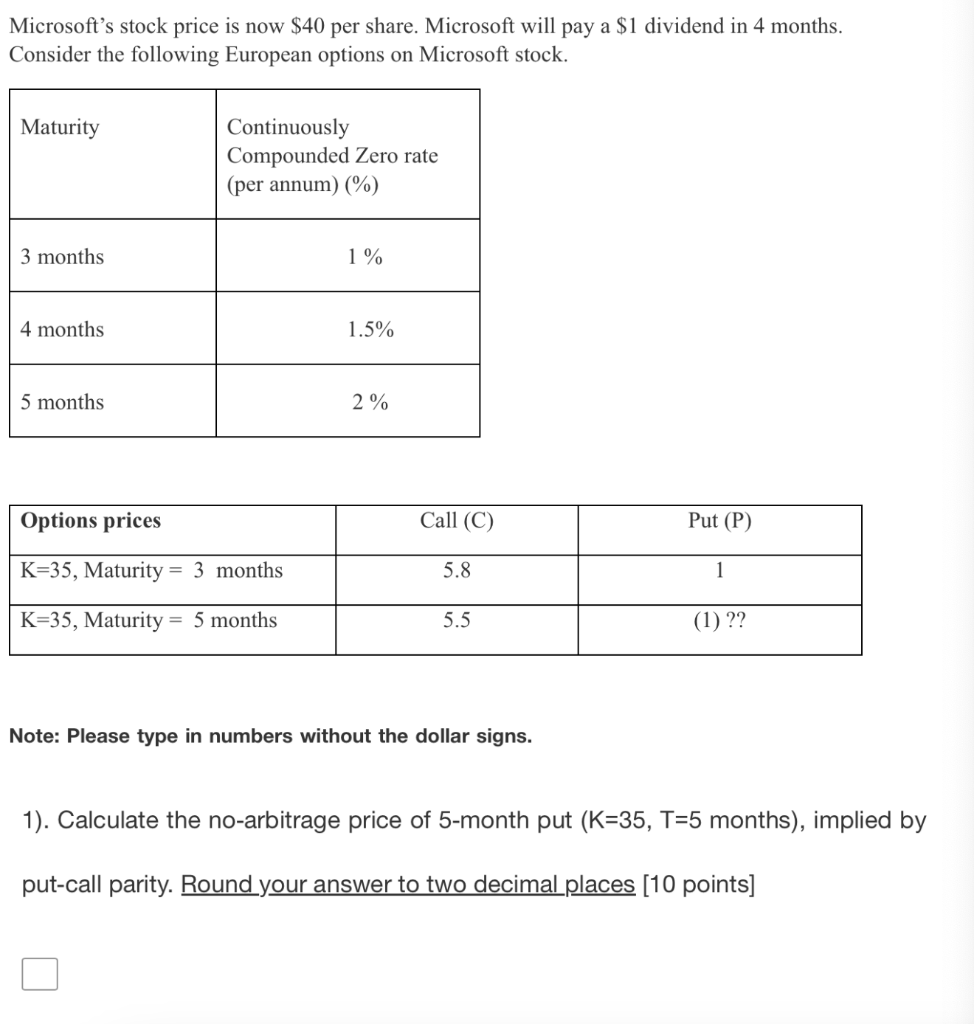

zero so that you would have a positive profit at time zero and zero net cash flow in the future. [36 points] Note: 1. Use uppercase S to represent the stock price at the expiration. Hint: S will be in the solution of some cells 2. Don't type in the dollar sign. 3. Round the answer to two decimal place, if needed Points possible: 24 (1) Buy Sell Points possible: 3 (2) Buy Sell Points possible: 3 (3) Buy Sell Points possible: 3 (4) Lend Borrow Microsoft's stock price is now $40 per share. Microsoft will pay a $1 dividend in 4 months. Consider the following European options on Microsoft stock. Note: Please type in numbers without the dollar signs. 1). Calculate the no-arbitrage price of 5-month put (K=35,T=5 months), implied by put-call parity. Round your answer to two decimal places [10 points] zero so that you would have a positive profit at time zero and zero net cash flow in the future. [36 points] Note: 1. Use uppercase S to represent the stock price at the expiration. Hint: S will be in the solution of some cells 2. Don't type in the dollar sign. 3. Round the answer to two decimal place, if needed Points possible: 24 (1) Buy Sell Points possible: 3 (2) Buy Sell Points possible: 3 (3) Buy Sell Points possible: 3 (4) Lend Borrow Microsoft's stock price is now $40 per share. Microsoft will pay a $1 dividend in 4 months. Consider the following European options on Microsoft stock. Note: Please type in numbers without the dollar signs. 1). Calculate the no-arbitrage price of 5-month put (K=35,T=5 months), implied by put-call parity. Round your answer to two decimal places [10 points]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts