Question: Only answer question 2-1 E F G H I J 91 Chapter 2 Financial Statements, Cash Flow, and Taxes Ordinary corporate operating losses can be

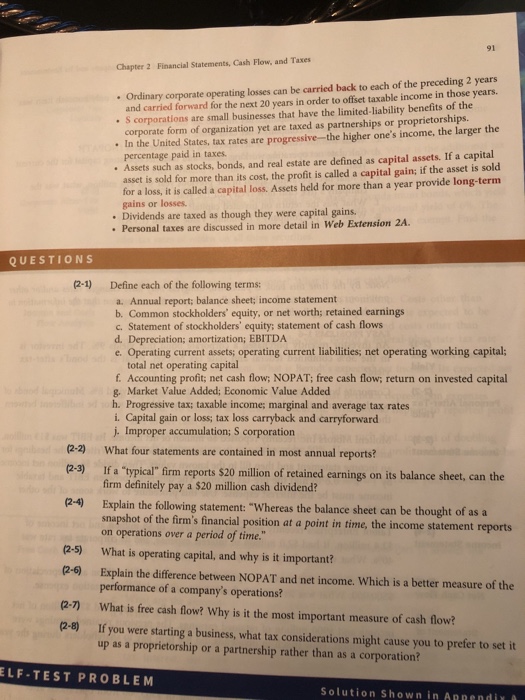

91 Chapter 2 Financial Statements, Cash Flow, and Taxes Ordinary corporate operating losses can be carried back to each of the preceding 2 years and carried forward for the next 20 years in order to offset taxable income in those years. * S corporations are small businesses that have the limited-liability benefits of the corporate form of organization yet are taxed as partnerships or proprietorships. In the United States, tax rates are progressive-the higher one's income, the larger the percentage paid in taxes Assets such as stocks, bonds, and real estate are defined as capital assets. If a capital asset is sold for more than its cost, the profit is called a capital gain; if the asset is sold for a loss, it is called a capital loss. Assets held for more than a year provide long-term gains or losses. . Dividends are taxed as though they were capital gains. .Personal taxes are discussed in more detail in Web Extension 2A. QUESTIONS (2-1) Define each of the following terms: a. Annual report; balance sheet: income statement b. Common stockholders' equity, or net worth; retained earnings c. Statement of stockholders' equity; statement of cash flows d. Depreciation; amortization; EBITDA e. Operating current assets; operating current liabilities; net operating working capital; total net operating capital f. Accounting profit; net cash flow; NOPAT; free cash flow; return on invested capital g. Market Value Added; Economic Value Added h. Progressive tax; taxable income; marginal and average tax rates i. Capital gain or loss; tax loss carryback and carryforward j. Improper accumulation; S corporation What four statements are contained in most annual reports? (2-2) (2-3) (2-4) Explain the following statement: "Whereas the balance sheet can be thought of as a If a "typical" firm reports $20 million of retained earnings on its balance sheet, can the firm definitely pay a $20 million cash dividend? snapshot of the firm's financial position at a point in time, the income statement reports on operations over a period of time." (2-5) What is operating capital, and why is it important? (2-6) Explain the difference between NOPAT and net income. Which is a better measure of the performance of a company's operations? What is free cash flow? Why is it the most important measure of cash flow? If you were starting a business, what tax considerations might cause you to prefer to set it up as a proprietorship or a partnership rather than as a corporation? 2-7) (2-8) ELF-TEST PROBLEM Solution Shown in Annendix

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts