Question: ONLY answer question no 2 I just need question 2 ans Short Questions [5+5 = 10 marks 1. What is Free Cash Flow? Calculate the

ONLY answer question no 2

I just need question 2 ans

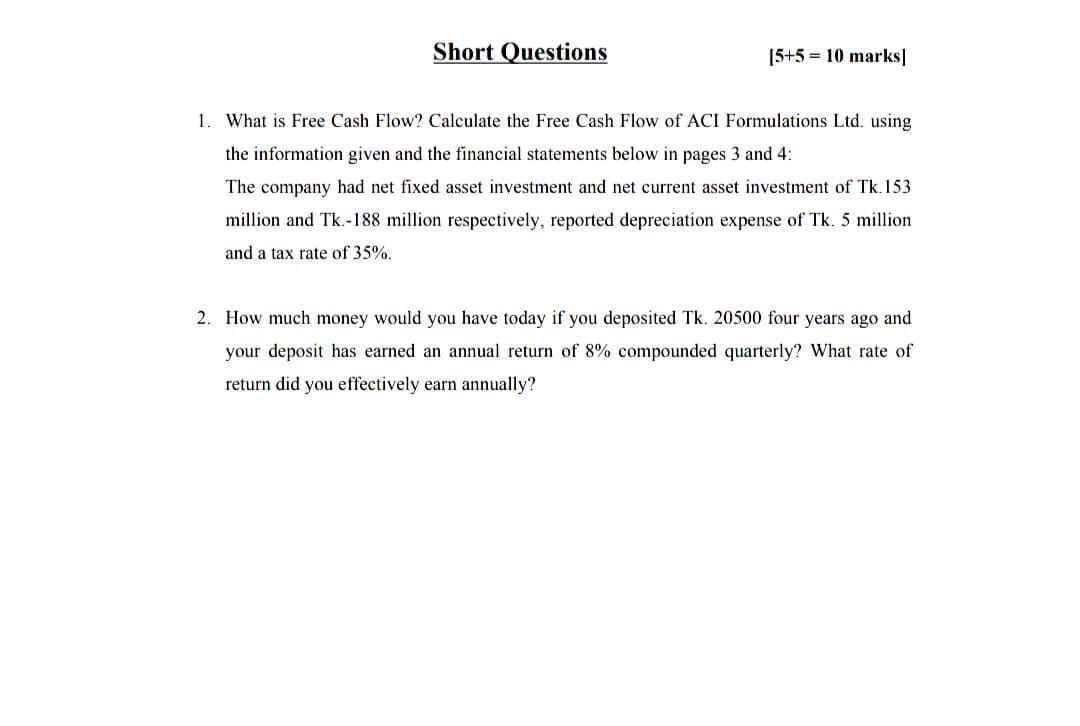

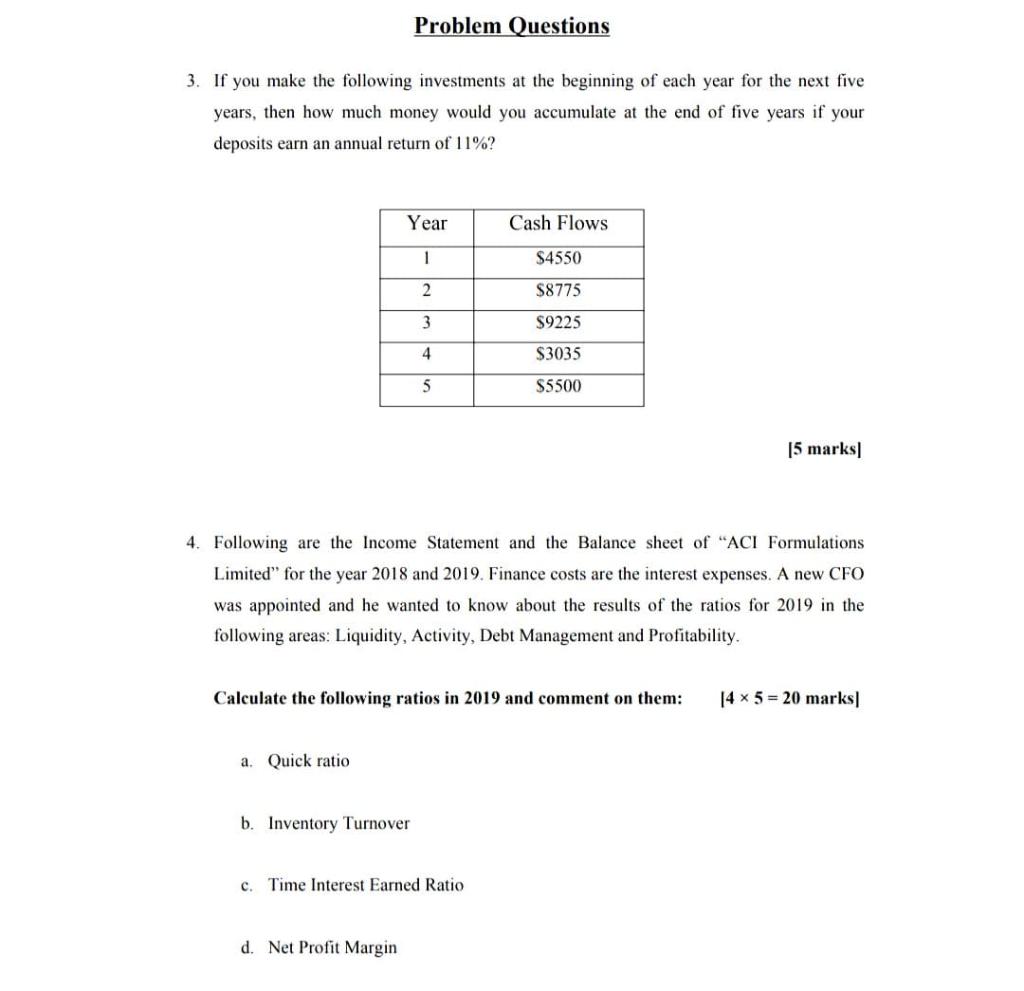

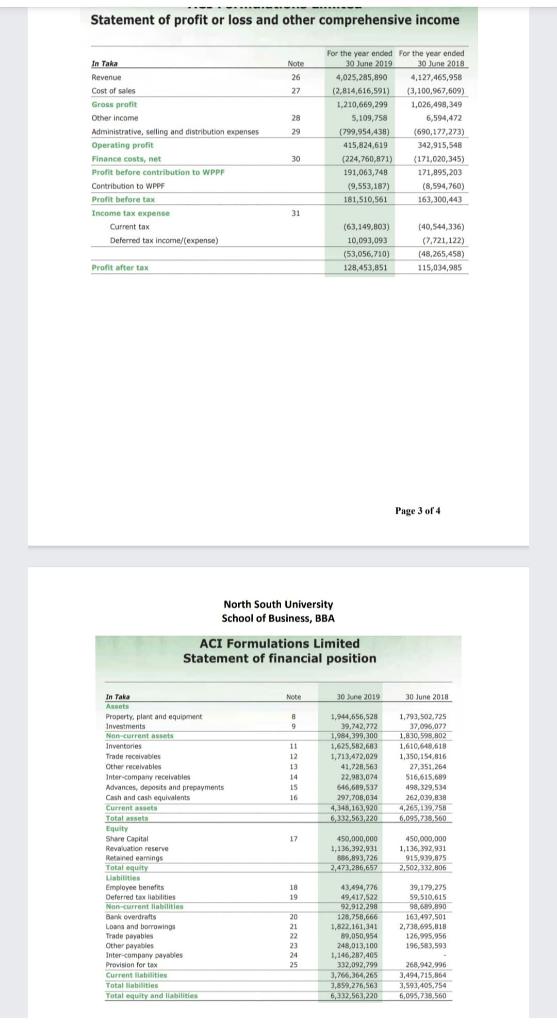

Short Questions [5+5 = 10 marks 1. What is Free Cash Flow? Calculate the Free Cash Flow of ACI Formulations Ltd. using the information given and the financial statements below in pages 3 and 4: The company had net fixed asset investment and net current asset investment of Tk.153 million and Tk.-188 million respectively, reported depreciation expense of Tk. 5 million and a tax rate of 35%. 2. How much money would you have today if you deposited Tk. 20500 four years ago and your deposit has earned an annual return of 8% compounded quarterly? What rate of return did you effectively earn annually? Problem Questions 3. If you make the following investments at the beginning of each year for the next five years, then how much money would you accumulate at the end of five years if your deposits earn an annual return of 11%? Year Cash Flows 1 $4550 2 S8775 3 S9225 4 S3035 5 S5500 15 marks) 4. Following are the Income Statement and the Balance sheet of "ACI Formulations Limited for the year 2018 and 2019. Finance costs are the interest expenses. A new CFO was appointed and he wanted to know about the results of the ratios for 2019 in the following areas: Liquidity, Activity, Debt Management and Profitability. Calculate the following ratios in 2019 and comment on them: 14 x 5 = 20 marks a Quick ratio b. Inventory Turnover c Time Interest Earned Ratio d. Net Profit Margin ---------- Statement of profit or loss and other comprehensive income Note 26 27 28 29 In Taka Revenue Cost of sales Gross profit Other income Administrative, selling and distribution expenses Operating profit Finance costs, net Profit before contribution to WPPF Contribution to WPPF Profit before tax Income tax expense Current tax Deferred tax income/expense) For the year ended for the year ended 30 June 2019 30 June 2018 4,025,285,890 4,127,465,958 (2,814,616,591) (3,100,967,609) 1,210,669,299 1,026,498,349 5. 109,758 6,594,472 (799,954,438) (690,177,273) 415,824,619 342,915,548 (224,760,871) (171,020,345) 191,063,748 171,895,203 (9,553,187) (8,594,760) 181,510,561 163,300,443 30 31 (63,149,803) 10,093,093 (53,056,710) 128,453,851 (40,544,336) (7.721,122) (48,265,458) 115,034,985 Profit after tax Page 3 of 4 North South University School of Business, BBA ACI Formulations Limited Statement of financial position Note 30 June 2019 30 June 2018 In Taka Ats Property, plant and equipment B 9 investments Non-current assets Inventories Trades receivables Other receivables Intercompany receivables Advances, deposits and prepayments Cash and cash equivalents 11 12 13 14 15 16 1,944,656,528 1,793,502.725 39.742,722 37,096,072 1,984,390,300 1,80,598,802 1,625,562,683 1,610,648,618 1.713,472,029 1,350,154,816 41.228,563 27,351,264 22.983,074 516,615.689 616,609,537 498,329,534 297,708,034 262,039,838 4,345,163,920 4,265,129,758 6332,563,220 6,095,733.560 17 450,000,000 1,136,392,931 86,893,726 2,472,286,657 450,000,000 1,136,392,931 915,939.875 2.502, 332.806 18 19 Total Equity Share Capital Revaluation reserve Retard earnings Total equity Lasbilities Employee benefits Deferred tax liabilities Non-current liabilities Bank overdrafts Les and borrowing Trade payables Other payables Inter-company Dayables Provision for tax Current faits Total abilities Total equity and liabilities 20 21 22 23 24 25 43,494,776 49,417,522 92.912,298 128.758,666 1,822,161,341 89,050,954 248,013,100 1,146,287,405 332,092,799 3,766,364,265 3.899.276,563 6,332,563,220 39,179,275 59,510,615 98.699.890 163,497,501 2,738,695,818 126.995.956 196,583,593 268,942.996 3,494,715,864 3,593,405,754 6,095,738,560

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts