Question: Only answer the first question (question #2), this is just in relation to the question and diagram above, thank you. 2. For the situation considered

Only answer the first question (question #2), this is just in relation to the question and diagram above, thank you.

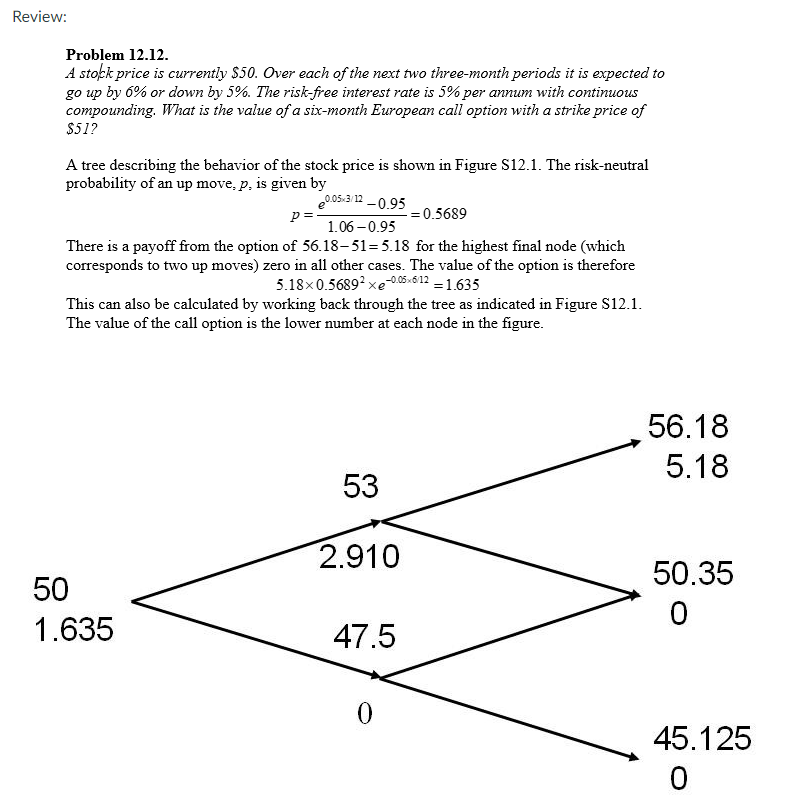

2. For the situation considered in Problem 12.12, what is the value of a six-month European put option with a strike price of $51 ? Verify that the European call and European put prices satisfy put-call parity. If the put option were American, would it ever be optimal to exercise it early at any of the nodes on the tree? go up by 6% or down by 5%. The risk-free interest rate is 5% per annum with continuous compounding. What is the value of a six-month European call option with a strike price of $51? A tree describing the behavior of the stock price is shown in Figure S12.1. The risk-neutral probability of an up move, p, is given by p=1.060.95e0.053/120.95=0.5689 There is a payoff from the option of 56.1851=5.18 for the highest final node (which corresponds to two up moves) zero in all other cases. The value of the option is therefore 5.180.56892e0.05612=1.635 This can also be calculated by working back through the tree as indicated in Figure S12.1. The value of the call option is the lower number at each node in the figure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts