Question: ONLY ANSWER THE SECOND QUESTION. THE FIRST JUST SUPPLIES INFORMATION FOR THE SECOND PROBLEM. THANKS PA12-4 Preparing and Interpreting a Statement of Cash Flows (Indirect

ONLY ANSWER THE SECOND QUESTION. THE FIRST JUST SUPPLIES INFORMATION FOR THE SECOND PROBLEM. THANKS

PA12-4 Preparing and Interpreting a Statement of Cash Flows (Indirect Method)

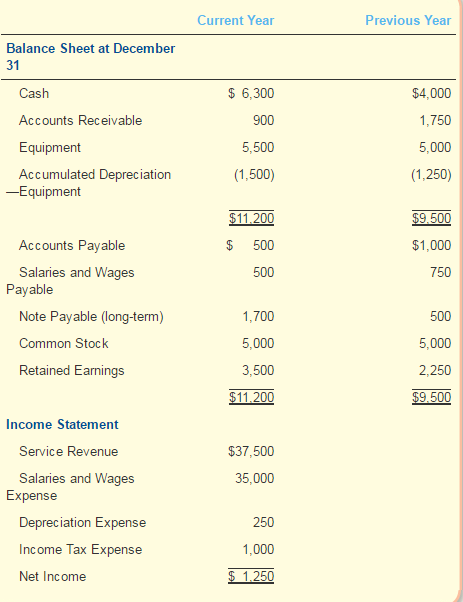

Heads Up Company was started several years ago by two hockey instructors. The company's comparative balance sheets and income statement follow, along with additional information

.

Additional Data:

a) Bought new hockey equipment for cash, $500.

b) Borrowed $1,200 cash from the bank during the year.

c) Accounts Payable includes only purchases of services made on credit for operating purposes. Because there are no liability accounts relating to income tax, assume that this expense was fully paid in cash.

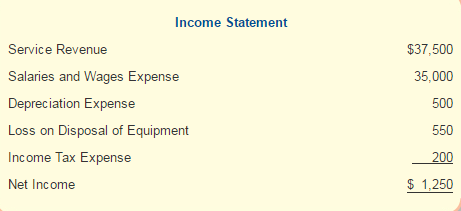

PA12-7 (Supplement 12A) Preparing and Interpreting a Statement of Cash Flows with Loss on Disposal (Indirect Method)

Assume the same facts as PA12-4, except for the income statement and additional data item (a). The new income statement is shown on the following page. Instead of item (a) from PA12-4, assume that the company bought new equipment for $1,800 cash and sold existing equipment for $500 cash. The equipment that was sold had cost $1,300 and had Accumulated Depreciation of $250 at the time of sale.

Required:

1. Prepare the statement of cash flows for the year ended December 31 using the indirect method.

1. Use the statement of cash flows to evaluate the company's cash flows.

Balance Sheet at December 31 Cash Accounts Receivable Equipment Accumulated Depreciation Equipment Accounts Payable Salaries and Wages Payable Note Payable (long-term) Common Stock Retained Earnings Income Statement Service Revenue Salaries and Wages Expense Depreciation Expense Income Tax Expense Net Income Current Year 6,300 900 5,500 (1,500) 11.200 500 500 1.700 5,000 3,500 11.200 $37,500 35,000 250 1,000 1.250 Previous Year $4,000 1,750 5,000 (1,250) 9500 $1,000 750 500 5,000 2.250 9500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts