Question: ONLY ANSWER WITHOUT EXPLANATION VERY URGENT Smith Inc has identified several capital budgeting projects they would like to complete (positive NPV). One of the projects

ONLY ANSWER WITHOUT EXPLANATION VERY URGENT

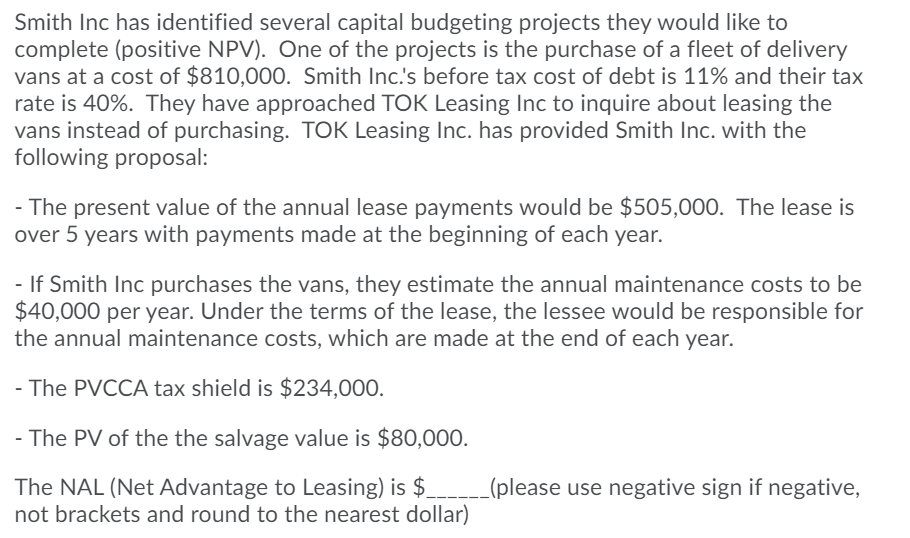

Smith Inc has identified several capital budgeting projects they would like to complete (positive NPV). One of the projects is the purchase of a fleet of delivery vans at a cost of $810,000. Smith Inc.'s before tax cost of debt is 11% and their tax rate is 40%. They have approached TOK Leasing Inc to inquire about leasing the vans instead of purchasing. TOK Leasing Inc. has provided Smith Inc. with the following proposal: - The present value of the annual lease payments would be $505,000. The lease is over 5 years with payments made at the beginning of each year. - If Smith Inc purchases the vans, they estimate the annual maintenance costs to be $40,000 per year. Under the terms of the lease, the lessee would be responsible for the annual maintenance costs, which are made at the end of each year. - The PVCCA tax shield is $234,000. - The PV of the the salvage value is $80,000. The NAL (Net Advantage to Leasing) is $ _(please use negative sign if negative, not brackets and round to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts