Question: only answers no need for explanation 22. . Using a price-weighted approach, what is the value of this index made of X & Y at

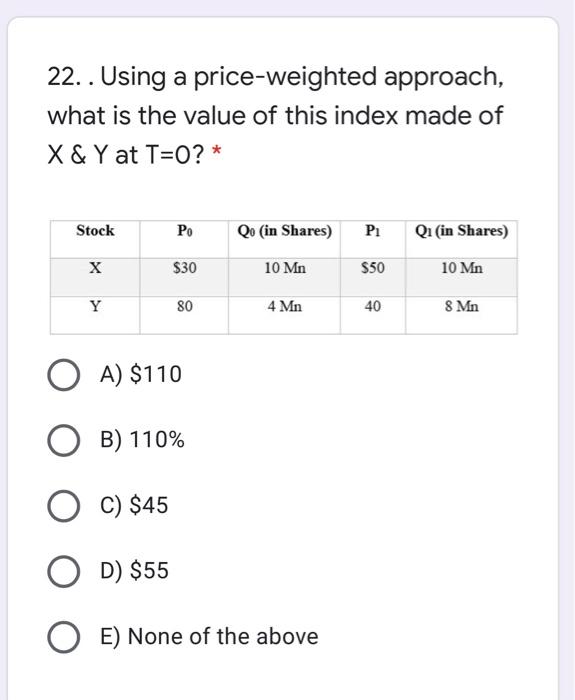

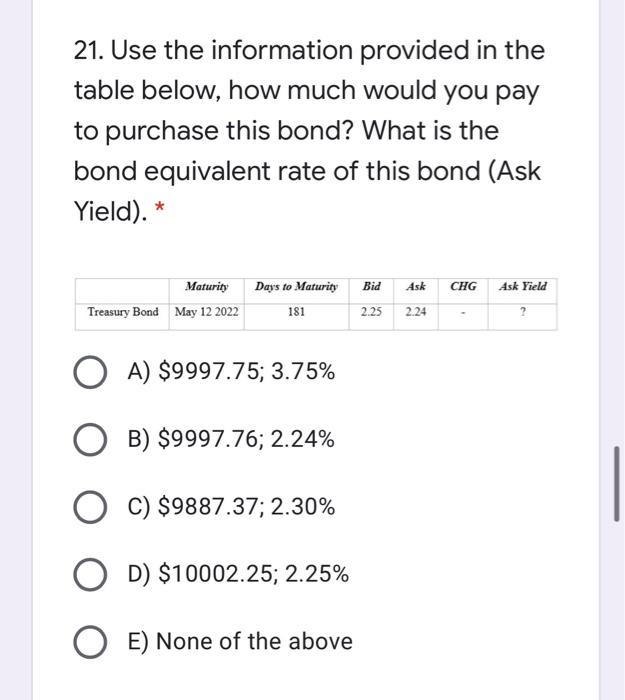

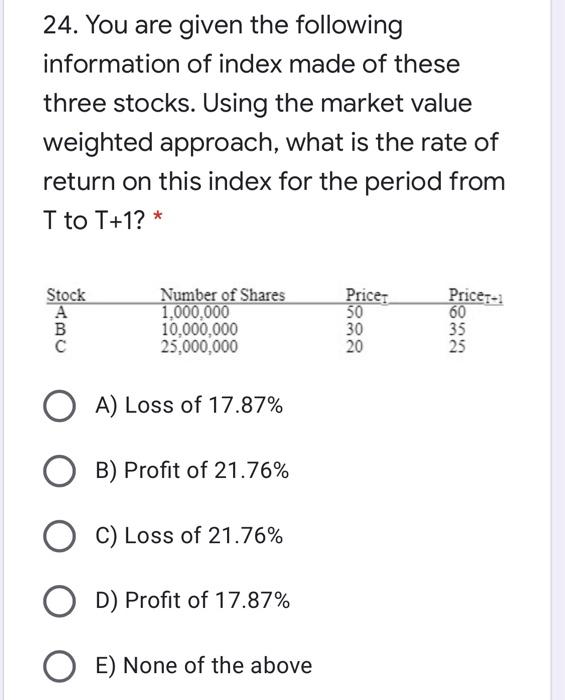

22. . Using a price-weighted approach, what is the value of this index made of X & Y at T=0?* Stock Qo (in Shares) P1 Q1 in Shares) $30 10 Mn $50 10 Mn Y 80 4 Mn 40 8 Mn OA) $110 B) 110% O C) $45 D) $55 OE) None of the above 21. Use the information provided in the table below, how much would you pay to purchase this bond? What is the bond equivalent rate of this bond (Ask Yield). * Bid Ask CHG Maturity Treasury Bond May 12 2022 Days to Maturity 181 Ask Yield ? 2.25 2.24 OA) $9997.75; 3.75% OB) $9997.76; 2.24% O C) $9887.37; 2.30% O D) $10002.25; 2.25% OE) None of the above 24. You are given the following information of index made of these three stocks. Using the market value weighted approach, what is the rate of return on this index for the period from T to T+1? * Price: Price: Stock A B Number of Shares 1,000,000 10,000,000 25,000,000 50 30 20 60 35 25 O A) Loss of 17.87% B) Profit of 21.76% C) Loss of 21.76% O D) Profit of 17.87% O E) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts